Proctor and Gamble 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis TheProcter&GambleCompanyandSubsidiaries 51

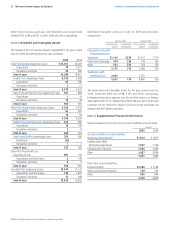

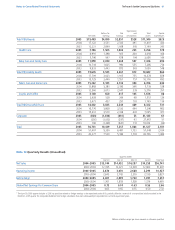

Note5Short-TermandLong-TermDebt

Theweightedaverageshort-terminterestrateswere3.5%and1.5%as

ofJune30,2005and2004,respectively,includingtheeffectsofrelated

interestrateswapsdiscussedinNote6.

Long-termweightedaverageinterestrateswere3.2%and4.0%asof

June30,2005and2004,respectively,includingtheeffectsofrelated

interestrateswapsandnetinvestmenthedgesdiscussedinNote6.

Thefairvalueofthelong-termdebtwas$13,904and$13,168atJune30,

2005and2004,respectively.Long-termdebtmaturitiesduringthe

nextfiveyearsareasfollows:2006-$2,606;2007-$1,440;2008-$816;

2009-$1,154and2010-$1,734.

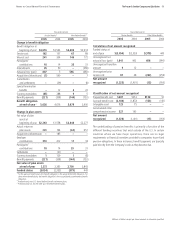

Note6RiskManagementActivities

Asamultinationalcompanywithdiverseproductofferings,weare

exposedtomarketrisks,suchaschangesininterestrates,currency

exchangeratesandcommoditypricing.Tomanagethevolatilityrelated

totheseexposures,weevaluateexposuresonaconsolidatedbasisto

takeadvantageoflogicalexposurenettingandcorrelation.Forthe

remainingexposures,weenterintovariousderivativetransactions.

Suchderivativetransactions,whichareexecutedinaccordancewithour

policiesinareassuchascounterpartyexposureandhedgingpractices,

areaccountedforunderSFASNo.133,“AccountingforDerivative

InstrumentsandHedgingActivities,”asamendedandinterpreted.Wedo

notholdorissuederivativefinancialinstrumentsforspeculative

tradingpurposes.

Atinception,weformallydesignateanddocumentthequalifying

financialinstrumentasahedgeofanunderlyingexposure.Weformally

assess,bothatinceptionandatleastquarterlyonanongoingbasis,

whetherthefinancialinstrumentsusedinhedgingtransactionsare

effectiveatoffsettingchangesineitherthefairvalueorcashflowsof

therelatedunderlyingexposure.Fluctuationsinthederivativevalue

generallyareoffsetbychangesinthefairvalueorcashflowsofthe

exposuresbeinghedged.Thisoffsetisdrivenbythehighdegreeof

effectivenessbetweentheexposurebeinghedgedandthehedging

instrument.Anyineffectiveportionofaninstrument’schangeinfair

valueisimmediatelyrecognizedinearnings.

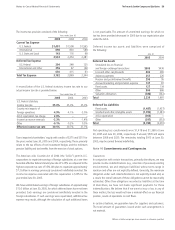

CreditRisk

Wehaveestablishedstrictcounterpartycreditguidelinesandnormally

enterintotransactionswithinvestmentgradefinancialinstitutions.

Counterpartyexposuresaremonitoreddailyanddowngradesin

creditratingarereviewedonatimelybasis.Creditriskarisingfrom

theinabilityofacounterpartytomeetthetermsofourfinancial

instrumentcontractsgenerallyislimitedtotheamounts,ifany,by

whichthecounterparty’sobligationsexceedourobligationstothe

counterparty.Wedonotexpecttoincurmaterialcreditlossesonour

riskmanagementorotherfinancialinstruments.

NotestoConsolidatedFinancialStatements TheProcter&GambleCompanyandSubsidiaries

Millionsofdollarsexceptpershareamountsorotherwisespecified.

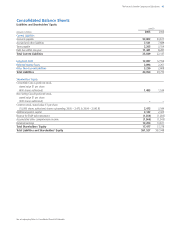

June30

2004

Short-TermDebt

USDcommercialpaper $6,059

Non-USDcommercialpaper 149

Currentportionoflong-termdebt 1,518

Bridgecreditfacility –

Other 561

8,287

June30

2004

Long-TermDebt

5.75%EURnotedueSeptember,2005 1,827

1.50%JPYnotedueDecember,2005 503

3.50%CHFnotedueFebruary,2006 240

5.40%EURnotedueAugust,2006 365

4.75%USDnotedueJune,2007 1,000

6.13%USDnotedueMay,2008 500

4.30%USDnotedueAugust,2008 500

3.50%USDnotedueDecember,2008 650

6.88%USDnotedueSeptember,2009 1,000

2.00%JPYnotedueJune,2010 458

FloatingrateUSDnotedueOctober2010 –

4.95%USDnotedueAugust2014 –

4.85%USDnotedueDecember,2015 700

9.36%ESOPdebenturesdue2007-20211 1,000

8.00%USDnotedueSeptember,2024 200

6.45%USDnotedueJanuary,2026 300

6.25%GBPnotedueJanuary,2030 906

5.25%GBPnotedueJanuary,2033 363

5.50%USDnotedueFebruary,2034 500

5.80%USDnotedueAugust,2034 –

Debtassumedundercapitalleases 252

Allotherlong-termdebt 2,808

Currentportionoflong-termdebt (1,518)

12,554

1DebtissuedbytheESOPisguaranteedbytheCompanyandmustberecordedasdebtof

theCompanyasdiscussedinNote8.