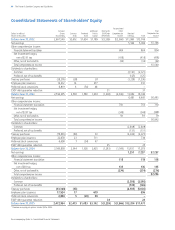

Proctor and Gamble 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis TheProcter&GambleCompanyandSubsidiaries 49

theintegrationofWella.Accordingly,suchamountsarenotnecessarily

indicativeoftheresultsthatwouldhaveoccurrediftheacquisitionhad

occurredonthedatesindicated.

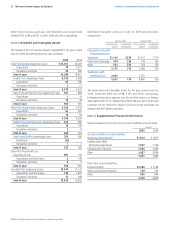

Thefollowingtablepresentstheallocationofpurchasepricerelatedto

theWellabusinessasofthedateofacquisition.

TheWellaacquisitionresultedin$5.94billioningoodwill,allofwhich

wasallocatedtotheP&GBeautyGlobalBusinessUnit.Thefollowing

tablepresentstheintangibleassetsacquired.

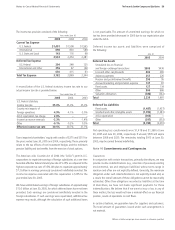

ChinaVenture

OnJune18,2004,wepurchasedtheremaining20%stakeinourChina

venturefromourpartner,HutchisonWhampoaChinaLtd.(Hutchison),

givingusfullownershipinouroperationsinChina.Thenetpurchase

pricewas$1.85billion,whichisthepurchasepriceof$2.00billion

netofminorityinterestandrelatedobligationsthatwereeliminated

asaresultofthetransaction.Theacquisitionwasfundedbydebt.The

fairvalueoftheincrementalindividualassetsandliabilitiesacquired

approximatescurrentbookvalue.Accordingly,thepurchasepricewas

recordedasgoodwill,whichwasallocatedtomultiplebusinesses.

NotestoConsolidatedFinancialStatements TheProcter&GambleCompanyandSubsidiaries

facilitycarriesavariableinterestrate.Interestonthefacilitywillbe

managedwithinouroverallinterestratemanagementpoliciesdescribed

inNote6.

WellaAcquisition

OnSeptember2,2003,weacquiredacontrollinginterestinWella.

Throughastockpurchaseagreementwiththemajorityshareholders

ofWellaandatenderoffermadeontheremainingshares,we

acquiredatotalof81%ofWella’soutstandingshares,including99%

ofWella’soutstandingvotingclassshares.InJune2004,theCompany

andWellaenteredintoaDominationandProfitTransferAgreement

(theDominationAgreement)pursuanttowhichweareentitledto

exercisefulloperatingcontrolandreceive100%ofthefutureearnings

ofWella.AsconsiderationfortheDominationAgreement,wewillpay

theholdersoftheremainingoutstandingsharesofWellaaguaranteed

perpetualannualdividendpayment.Alternatively,theremainingWella

shareholdersmayelecttotendertheirsharestousforanagreedprice.

Thefairvalueofthetotalguaranteedannualdividendpaymentswas

$1.11billion,whichapproximatesthecostifallremainingshareswere

tendered.BecausetheDominationAgreementtransfersoperationaland

economiccontroloftheremainingoutstandingsharestotheCompany,

ithasbeenaccountedforasanacquisitionoftheremainingshares,

withaliabilityrecordedequaltothefairvalueoftheguaranteed

payments.Becauseofthetenderfeature,theliabilityisrecordedasa

currentliabilityintheaccruedand otherliabilities lineofthe

ConsolidatedBalanceSheets.Paymentsmadeundertheguaranteed

annualdividendandtenderprovisionsareallocatedbetweeninterest

expenseandareductionoftheliability,asappropriate.Thetotal

purchasepriceforWella,includingacquisitioncosts,was$6.27billion

basedonexchangeratesattheacquisitiondates.Itwasfundedwith

acombinationofcash,debtandtheliabilityrecordedunderthe

DominationAgreement.

TheacquisitionofWella,withover$3billioninannualnetsales,gives

usaccesstotheprofessionalhaircarecategoryplusgreaterscaleand

scopeinhaircare,haircolorants,cosmeticsandfragranceproducts,

whileprovidingpotentialforsignificantsynergies.Theoperatingresults

oftheWellabusinessarereportedinourP&GBeautyGlobalBusiness

UnitbeginningSeptember2,2003.

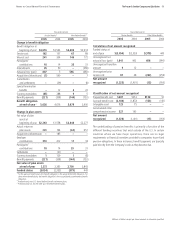

Thefollowingtableprovidesproformaresultsofoperationsforthe

yearsendedJune30,2004and2003,asifWellahadbeenacquiredas

ofthebeginningofeachfiscalyearpresented.Proformainformation

for2005isnotprovidedastheresultsofWellaareincludedinour

resultsfortheentireyear.Theproformaresultsincludecertain

adjustments,includingadjustmentstoconvertWella’shistoricalfinancial

informationfromInternationalFinancialReportingStandards(IFRS)into

U.S.GAAP,estimatedinterestimpactsfromfundingoftheacquisition

andestimatedamortizationofdefinite-livedintangibleassets.However,

proformaresultsdonotincludeanycostsavingsorothereffectsof

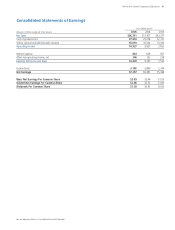

Millionsofdollarsexceptpershareamountsorotherwisespecified.

YearsendedJune30

Proformaresults 2004 2003

NetSales $51,958 $46,751

NetEarnings 6,402 5,222

DilutedNetEarningsperCommonShare $2.29 $1.86

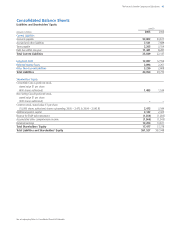

Weighted

averagelife

IntangibleAssetswith

DeterminableLives

Trademarks

$267 9

Professionalcustomerrelationships 196 15

Patentsandtechnology

10 5

Other 46 23

519

Trademarkswith

IndefiniteLives

1,152

1,671

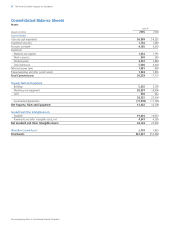

Currentassets $1,797

Property,plantandequipment 407

Goodwill 5,941

Intangibleassets 1,671

Othernon-currentassets 157

9,973

Currentliabilities 2,099

Non-currentliabilities 1,601

3,700

6,273