Proctor and Gamble 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysisTheProcter&GambleCompanyandSubsidiaries

34

partiallyoffsetbyhigherinterestchargesassociatedwithWella,hedging

impactsandcurrentyearchargesforprojectstomaintainacompetitive

coststructure.

FinancialCondition

Webelieveourfinancialconditioncontinuestobeofhighquality,as

evidencedbyourabilitytogeneratesubstantialcashfromoperations

andreadyaccesstocapitalmarketsatcompetitiverates.

Operatingcashflowprovidestheprimarysourceoffundstofinance

operatingneedsandcapitalexpenditures.Excessoperatingcashisused

firsttofundshareholderdividends.Otherdiscretionaryusesincludeshare

repurchasesand“tack-on”acquisitionstocomplementourportfolioof

brandsandgeographies.Asnecessary,wemaysupplementoperating

cashflowwithdebttofundtheseactivities.Theoverallcashposition

oftheCompanyreflectsourstrongbusinessresultsandaglobalcash

managementstrategythattakesintoaccountliquiditymanagement,

economicfactorsandtaxconsiderations.

OperatingActivities

In2005,operatingcashflowwas$8.72billioncomparedto$9.36

billionin2004.Thebenefitofhighernetearningsinthecurrentyear

wasmorethanoffsetbychangesinworkingcapital.Wedefineworking

capitalasthecombinationofinventory,accountsreceivableand

accountspayable.Totalinventorydaysonhandincreasedbytwodays

in2005reflectingtheimpactsofhighercommoditycostsandthe

Company’seffortstorebuildinventorylevelsinproductcategoriesthat

couldnotsufficientlymeetcustomerdemand.Receivabledayssales

outstandingimprovedbytwodays,resultinginaslightimprovementto

operatingcashflow.Accountspayabledecreasedthreedays.Inaddition

totheincreaseinworkingcapital,operatingcashwasreducedbytax

paymentsrelatedtothesettlementofprioryearaudits.

In2004,operatingcashflowwas$9.36billioncomparedto$8.70

billionin2003,representinganincreaseof8%.Highernetearnings

weretheprimarydriveroftheincreaseinoperatingcashflow.Operating

cashflowgrowthtrailedearningsgrowthduetoanincreaseinaccounts

receivable,cashpaymentsforaccruedrestructuringprogramcharges

andadividendreceivedfromajointventurein2003.

Weviewfreecashflowasanimportantmeasurebecauseitisone

factorimpactingtheamountofcashavailablefordividendsand

discretionaryinvestment.Itisdefinedasoperatingcashflowless

capitalexpendituresandisoneofthemeasuresusedtoevaluate

seniormanagementanddeterminetheirat-riskcompensation.In2005,

freecashflowwas$6.54billioncomparedto$7.34billionin2004.

Inadditiontoloweroperatingcashflow,freecashflowdeclined

year-over-yearduetohighercapitalexpenditures.Capitalexpenditures

in2005werehigherthanin2004,butstillbelowourtargetofcapital

spendingatorbelow4%ofnetsales.

In2004,freecashflowwas$7.34billioncomparedto$7.22billion

in2003.Freecashflowin2004reflectedincreasedoperatingcash

flow,partiallyoffsetbyincreasedcapitalexpenditures,althoughspending

wasin-linewithourtargetofcapitalspendingatorbelow4%ofsales.

Capitalspendingin2003waswellbelowhistoricallevelsandthe

Company'starget.

Freecashflowproductivity,definedastheratiooffreecashflowto

netearnings,was90%in2005,in-linewiththeCompany’starget.Free

cashflowproductivitywas113%in2004.

InvestingActivities

Investingactivitiesinthecurrentyearused$2.34billionofcash

comparedto$10.14billionintheprioryear,whichincludedthe

cashusedfortheacquisitionofWella.

Acquisitions.Acquisitions(netofcashacquired)used$572millionof

cashinthecurrentyearwhichincludesacquisitionsofaPharmaceuticals

businessinSpain,FabricCarebusinessesinEuropeandLatinAmerica

andincreasedownershipinourGladventurewithTheCloroxCompany.

In2004,netcashusedforacquisitionswas$7.48billion,drivenbythe

acquisitionofWellaandthepurchaseoftheremainingstakeinourChina

venture fromHutchisonWhampoa China Ltd.(Hutchison).The

initialWellaacquisitioninSeptember2003wasapproximately$5.10

billionforan81%interest,fundedbyacombinationofdebtandcash.

InJune2004,theCompanyandWellacompletedaDominationand

ProfitTransferAgreement,whichprovidedusfulloperatingcontroland

rightsto100%offutureoperatingresults.Inexchange,wemustpay

theremainingWellashareholdersaguaranteedannualdividendpayment.

Alternatively,theWellashareholdersmayelecttotendertheshares

forafixedprice.TheobligationassociatedwiththeDominationand

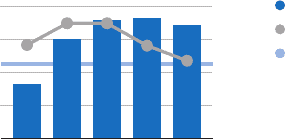

Free Cash Flow and Free Cash Flow Productivity

(in billions of dollars, and as % of net earnings)

2002 20052003 20042001

0%

160%

120%

80%

40%

0

$8

4

2

6

Free Cash Flow

Free Cash Flow Productivity

Free Cash Flow Productivity Target