Proctor and Gamble 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis TheProcter&GambleCompanyandSubsidiaries 35

ProfitTransferAgreementwas$1.11billionandhasbeenrecognizedas

acurrentliability.TheportionoftheacquisitionrelatedtotheDomination

andProfitTransferAgreementrepresentsanon-cashtransaction.Future

paymentsrelatedtotheprincipalportionoftheannualdividendarrange-

mentoracquisitionofsharestenderedwillbereflectedasinvesting

activities,consistentwiththeunderlyingtransaction.

ThegrosscashoutlayforHutchisonin2004was$2.00billion,which

alsoincludedthesettlementofminorityinterestandcertainother

liabilities,foranetcostof$1.85billion.Theacquisitionwasfundedby

debt.Wealsocompletedcertainsmalleracquisitionswithanaggregate

costof$384millionin2004,includingGlidedentalflossandFabric

CarebrandsinWesternEurope,LatinAmericaandtheMiddleEast.Net

cashusedforacquisitionswas$61millionin2003.

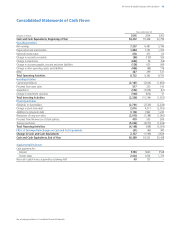

CapitalSpending.Capitalspendingefficiencycontinuestobeacritical

componentoftheCompany’soverallcashmanagementstrategy.Capital

expendituresin2005were$2.18billioncomparedto$2.02billionin

2004and$1.48billionin2003.Capitalspendingin2005was3.8%

ofnetsales–slightlylowerthanthecomparableprioryearperiodas

apercentageofnetsalesandbelowourtargetratio.Overthepast

severalyears,wehavemadesystemicinterventionstoimprovecapital

spendingefficienciesandassetutilization.WhiletheCompany’sgoal

istomaintaincapitalexpendituresatorbelow4%ofsalesonan

ongoingbasis,theremaybeexceptionalyearswhenspecificbusiness

circumstances,suchascapacityadditions,mayleadtohigherspending.

ProceedsfromAssetSales.Proceedsfromassetsalesincreased

primarilyduetothedivestitureoftheJuicebusinessinAugustof2004.

FinancingActivities

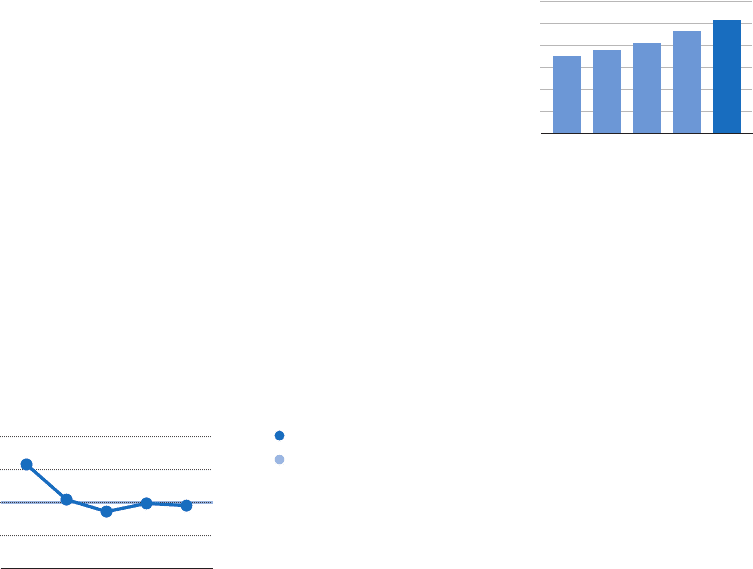

DividendPayments.Ourfirstdiscretionaryuseofcashisdividend

payments.Dividendspercommonsharegrew11%to$1.03pershare

in2005.Thisincreaserepresentsthe49thconsecutivefiscalyearthe

Companyhasincreaseditscommonsharedividend.TheCompanyhas

beenpayingcommonsharedividendseachyear,withoutinterruption,

sinceincorporationin1890.Totaldividendpaymentstobothcommon

andpreferredshareholderswere$2.73billion,$2.54billionand$2.25

billionin2005,2004and2003,respectively.

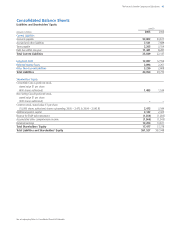

Long-TermandShort-TermDebt.Wemaintaindebtlevelsweconsider

appropriateafterevaluatinganumberoffactors,includingcashflow

expectations,cashrequirementsforongoingoperations,investment

plans(includingacquisitionsandsharerepurchaseactivities)andthe

overallcostofcapital.Totaldebtincreasedby$3.49billionin2005

to$24.33billion.Theincreasewasprimarilyduetoadditionaldebtto

financesharerepurchasesannouncedconcurrentlywithourplanned

acquisitionofTheGilletteCompany.

In2004,totaldebtincreasedby$7.19billionto$20.84billion.

TheincreasewasprimarilyduetotheacquisitionsofWellaandthe

Hutchisonminorityinterest,alongwithdiscretionarysharerepurchases.

Liquidity.Asdiscussedpreviously,ourprimarysourceofliquidityis

cashgeneratedfromoperations.Webelieveinternally-generatedcash

flowsadequatelysupportbusinessoperations,capitalexpendituresand

shareholderdividends,aswellasalevelofdiscretionaryinvestments

(e.g.,fortack-onacquisitions).

Weareabletosupplementourshort-termliquidity,ifnecessary,

withbroadaccesstocapitalmarketsand$2.00billioninbankcredit

facilities.Broadaccesstofinancingincludescommercialpaperprograms

inmultiplemarketsatfavorableratesgivenourstrongcreditratings

(includingseparateU.S.dollarandEuromulti-currencyprograms).We

maintaintwobankcreditfacilities:a$1.00billion,five-yearfacility

whichmaturesinJuly2007anda$1.00billion,five-yearfacilitywhich

maturesinJuly2009.Wehaveneverdrawnagainsteitherfacilityand

havenoplanstodosointheforeseeablefuture.

Capital Spending

(% of sales)

2002 20052003 20042001

0%

8%

6%

4%

2%

Capital Spending

% of Sales Target

Dividends

(per common share)

20022001 20052003 2004

.00

.20

.40

.80

.60

1.00

$1.20