Porsche 2009 Annual Report Download - page 57

Download and view the complete annual report

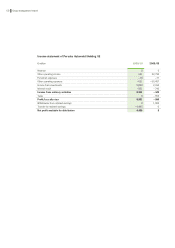

Please find page 57 of the 2009 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other operating income fell over the period

from 1 August 2009 to 31 July 2010 from 52,957

million euro to 709 million euro in comparison to the

corresponding prior-year period. Other operating ex-

penses decreased from 55,435 million euro to 956

million euro. The significant drop in income and ex-

penses was mainly caused by the sale of a significant

portion of the cash-settled options for Volkswagen AG

shares to Qatar Holding LLC at the beginning of the

current fiscal year.

After deconsolidation of the two groups, per-

sonnel expenses came to 17 million euro in the Por-

sche SE group (2008/09: 74 million euro).

The profit/loss from investments accounted

for at equity comes to 6,792 million euro (2008/09:

400 million euro) and primarily includes the income of

7,841 million euro from first-time inclusion of the in-

vestment in Volkswagen AG accounted for at equity.

This income arises from the difference between the

pro rata revalued equity and the investment’s lower

carrying amount used as a basis for determining the

income from deconsolidation and which is calculated

from the stock market price of Volkswagen on the

date of first-time consolidation (3 December 2009) in

accordance with IFRSs. The profit/loss from invest-

ments accounted for at equity also comprises the di-

lutive effect recognized as a non-cash expense of

1,440 million euro arising from the capital increase

performed at Volkswagen AG in March 2010, in which

Porsche SE did not participate.

In addition, profit/loss from investments ac-

counted for at equity includes the profit for the year

of the Porsche Zwischenholding GmbH group of 30

million euro and of the Volkswagen group of 361 mil-

lion euro generated since first-time inclusion of the

two groups at equity and attributable to Porsche SE.

These profit contributions also include effects of am-

ortization of the purchase price allocations begun at

the time of inclusion of Porsche Zwischenholding

GmbH as a joint venture and Volkswagen AG as an

associate, which had not been finalized by the date of

publication of this annual report. The profit contribu-

tions are consequently preliminary. The profit/loss

from investments accounted for at equity – and there-

fore the Porsche SE group’s profit after tax – was re-

duced by 606 million euro by the subsequent effects

of the purchase price allocations commenced in De-

cember 2009 for the Porsche Zwischenholding GmbH

and Volkswagen groups, i.e. the amortization of hid-

den reserves and liabilities identified in the process.

Over the reporting period, the financial result

deteriorated from minus 407 million euro to minus

673 million euro. The change is essentially due to an

increase in interest payments.

At 5,855 million euro, profit/loss before tax

from continuing operations was significantly higher

than the prior-year level of minus 2,559 million euro.

The tax expense for the fiscal year 2009/10 totaled

114 million euro (2008/09: tax income of 214 million

euro).

Profit after tax from continuing operations in-

creased compared to the prior-year period from mi-

nus 2,345 million euro to 5,741 million euro. With a

profit/loss after tax from discontinued operations of

minus 6,195 million euro, the profit/loss for the year

of the Porsche SE group at the end of the fiscal year

2009/10 came to minus 454 million euro.

The preliminary overall effect of the restruc-

turing performed in the fiscal year 2009/10 de-

scribed above on profit/loss after tax amounts to 416

million euro.

57