Porsche 2009 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2009 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

247

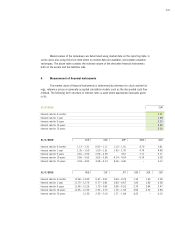

Segment reporting was generally based on the same accounting policies as the consoli-

dated financial statements. Measurement methods were unchanged in comparison to earlier periods.

The executive board of Porsche Automobil Holding SE was responsible for allocating resources and

assessing the earnings power of the reportable segments. Before deconsolidation of the discontin-

ued operations, the segments were managed using profit before the financial result and income

taxes.

Intersegment receivables and liabilities, provisions, income and expenses as well as in-

tersegment profits and losses and reclassifications of discontinued operations in accordance with

IFRS 5 were eliminated in the column “Reconciliation/reclassification according to IFRS 5”. This

column also includes the items not allocable to the individual segments. The business relations

between the entities of the Porsche SE group were and are generally based on prices as agreed

with third parties.

Revenue from third-parties shows the share of each operating segment in the Porsche SE

group’s revenue. Intersegment revenue shows the revenue generated between the segments before

deconsolidation of the discontinued operations. Profit or loss before profit or loss from investments

accounted for at equity, financial result and income tax constitutes the segment result. The material

items of income and expenses disclosed in the prior year mainly include the results from stock

options. The non-cash expenses included therein amounted to €10,283 million and were allocable

to the Porsche segment. Segment assets include all assets except for income tax claims and as-

sets where the associated income and expenses are allocable to the financial result. In addition,

segment assets do not include investments accounted for at equity. The amortization and deprecia-

tion and additions to non-current assets relate to property, plant and equipment, intangible assets,

investment property and leased assets.

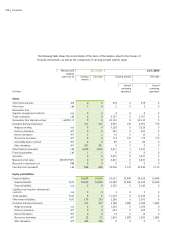

The group’s structure has changed fundamentally since the discontinued operations were

deconsolidated. Since then, the business activities of the Porsche SE group have been limited to

holding and managing investments. Porsche SE lost control over the operating subsidiaries upon

deconsolidation and now only has significant influence or joint control over them. Consequently, the

executive board of Porsche SE now manages the remaining investments in Porsche Zwischenhold-

ing GmbH and Volkswagen AG on an aggregated basis only, based on the profit or loss from in-

vestments accounted for at equity. As separate assets these two investments do not meet the

definition of operating segments, and segmentation in accordance with IFRS 8 is therefore not

prepared.

Based on the internal reporting and organizational structure that existed at the beginning of

the fiscal year until deconsolidation of Porsche Zwischenholding GmbH and Volkswagen AG, the

segment information is as follows: