Nordstrom 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

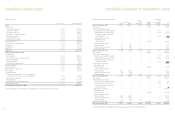

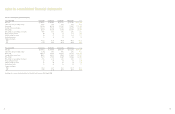

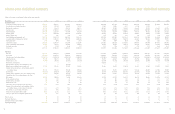

notes to consolidated financial statements

The following tables set forth the information for our reportable segments and a reconciliation to the consolidated totals:

Retail Credit Catalog/ Corporate

Fiscal Year 2004 Stores Operations Internet and Other Eliminations Total

Net sales (a) $6,756,054 — $375,334 — — $7,131,388

Other income including finance charge, net (8,656) $202,359 (208) $(20,553) — 172,942

Intersegment revenues 26,546 36,645 — — $(63,191) —

Interest expense, net (413) (23,522) 148 (53,641) — (77,428)

Depreciation and amortization 233,081 1,107 4,395 26,186 — 264,769

Earnings before taxes 789,204 39,503 34,324 (215,750) — 647,281

Goodwill 35,998 — 15,716 — — 51,714

Tradename 84,000 — — — — 84,000

Assets (b)(c) 2,665,425 1,030,941 103,960 805,064 — 4,605,390

Capital expenditures 212,729 605 6,196 27,321 — 246,851

Retail Credit Catalog/ Corporate

Fiscal Year 2003 Stores Operations Internet and Other Eliminations Total

Net sales (a) $6,156,028 — $292,650 — — $6,448,678

Other income including finance charge, net (7,563) $176,551 (602) $(13,296) — 155,090

Intersegment revenues 25,652 34,276 — — $(59,928) —

Interest expense, net (697) (22,122) 105 (68,238) — (90,952)

Depreciation and amortization 224,018 2,838 5,052 18,775 — 250,683

Earnings before taxes 582,737 17,473 8,625 (210,694) — 398,141

Goodwill 35,998 — 15,716 — — 51,714

Tradename 84,000 — — — — 84,000

Assets (b)(c) 2,717,462 878,541 93,070 880,160 — 4,569,233

Capital expenditures 242,331 1,104 4,729 10,150 — 258,314

Retail Credit Catalog/ Corporate

Fiscal Year 2002 Stores Operations Internet and Other Eliminations Total

Net sales (a) $5,691,097 — $253,559 — — $5,944,656

Other income including finance charge, net (1,999) $165,564 (11,721) $(12,555) — 139,289

Intersegment revenues 29,737 32,783 — — $(62,520) —

Interest expense, net (191) (23,582) (972) (57,176) — (81,921)

Depreciation and amortization 201,861 3,212 4,977 23,881 — 233,931

Earnings before taxes and cumulative effect

of accounting change 450,476 21,194 (21,926) (254,120) — 195,624

Goodwill 35,998 — 15,716 — — 51,714

Tradename 84,000 — — — — 84,000

Assets (b)(c) 2,718,781 753,377 89,512 623,599 — 4,185,269

Capital expenditures 230,864 2,058 4,507 90,737 — 328,166

(a) Retail stores net sales includes foreign sales of $94,994, $92,524, and $82,126 for 2004, 2003 and 2002.

(b) Retail stores assets include foreign assets of $207,095, $234,459, and $219,861 at the end of 2004 2003, and 2002.

(c) Segment assets in Corporate and Other include unallocated assets in corporate headquarters, consisting primarily of cash, land, buildings

and equipment, and deferred tax assets.

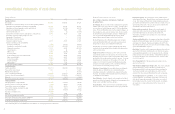

notes to consolidated financial statements

Note 17: Impairment

In 2002, we recognized a charge of $15,570 to write-down an IT

investment in a supply chain software application intended to support

our private label division. A strategic decision was made not to expand

our private label division to support an external wholesale business,

resulting in impairment to an in-process software project designed to

support this activity. This charge to the Retail Stores segment reduced

this asset to its estimated market value. The charge was recorded in

selling, general and administrative expense.

Note 18: Nordstrom.com

In May 2002, we paid $70,000 for the outstanding shares of

Nordstrom.com, Inc. series C preferred stock in fulfillment of our put

agreement with the minority interest holders of Nordstrom.com LLC.

The excess of the purchase price over the fair market value of the

preferred stock and professional fees resulted in a one-time charge

of $42,736. No tax benefit was recognized, as we do not believe it is

probable that this benefit will be realized. Purchase of the minority

interest of Nordstrom.com also resulted in goodwill of $15,716.

In July 2002, we purchased 3,608 Nordstrom.com options and 470

warrants for $11,802. We recognized $10,432 of expense related to

the purchase of these options and warrants.

The following table presents the charges associated with the minority

interest purchase and reintegration costs:

Fiscal Year 2002

Excess of the purchase price over the fair market

value of the preferred stock $40,389

Nordstrom.com option/warrant buyback expense 10,432

Professional fees incurred 2,347

Total $53,168

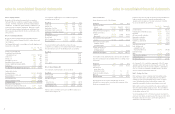

Note 19: Self Insurance

We are self insured for certain losses related to health and welfare,

workers’ compensation and general liability. We record estimates of

the total cost of claims incurred as of the balance sheet date. These

estimates are based on analysis of historical data and independent

actuarial estimates.

Workers’ Compensation – we have a deductible per claim of $1,000

or less and no policy limits. Our workers’ compensation reserve was

$64,446 and $57,421 at the end of 2004 and 2003 and our expense

was $29,263, $33,782 and $21,368 in 2004, 2003 and 2002.

General Liability – we have a deductible per claim of $1,000 or less

and a policy limit up to $150,000. Our general liability insurance

reserve was $9,872 and $10,266 at the end of 2004 and 2003.

Health and Welfare – We are self insured for our health and welfare

coverage and do not have stop-loss coverage. Participants contribute

to the cost of their coverage and are subject to certain plan limits

and deductibles. Our health and welfare reserve was $10,545 and

$9,998 at the end of 2004 and 2003.

Note 20: Commitments and Contingent Liabilities

We are involved in routine claims, proceedings, and litigation arising

from the normal course of our business. We do not believe any such

claim, proceeding or litigation, either alone or in aggregate, will

have a material impact on our results of operations, financial position,

or liquidity.

We are routinely audited for tax compliance by the federal, state, local

and foreign jurisdictions in which we operate. The audits generally

cover several years and issues raised in an audit can impact other

years that are available to be audited. We have accrued $25,000 for

anticipated exposures for audit issues in all years that are open to

adjustment by a tax jurisdiction.

Additionally, in connection with the purchase of foreign merchandise,

we have outstanding import letters of credit totaling $28,961 and

standby letters of credit totaling $1,370 as of January 29, 2005.

47

46