Nordstrom 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

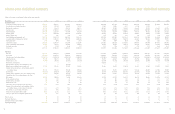

the assumptions used below are different in 2004, the impact of the

assumption change was not significant and does not reflect a change

in the underlying quality of the portfolio.

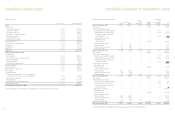

January 29, January 31,

2005 2004

Total face value of co-branded Nordstrom

VISA credit card principal receivables $612,549 $465,198

Securities issued by the VISA Trust:

Off-balance sheet (sold to third parties):

2002 Class A & B Notes at par value $200,000 $200,000

Amounts recorded on balance sheet:

Investment in asset backed

securities at fair value 422,416 272,294

Expected assumptions used to estimate the fair

value of the investment in asset backed securities:

Weighted average remaining life (in months) 8.1 2.5

Average credit losses 6.9% 5.5%

Average gross yield 15.8% 17.8%

Weighted average coupon on issued securities 3.8% 1.4%

Average payment rates 7.5% 23.4%

Internal rate of returns on

investment in asset backed securities 9.4-16.5% 6.8-12.6%

The internal rate of returns represents the volatility and risk of the

assets and is calculated using an established formula that considers

both the current interest rate environment and credit spreads.

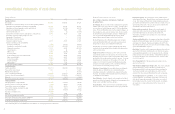

The following table illustrates the changes in the fair market value

estimates of the investment in asset backed securities given

independent changes in assumptions as of January 29, 2005:

+10% +20% -10% -20%

Gross yield $5,394 $10,787 $(5,394) $(10,787)

Interest expense on issued

classes (1,038) (2,076) 1,038 2,076

Card holders payment rate 91 98 (214) (606)

Charge offs (2,463) (4,898) 2,492 5,014

Internal rate of return (1,003) (1,990) 1,019 2,054

notes to consolidated financial statements

Fiscal Year 2004 2003 2002

Net earnings $393,450 $242,841 $90,224

Basic shares 139,497 136,329 135,107

Dilutive effect of

stock options and

performance share units 2,770 1,410 617

Diluted shares 142,267 137,739 135,724

Basic earnings per share $2.82 $1.78 $0.67

Diluted earnings per share $2.77 $1.76 $0.66

Note 8: Accounts Receivable

The components of accounts receivable are as follows:

January 29, January 31,

2005 2004

Trade receivables:

Unrestricted $31,400 $25,228

Restricted 568,062 589,992

Allowance for doubtful accounts (19,065) (20,320)

Trade receivables, net 580,397 594,900

Other 65,266 71,911

Accounts receivable, net $645,663 $666,811

Our restricted trade receivables relate to our Nordstrom private label

card and back the previously discussed $300,000 Class A notes and the

$150,000 variable funding note renewed in May 2004. The unrestricted

trade receivables consist primarily of our Façonnable trade receivables

and Nordstrom private label receivables that are not eligible for

securitization, such as foreign and employee receivables exceeding

a contractual threshold.

Other accounts receivable consist primarily of credit card receivables

due from third-party financial institutions and vendor rebates, which

are believed to be fully realizable as they are collected soon after they

are earned.

Note 9: Investment in Asset Backed Securities – Co-branded

Nordstrom VISA Credit Card Receivables

The table below summarizes our co-branded Nordstrom VISA credit card

activities and the estimated fair values of our investment in asset

backed securities as well as the assumptions used.

In 2004, we revised the repayment period assumption in our valuation

model that we use to determine the fair value of the VISA Trust. The

2004 repayment period assumption is based on historical payment,

default and finance charge yield experience on a specific account

basis. The prior repayment period assumption was based on our

ongoing payment experience, which included payments by card

holders who pay their account balance in full each month. While

notes to consolidated financial statements

These sensitivities are hypothetical and should be used with caution.

The effect of an adverse change in a particular assumption on the

fair value of the investment in asset backed securities is calculated

without changing any other assumption. In reality, changes in one

factor may result in changes in another, which might alter the

reported sensitivities.

The following table summarizes certain income, expenses and cash

flows received from and paid to the VISA Trust:

Fiscal Year 2004 2003 2002

Principal collections reinvested in

new receivables $2,019,162 $1,332,790 $824,715

Gains on sales of receivables 8,876 4,920 8,290

Income earned on retained interests 46,645 31,926 10,786

Cash flows from retained assets:

Investment in asset

backed securities 76,381 58,222 28,100

Servicing fees 10,698 7,631 5,407

Gross credit losses were $25,182, $22,393, and $18,580 for 2004, 2003

and 2002, and receivables past due for more than 30 days were $9,736

and $8,805 at the end of 2004 and 2003.

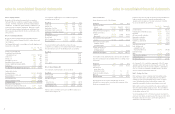

The following table illustrates default projections using net credit losses

as a percentage of average outstanding receivables in comparison to

actual performance:

Fiscal Year 2005 2004 2003

Original projection 4.43% 5.59% 6.16%

Actual N/A 4.62% 5.57%

Our continued involvement in the securitization of co-branded

Nordstrom VISA credit card receivables will include recording

gains/losses on sales, recognizing income on investment in asset

backed securities, holding subordinated, non-subordinated and residual

interests in the trust, and servicing the portfolio.

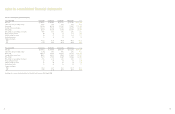

Note 10: Land, Buildings and Equipment

Land, buildings and equipment consist of the following:

January 29, January 31,

2005 2004

Land and land improvements $64,037 $64,238

Buildings and improvements 818,733 838,521

Leasehold improvements 1,066,383 1,011,989

Store fixtures and equipment 1,817,294 1,728,421

Software 233,223 206,751

Construction in progress 91,303 79,016

4,090,973 3,928,936

Less accumulated depreciation

and amortization (2,310,607) (2,121,158)

Land, buildings and equipment, net $1,780,366 $1,807,778

The total cost of buildings and equipment held under capital lease

obligations was $20,035 at the end of 2004 and 2003, with related

accumulated amortization of $15,259 and $14,021. The amortization

of capitalized leased buildings and equipment was recorded in

depreciation expense.

In 2002, we sold the Credit Operation’s office complex and subsequently

leased it back. We received net proceeds of $20,000, and the related

gain of $16,022 is being recognized as a reduction to rent expense

evenly over the 15 year life of the lease.

At January 29, 2005, we have contractual commitments of

approximately $171,000 primarily for the construction of new stores

and the remodeling of existing stores.

Note 11: Long-Term Debt

A summary of long-term debt is as follows:

January 29, January 31,

2005 2004

Private Label Securitization, 4.82%,due 2006 $300,000 $300,000

Senior debentures, 6.95%, due 2028 300,000 300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Senior notes, 8.95%, due 2005 — 196,770

Notes payable, 6.7%, due 2005 96,027 97,500

Mortgage payable, 7.68%, due 2020 75,406 79,204

Other 16,495 18,860

Fair market value of interest rate swap (7,821) (8,091)

Total long-term debt 1,030,107 1,234,243

Less current portion (101,097) (6,833)

Total due beyond one year $929,010 $ 1,227,410

41

40