Nordstrom 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

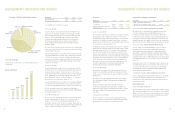

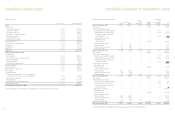

2004 VS 2003 OTHER INCOME INCLUDING FINANCE CHARGES, NET

Our overall other income including finance charges, net increased $17.9

million, primarily from our co-branded VISA credit card program growth.

Since 2002, we marketed this credit card to our in-store customers and

the inactive Nordstrom private label credit card holders. These

marketing efforts showed success in 2004, as the co-branded VISA

credit card holders used the cards more extensively in 2004, resulting

in a 45.7% volume increase.

2003 VS 2002 OTHER INCOME INCLUDING FINANCE CHARGES, NET

We continued to see improvements in our 2003 other income including

finance charges, net primarily due to growth in the co-branded VISA

program. Our income benefited from substantial increases in our VISA

credit card volume and receivables during the year, as well as a small

improvement in the cost of funds and bad debt write-offs. This

increase was partially offset by a decline in finance charge and late fee

income resulting from a decline in our private label accounts receivable.

2005 FORECAST OF OTHER INCOME INCLUDING FINANCE CHARGES, NET

In 2005, other income including finance charges, net is expected to

increase approximately $12 million as we continue to see growth in

our VISA credit card volume and corresponding income.

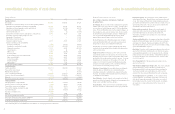

Diluted Earnings per Share

2004 VS 2003 DILUTED EARNINGS PER SHARE

In 2004, earnings per share increased to $2.77 from $1.76 in 2003.

This increase was driven by a strong increase in overall and same-

store sales, improvements in gross profit through better inventory

management, and sales leverage on buying and occupancy and selling,

general and administrative expenses.

management’s discussion and analysis

2003 VS 2002 INTEREST EXPENSE, NET

Interest expense, net increased in 2003 because of debt prepayment

costs of $14.3 million in 2003 and lower capitalized interest. The debt

prepayment costs were partially offset by lower interest expense

resulting from the reduced debt balance outstanding. Capitalized

interest decreased as the completion of several software projects

in early 2003 reduced our software development balance.

2005 FORECAST OF INTEREST EXPENSE, NET

Interest expense for 2005 is expected to decrease as we re-pay the

remaining $96.0 million of our 6.7% medium-term notes due in July

2005. We expect to see a year-over-year reduction in interest expense

of approximately $26 million. A portion of the forecasted interest

expense is based on variable interest rates, which could fluctuate.

Minority Interest Purchase and Reintegration Costs

During 2002, we purchased the outstanding shares of Nordstrom.com,

Inc. series C preferred stock for $70.0 million. The minority interest

purchase and reintegration costs resulted in a one-time charge of

$53.2 million. No tax benefit was recognized as there was no possibility

of a future tax benefit. The impact of not recognizing this income tax

benefit increased our 2002 effective tax rate to 47% before the

cumulative effect of accounting change.

Other Income Including Finance Charges, Net (in millions)

Fiscal Year 2002 2003 2004

Other income including finance charges,

net as a percentage of sales 2.4% 2.4% 2.4%

management’s discussion and analysis

2003 VS 2002 DILUTED EARNINGS PER SHARE

Our earnings per share in 2002 included the write down of a supply

chain software application, the Nordstrom.com minority interest

purchase and reintegration costs and the cumulative effect of an

accounting change associated with the adoption of FAS 142, for a total

impact of $71.0 million or $0.53 per share. We believe that excluding

these charges provides a more comparable basis from which to

evaluate performance between 2003 and 2002. Without the impact

of these charges, 2002 earnings per share would have been $1.19.

Our earnings per share in 2003 increased to $1.76 from $0.66 in 2002.

Excluding the prior year charges noted above, 2003 earnings per share

increased $0.57 or 47.9%. This increase was primarily driven by

a strong increase in overall and same-store sales, significant

improvement in gross profit rate and a moderate decrease in selling,

general and administrative expenses as a percentage of sales.

2005 FORECAST OF DILUTED EARNINGS PER SHARE

Based upon the factors discussed above, especially the expected 2005

same-store sales increase and the 2004 debt prepayment cost that will

not recur in 2005, our diluted earnings per share is expected to increase

16% - 20% in 2005. As we saw in 2004, earnings trends should be

consistent with same-store sales trends.

Fourth Quarter Results

Fourth quarter 2004 net earnings was $140.0 million compared with

$104.3 million in 2003. Fourth quarter 2004 net earnings was

reduced $4.7 million or $0.03 per share due to a non-cash expense

adjustment related to a correction in our lease accounting policy.

Our new policy is to record lease expense when we take possession

of a location; in the past, lease expense started when our retail

operations started.

Total sales for the quarter increased by 9.4% to $2.1 billion and same-

store sales increased by 7.2%. This was the first time in our history

that sales exceeded $2.0 billion in a quarter.

Gross profit as a percentage of net sales increased to 36.6% from

36.2% last year. The quarterly improvement in gross profit as a

percentage of net sales was primarily the result of sales growth

leverage on our buying and occupancy expenses. Selling, general and

administrative expense as a percentage of sales improved 160 basis

points from 28.5% to 26.9%, primarily from lower year-over-year

incentive compensation costs in the quarter.

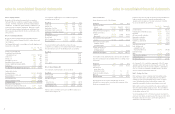

GAAP Sales Reconciliation (in millions)

We converted to a 4-5-4 Retail Calendar at the beginning of 2003 so

our financial results are more comparable to other retailers. Sales

performance numbers included in this document have been calculated

on a comparative 4-5-4 basis. We believe that adjusting for the

difference in days provides a more comparable basis from which to

evaluate sales performance. The following reconciliation bridges the

reported GAAP sales to the 4-5-4 comparable sales.

%Change %Change

YTD YTD Dollar Total Comp

Sales Reconciliation 2003 2004 Increase Sales Sales

Number of Days

Reported GAAP 365 364

Reported GAAP Sales $6,448.7 $7,131.4 $682.7 10.6% N/A

Less Feb. 1, 2003 (18.2) —

Reported 4-5-4 Sales $6,430.5 $7,131.4 $700.9 10.9% 8.5%

4-5-4 Adjusted Days 364 364

LIQUIDITY AND CAPITAL RESOURCES

Overall, cash and short-term investments decreased by $113.8

million to $402.4 million at the end of 2004, as we used our cash from

operations for capital expenditures, additional debt prepayments and

repurchases of common stock.

Operating Activities

Our operations are seasonal in nature. The second quarter, which

includes our Anniversary Sale, accounts for approximately 27% of net

sales, while the fourth quarter, which includes the holiday season,

accounts for about 29% of net sales. Cash requirements are highest

in the third quarter as we build our inventory for the holiday season.

2004 VS 2003 OPERATING ACTIVITIES

In 2004, cash flow from operating activities increased to $606.3

million, a $7.1 million increase. Higher net earnings was offset by our

merchandise purchase and payment flow changes in 2004 as compared

to 2003 and the timing of income tax payments. Toward the end of

2003 and into 2004, we have achieved a more even flow of merchandise

purchases in relation to our sales trends. Our 2004 inventory turns

have improved over the prior year; the payables leverage we achieved

in 2004 is consistent with our merchandise purchase plan. Income tax

payments have increased in 2004 as a result of our earnings growth.

2003 VS 2002 OPERATING ACTIVITIES

The increase in net cash provided by operating activities between

2003 and 2002 was primarily due to an increase in net earnings

before noncash items, decreases in inventories and increases in

accounts payable, partially offset by an increase in our investment

in asset backed securities. Strong sales and effective inventory

management left us with lower, appropriate inventory levels after

the holidays. January receipts of new merchandise replenished

our inventory levels resulting in an increase in accounts payable.

Investment in asset backed securities increased as Nordstrom VISA

credit sales increased during the year.

21

20

2000 2001 2002 2003 2004

$131

$134

$139

$155

$173

2000 2001 2002 2003 2004

$0.78

$0.93

$0.66

$1.76

$2.77