Nordstrom 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

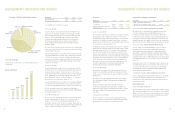

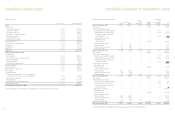

Total Square Footage (in thousands)

Financing Activities

Financing activities primarily consist of principal payments on debt,

dividend payments, repurchases of common stock and proceeds from

the exercise of stock options.

During 2004, we retired $196.8 million of our 8.95% senior notes

and $1.5 million of our 6.7% medium-term notes for a total cash

payment of $220.1 million. After considering non-cash items related

to these debt retirements, our pre-tax expense for debt buyback was

$20.9 million.

During 2003, we purchased $103.2 million of our 8.95% senior notes

and $2.5 million of our 6.7% medium-term notes for a total cash

payment of $120.8 million. Approximately $14.3 million of expense

was recognized during 2003 related to these purchases.

In July 2005, we plan to re-pay the remaining $96.0 million of our 6.7%

medium-term notes at maturity. No additional debt repurchases are

planned for 2005.

In August 2004, our Board of Directors authorized $300.0 million of

share repurchases, replacing a previous share repurchase authorization.

We purchased 6.9 million shares in the open market for the entire

authorized amount of $300.0 million at an average price of $43.43

per share.

In February 2005, our Board of Directors authorized $500.0 million

of additional share repurchases. The actual number and timing of

share repurchases will be subject to market conditions and applicable

SEC rules.

Debt to Capital Ratio

Our recent strong operating results allowed us to repay debt, which

contributed to a decrease in our debt to capital ratio from 43.0% at

management’s discussion and analysis

2005 FORECAST FOR OPERATING ACTIVITIES

In 2005, cash flows provided by operating activities are expected to

increase slightly as a result of increased earnings.

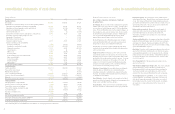

Investing Activities

In 2004, investing activities have primarily consisted of capital

expenditures and the sales and purchases of high quality short-term

investments. Capital expenditures in 2004 decreased slightly in

comparison to 2003 as a planned reduction in store openings reduced

our capital expenditures.

In 2004, 37% of our capital expenditures was for remodels and 28%

was for new stores, half of which related to stores that opened in 2004

and the other half for stores opening in 2005. In addition, 22% of

our capital expenditures was for information technology and 13%

for other routine projects.

Our capital expenditures over the last three years totaled $833.3

million; we received property incentives of $151.1 million over that

same period, which offsets a portion of the cash we used for capital

expenditures. The capital expenditures added stores, enhanced existing

facilities and improved our information systems. More than 2.3 million

square feet of retail store space has been added during this period,

representing an increase of 14% since January 31, 2002.

We plan to spend approximately $850-$875 million, net of property

incentives of approximately $130 million, on capital projects during

the next three years. We plan to use approximately 40% of this capital

to build new stores, 30% on remodels, and 15% toward information

technology. The remaining 15% is planned for other routine projects.

Compared to the previous three years, this represents a 30% increase

in capital expenditures, with more spending allocated to improving our

existing facilities and less spending on information systems. We watch

over our store locations so they meet our customer expectations for a

high-quality shopping experience. We also analyze the useful lives

assigned to our stores so we can match our depreciation with the actual

use of these assets. In the information systems area, we completed

the implementation of our “Point of Sale” system in 2004 and plan

to continue to make investments to enhance our technology platform.

As of January 29, 2005, approximately $171.0 million has been

contractually committed primarily for constructing new stores

or remodeling existing stores.

Consistent with our investment policy, we utilize our high quality short-

term investments to generate income on our available working capital.

management’s discussion and analysis

the end of 2003 to 36.5% at the end of 2004. Other factors that

impacted this ratio in 2004 were the share repurchase described

above and the volume of stock option activity. We believe that a debt

to capital ratio in the range of 25% to 40% results in favorable debt

ratings and sets us on a capital structure that provides appropriate

flexibility while we maintain a reasonable cost of capital.

Off-Balance Sheet Financing

We transfer our Nordstrom co-branded VISA credit card receivables

to a third-party trust that issued $200 million of VISA receivable backed

securities to third parties in 2002. The outstanding balance of the

co-branded VISA credit card receivables exceeds the receivable backed

securities balance. As a result, we hold securities that represent our

retained interests in the trust, recorded as investment in asset backed

securities in our consolidated balance sheets. We do not record the

$200.0 million of VISA receivable backed securities or the co-branded

Nordstrom VISA credit card receivables transferred to the trust on our

consolidated balance sheets.

This off-balance sheet financing allows us greater financial flexibility.

Additionally, our exposure to credit losses on the underlying co-branded

Nordstrom VISA credit card receivables is limited to our investment in

asset backed securities.

Interest Rate Swaps

To manage our interest rate risk, we entered into an interest rate swap

agreement in 2003, which had a $250.0 million notional amount

expiring in 2009. Under the agreement, we receive a fixed rate of

5.63% and pay a variable rate based on LIBOR plus a margin of 2.3%

set at six-month intervals (5.20% at January 29, 2005, based on the

January 18, 2005 LIBOR rate); this reduced our net interest expense in

2004. The interest rate swap agreement had a fair value of ($7.8)

million and ($8.1) million at January 29, 2005 and January 31, 2004.

We have locked in our LIBOR rate until July 15, 2005.

Available Credit

In May 2004, we replaced our existing $300.0 million unsecured line of

credit with a $350.0 million unsecured line of credit, which is available

as liquidity support for our commercial paper program. Under the terms

of the agreement, we pay a variable rate of interest based on LIBOR

plus a margin of 0.31% (2.90% at January 29, 2005). The variable rate

of interest increases to LIBOR plus a margin of 0.41% if more than

$175.0 million is outstanding on the facility. The line of credit

agreement expires in May 2007 and contains restrictive covenants,

which include maintaining a leverage ratio. We also pay a commitment

fee for the line based on our debt rating.

Also in May 2004, we renewed our variable funding note backed by

Nordstrom private label card receivables, but we reduced the capacity

by $50.0 million to $150.0 million due to better pricing on the

unsecured line of credit. This note is renewed annually and interest

is paid based on the actual cost of commercial paper plus specified

fees. We also pay a commitment fee for the note based on the amount

of the commitment.

We did not make any borrowings under our unsecured line of credit

or our variable funding note backed by Nordstrom private label card

receivables during 2004.

We also have universal shelf registrations on file with the Securities

and Exchange Commission that permit us to offer an additional $450

million of securities to the public. These registration statements allow

us to issue various types of securities, including debt, common stock,

warrants to purchase common stock, warrants to purchase debt

securities and warrants to purchase or sell foreign currency.

Debt Ratings

The following table shows our credit ratings at the date of this report.

Standard

Credit Ratings Moody’s and Poor’s

Senior unsecured debt Baa1 A-

Commercial paper P-2 A-2

Outlook Stable Stable

These ratings could change depending on our performance and other

factors. Our outstanding debt is not subject to termination or interest

rate adjustments based on changes in our credit ratings.

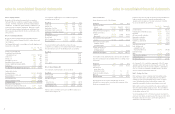

Contractual Obligations (in millions)

The following table summarizes our contractual obligations and the

expected effect on our liquidity and cash flows. We expect to fund

these commitments primarily with operating cash flows generated in

the normal course of business and credit available to us under existing

and potential future facilities.

Less More

than 1-3 3-5 than 5

Fiscal Year Total 1 year years years years

Long-term debt $1,227.5 $100.1 $507.3 $258.0 $362.1

Capital lease

obligations 17.8 2.3 3.9 3.3 8.3

Operating leases 699.8 72.5 138.5 128.5 360.3

Purchase

obligations 1,007.5 932.9 65.2 9.4 —

Other long-term

liabilities 153.2 — 55.4 20.4 77.4

Total $3,105.8 $1,107.8 $770.3 $419.6 $808.1

23

22

2000 2001 2002 2003 2004

16,056

17,048

18,428

19,138 19,397