Nordstrom 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

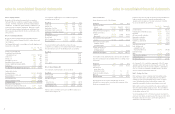

consolidated statements of cash flows

Amounts in thousands

Fiscal year 2004 2003 2002

Operating Activities

Net earnings $393,450 $242,841 $90,224

Adjustments to reconcile net earnings to net cash from operating activities:

Depreciation and amortization of buildings and equipment 264,769 250,683 233,931

Amortization of deferred property incentives and other, net (31,378) (27,712) (22,179)

Stock-based compensation expense 8,051 17,894 1,130

Deferred income taxes, net (8,040) (1) (11,030)

Tax benefit of stock option exercises and employee stock purchases 25,442 10,199 1,358

Cumulative effect of accounting change, net of tax —— 13,359

Impairment of IT investment —— 15,570

Minority interest purchase expense —— 40,389

Provision for bad debt expense 24,639 27,975 29,080

Change in operating assets and liabilities:

Accounts receivable, net (2,950) (30,677) (24,227)

Investment in asset backed securities (149,970) (141,264) (67,561)

Merchandise inventories (11,771) 28,213 (117,379)

Prepaid expenses (3,163) 86 521

Other assets (8,143) (10,109) 3,378

Accounts payable 23,930 75,736 6,103

Accrued salaries, wages and related benefits 15,055 42,885 18,629

Other current liabilities 58,471 38,970 24,740

Income taxes payable (18,999) 21,319 54,993

Property incentives 19,837 46,007 85,258

Other liabilities 7,116 6,237 14,227

Net cash from operating activities 606,346 599,282 390,514

Investing Activities

Capital expenditures (246,851) (258,314) (328,166)

Proceeds from sale of assets 5,473 — 32,415

Minority interest purchase —— (70,000)

Sales of short-term investments 3,366,425 2,090,175 937,521

Purchases of short-term investments (3,232,250) (2,144,909) (1,058,787)

Other, net (2,830) 3,451 (2,133)

Net cash used in investing activities (110,033) (309,597) (489,150)

Financing Activities

Principal payments on long-term debt (205,252) (111,436) (88,981)

(Decrease) increase in cash book overdrafts (2,680) 33,832 (11,908)

Proceeds from exercise of stock options 87,061 48,598 6,601

Proceeds from employee stock purchase plan 12,892 8,861 8,062

Cash dividends paid (67,240) (55,853) (51,322)

Repurchase of common stock (300,000) ——

Other, net (752) 2,341 6,596

Net cash used in financing activities (475,971) (73,657) (130,952)

Net increase (decrease) in cash and cash equivalents 20,342 216,028 (229,588)

Cash and cash equivalents at beginning of year 340,281 124,253 353,841

Cash and cash equivalents at end of year $360,623 $340,281 $124,253

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

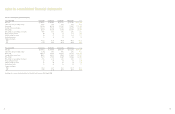

notes to consolidated financial statements

Amounts in thousands except per share amounts

Note 1: Nature of Operations and Summary of Significant

Accounting Policies

The Company: We are one of the nation's leading fashion specialty

retailers, with 151 US stores located in 27 states. Founded in 1901

as a shoe store in Seattle, today we operate 95 Full-Line Nordstrom

stores, 49 discount Nordstrom Racks, five Façonnable boutiques, one

free-standing shoe store, and one clearance store. We also operate

31 international Façonnable boutiques in Europe. Additionally, we

serve our customers through Nordstrom Direct (on the web at

www.nordstrom.com and through our direct mail catalogs).

Our Credit Operations offer a Nordstrom private label card and a

co-branded Nordstrom VISA credit card, which generate earnings

through finance charges and securitization-related gains.

Our operations also include a product development group, which

coordinates the design and production of private label merchandise

sold in our retail stores.

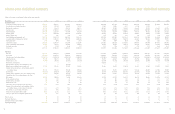

Change in Fiscal Year: On February 1, 2003, our fiscal year end

changed from January 31st to the Saturday closest to January 31st.

Our new fiscal year consists of four, 13 week quarters, with an extra

week added onto the fourth quarter every five to six years. A one-day

transition period is included in our first quarter 2003 results. All

references to 2004 and 2003 relate to the fifty-two weeks ending

January 29, 2005 and January 31, 2004, respectively. References

to 2002 relate to the year ending January 31, 2003.

Principles of Consolidation: The consolidated financial statements

include the balances of Nordstrom, Inc. and its wholly-owned

subsidiaries and investees controlled by the company for the entire

fiscal year. All significant intercompany transactions and balances

are eliminated in consolidation.

Use of Estimates: We make estimates and assumptions that affect

amounts reported in the financial statements and accompanying notes.

Actual results could differ from those estimates.

Reclassifications: Certain prior year financial statement amounts

have been reclassified to conform with our current year presentation.

Revenue Recognition: We record revenues net of estimated returns

and excluding sales taxes. Our retail stores record revenue at the point

of sale. Our catalog and Internet sales include shipping revenue and

are recorded upon delivery to the customer. Our sales returns are based

upon historical return rates. Our sales return reserves were $49,745

and $39,841 at the end of 2004 and 2003.

Buying and Occupancy Costs: Buying costs consist primarily of

salaries and costs incurred by our merchandise and private label

product development groups. Occupancy costs include rent,

depreciation, property taxes and operating costs of our retail and

distribution facilities.

Shipping and Handling Costs: Our shipping and handling costs include

payments to third-party shippers and costs to hold, move and prepare

merchandise for shipment. Shipping and handling costs of $75,421

$67,583 and $54,961 in 2004, 2003, and 2002 were included in selling,

general and administrative expenses.

Advertising: Production costs for newspaper, radio and other media are

expensed the first time the advertisement is run. Our direct response

catalog advertising production costs are expensed over the estimated

revenue stream, not to exceed six months. Total advertising expenses,

net of vendor allowances, were $123,974, $117,411, and $112,618 in

2004, 2003, and 2002.

Store Preopening Costs: Store preopening and opening costs are

expensed as they occur.

Other Income Including Finance Charges, Net: This consists primarily

of income from finance charges and late fees generated by our

Nordstrom private label cards and earnings from our investment in

asset backed securities and securitization gains, which are both

generated from the co-branded Nordstrom VISA credit card program.

Stock Compensation: We apply APB No. 25, “Accounting for Stock

Issued to Employees,” in measuring compensation costs under our

stock-based compensation programs. Stock options are issued at

the fair market value of the stock at the date of grant. Accordingly,

we recognized no compensation expense for the issuance of our

stock options.

33

32