Nordstrom 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income Taxes: We use the asset and liability method of accounting

for income taxes. Using this method, deferred tax assets and liabilities

are recorded based on differences between financial reporting and tax

basis of assets and liabilities. The deferred tax assets and liabilities

are calculated using the enacted tax rates and laws that are expected

to be in effect when the differences are expected to reverse. We

establish valuation allowances for tax benefits when we believe it is

not likely that the related expense will be deductible for tax purposes.

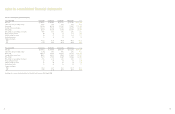

Other current liabilities: The following table shows the components of

other current liabilities:

Fiscal Year 2004 2003

Gift cards $133,532 $109,324

Other 220,669 205,429

Total other current liabilities $354,201 $314,753

Loyalty Program: Customers who reach a cumulative purchase

threshold when using our Nordstrom private label cards or our co-

branded Nordstrom VISA credit cards receive merchandise certificates.

These merchandise certificates can be redeemed in our stores similar

to a gift certificate. We estimate the net cost of the merchandise

certificate that will be ultimately earned and redeemed by the customer

and record this cost as the customer earns the merchandise

certificates. The cost of the loyalty program is not significant in

relation to the corresponding sales, so the program expense is

recorded in cost of sales rather than as a reduction of net sales.

Vendor Allowances: We receive allowances from merchandise vendors

for purchase price adjustments, cooperative advertising programs,

cosmetic selling expenses, and vendor sponsored contests. Purchase

price adjustments are recorded as a reduction of cost of sales at the

point they have been earned and the related merchandise has been

sold. Allowances for cooperative advertising programs and vendor

sponsored contests are recorded in cost of sales and selling, general

and administrative expenses as a reduction to the related cost when

incurred. Allowances for cosmetic selling expenses are recorded in

selling, general and administrative expenses as a reduction to the

related cost when incurred. Any allowances in excess of actual costs

incurred that are recorded in selling, general and administrative

expense are recorded as a reduction to cost of sales. The following

table shows vendor allowances earned during the year:

Fiscal Year 2004 2003 2002

Purchase price adjustments $47,707 $49,312 $42,777

Cosmetic selling expenses 96,936 88,518 79,794

Cooperative advertising 57,786 44,939 41,309

Vendor sponsored contests 3,975 4,180 3,734

Total vendor allowances $206,404 $186,949 $167,614

notes to consolidated financial statements

Leases: We recognize lease expense on a straight-line basis over the

initial lease term. In 2004, we corrected our lease accounting policy

to recognize lease expense, net of landlord reimbursements, from the

time that we control the leased property. In the past, we recorded net

rent expense once lease payments or retail operations started. We

recorded a charge of $7,753 ($4,729 net of tax) in the fourth quarter

of 2004 to correct this accounting policy. The impact of this change

was immaterial to prior periods.

We lease the land or the land and building at many of our Full-Line

stores, and we lease the building at many of our Rack stores.

Additionally, we lease office facilities, warehouses and equipment.

Most of these leases are classified as operating leases and they expire

at various dates through 2080. We have no significant individual or

master lease agreements.

Our fixed, noncancelable terms of the lease generally are 20 to 30

years for Full Line stores and 10 to 15 years for Rack stores. Many

of our leases include options that allow us to extend the lease term

beyond the initial commitment period, subject to terms agreed to at

lease inception.

For leases that contain predetermined, fixed escalations of the

minimum rentals, we recognize the rent expense on a straight-line

basis and record the difference between the rent expense and the

rental amount payable under the leases in liabilities.

Most of our leases also provide for payment of operating expenses,

such as common area charges, real estate taxes and other executory

costs. Some leases require additional payments based on sales and

are recorded in rent expense when the contingent rent is probable.

Leasehold improvements made at the inception of the lease are

amortized over the shorter of the asset life or the initial lease term

as described above. Leasehold improvements made during the lease

term are also amortized over the shorter of the asset life or the initial

lease term.

We receive incentives to construct stores in certain developments.

These incentives are recorded as a deferred credit and recognized as

a reduction to rent expense on a straight-line basis over the lease term

as described above. At the end of 2004 and 2003, this deferred credit

balance was $392,807 and $407,856. We also receive incentives based

on a percentage of a store’s net sales and recognize these amounts in

the year that they are earned as a reduction to rent expense.

Foreign Currency Translation: The assets and liabilities of our foreign

subsidiaries have been translated to U.S. dollars using the exchange

rates effective on the balance sheet date, while income and expense

accounts are translated at the average rates in effect during the year.

The resulting translation adjustments are recorded in accumulated

other comprehensive earnings.

notes to consolidated financial statements

Allowances were recorded in our consolidated statement of earnings

as follows:

Fiscal Year 2004 2003 2002

Cost of sales $106,902 $55,161 $44,379

Selling, general and administrative

expense 99,502 131,788 123,235

Total vendor allowances $206,404 $186,949 $167,614

Fair Value of Financial Instruments: The carrying amounts of cash

equivalents and short term-investments approximate fair value.

See Note 11 for the fair values of our long-term debt, including

current maturities and interest rate swap agreements.

Derivatives Policy: We use derivative financial instruments to manage

our interest rate and foreign currency exchange risks. Our derivative

financial instruments for our interest rate lock and our foreign

currencies are not material to our financial condition or results of

operations and we have no material off-balance sheet credit risk.

See Note 11 for a further description of our interest rate swaps.

Recent Accounting Pronouncements: In November 2004, the FASB

issued SFAS No. 151, “Inventory Costs an amendment of ARB No. 43,

Chapter 4.” SFAS No. 151 amends ARB No. 43, Chapter 4, “Inventory

Pricing” to clarify that abnormal amounts of idle facility expense,

freight, handling costs, and wasted material should be recognized

as current period charges. In addition, this statement requires that

fixed overhead production costs be allocated to conversion costs based

on the normal capacity of the production facilities. SFAS No. 151 is

effective for inventory costs incurred during fiscal years beginning

after June 15, 2005, and should be applied prospectively. We do not

believe the adoption of SFAS No. 151 will have a material impact on

our financial statements.

In December 2004, the FASB issued SFAS No. 123R, “Share-Based

Payment.” SFAS No. 123R requires us to measure the cost of employee

services received in exchange for an award of equity instruments based

on the grant-date fair value of the award. That cost will be recognized

over the period during which an employee is required to provide services

in exchange for the award. We have not yet quantified the effects of

the adoption of SFAS No. 123R, but it is expected that the new standard

will result in significant stock-based compensation expense. SFAS

No. 123R will be effective for our third fiscal quarter beginning

July 31, 2005.

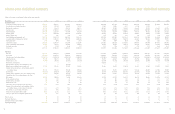

Note 2: Cumulative Effect of Accounting Change

In 2002, we adopted SFAS No. 142, “Goodwill and Other Intangible

Assets,” which revised the accounting and reporting requirements for

goodwill and other intangible assets. Under SFAS No. 142, goodwill

and intangible assets having indefinite lives are no longer amortized

but are subject to annual impairment tests. Our intangible assets

were determined to be either goodwill or indefinite lived tradename.

We have three reporting units that we evaluate. At the beginning of

2002, we had $133,436 of intangibles associated with our Façonnable

Business Unit, which is one level below our reportable Retail Stores

segment. The purchase of the minority interest of Nordstrom.com LLC

in the first quarter of 2002 resulted in additional goodwill of $24,178,

of which $8,462 was allocated to the Retail Stores reporting unit and

$15,716 to the Catalog/Internet reporting unit.

We test our intangible assets for impairment by comparing the fair

value of the reporting unit with its carrying value. Fair value was

determined using a discounted cash flow methodology. We perform

our impairment test annually during our first quarter or when

circumstances indicate we should do so. Our initial impairment test

of the Façonnable Business Unit resulted in an impairment charge to

tradename of $16,133 and to goodwill of $5,767. These impairments

resulted from a reduction in management’s estimate of future growth

for this reporting unit. The impairment charge is reflected as a

cumulative effect of accounting change. No further impairments

have occurred to date.

The following table shows the actual results of operations as well as

pro-forma results adjusted to exclude the cumulative effect of the

accounting change in 2002. There was no impact to 2004 or 2003.

Fiscal year 2002 Net earnings Earnings per share

Basic Diluted

Reported net earnings $90,224 $0.67 $0.66

Cumulative effect of accounting

change, net of tax 13,359 0.10 0.10

Adjusted net earnings $103,583 $0.77 $0.76

37

36