Nordstrom 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

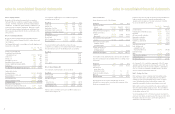

notes to consolidated financial statements

In 2004, we prepaid $196,770 of our 8.95% senior notes and $1,473

of our 6.7% medium-term notes for a total cash payment of $220,106.

After considering deferred issuance costs related to these debt

retirements, we recorded a pre-tax charge for debt retirements in

interest expense, net of $20,862.

To manage our interest rate risk, we have an interest rate swap

outstanding recorded in other liabilities. Our swap has a $250,000

notional amount, expires in 2009 and is designated as a fully effective

fair value hedge. Under the agreement, we receive a fixed rate of

5.63% and pay a variable rate based on LIBOR plus a margin of 2.3%

set at six-month intervals (5.20% at January 29, 2005).

The fair value of long-term debt, including current maturities, using

quoted market prices of the same or similar issues, was approximately

$1,105,000 and $1,336,000 at the end of 2004 and 2003.

We own a 49% interest in a limited partnership which constructed

a corporate office building in which we are the primary occupant.

During 2002, the limited partnership refinanced its construction loan

obligation with a mortgage secured by the property. This mortgage,

which is included in our long-term debt, will be amortized as we make

rental payments to the limited partnership over the life of the mortgage.

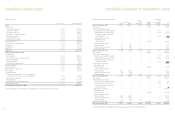

Required principal payments on long-term debt, excluding capital

lease obligations and the fair market value of the interest rate swap,

are as follows:

Fiscal Year

2005 100,033

2006 303,669

2007 3,675

2008 253,650

2009 4,340

Thereafter 362,119

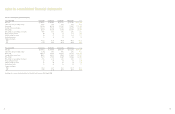

In May 2004, we replaced our existing $300,000 unsecured line of

credit with a $350,000 unsecured line of credit, which is available as

liquidity support for our commercial paper program. Under the terms

of the agreement, we pay a variable rate of interest based on LIBOR

plus a margin of 0.31%, or 2.90% at January 29, 2005. The variable

rate of interest increases to LIBOR plus a margin of 0.41% if more than

$175,000 is outstanding on the facility. The line of credit agreement

expires in May 2007 and contains restrictive covenants, which include

maintaining a leverage ratio. We also pay a commitment fee for the line

based on our debt rating. As of January 29, 2005, no borrowings have

been made against this revolving credit facility.

Also in May 2004, we renewed our variable funding note backed by

Nordstrom private label card receivables and reduced the capacity

by $50,000 to $150,000. This note is renewed annually and interest

is paid based on the actual cost of commercial paper plus specified

fees. We also pay a commitment fee for the note based on the amount

of the commitment. As of January 29, 2005, no borrowings have been

made against the variable funding note.

Note 12: Leases

Future minimum lease payments as of January 29, 2005 are as follows:

Capital Operating

Fiscal Year Leases Leases

2005 $2,314 $72,541

2006 1,946 70,756

2007 1,946 67,700

2008 1,946 65,247

2009 1,376 63,252

Thereafter 8,259 360,332

Total minimum lease payments $17,787 $699,828

Less amount representing interest (7,345)

Present value of net minimum lease payments $10,442

Rental expense for 2004, 2003 and 2002 was as follows:

Fiscal Year 2004 2003 2002

Minimum rent:

Store locations $79,285 $61,451 $54,061

Offices, warehouses

and equipment 21,104 23,158 23,026

Percentage rent:

Store locations 9,214 7,920 7,776

Property incentives: (46,737) (37,380) (29,868)

Total rent expense $62,866 $55,149 $54,995

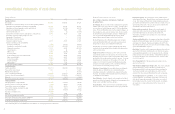

Note 13: Stock-Based Compensation

Stock Option Plans

In 2004, our shareholders approved the 2004 Equity Incentive Plan.

We currently grant stock options, performance share units and common

shares under this new plan.

Stock Options: As of January 29, 2005, we have options outstanding

under three stock option plans, (collectively, the “Nordstrom, Inc.

Plans”) with total shares authorized of 24,185. At January 29, 2005,

approximately 9,100 shares are reserved for future stock grants

pursuant to the Nordstrom, Inc. Plans. Options vest over periods

ranging from four to eight years, and expire ten years after the date

of grant. Stock option activity for the Nordstrom, Inc. Plans were

as follows:

notes to consolidated financial statements

Fiscal Year 2004 2003 2002

Weighted- Weighted- Weighted-

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

Outstanding, beginning of year 11,684 $24 11,886 $25 10,764 $24

Granted 1,415 39 2,715 18 2,424 25

Exercised (3,620) 24 (2,260) 22 (350) 19

Cancelled (319) 25 (656) 23 (949) 26

Expired —— (1) 14 (3) 18

Outstanding, end of year 9,160 $26 11,684 $24 11,886 $25

Options exercisable at end of year 3,938 $26 5,357 $27 5,725 $26

The following table summarizes information about stock options outstanding for the Nordstrom, Inc. Plans as of January 29, 2005:

Options Outstanding Options Exercisable

Weighted

Average Weighted- Weighted-

Remaining Average Average

Range of Contractual Exercise Exercise

Exercise Prices Shares Life (Years) Price Shares Price

$15 – $22 4,177 7 $18 1,739 $19

$23 – $32 2,572 6 $26 1,307 $27

$33 – $40 2,411 7 $38 892 $36

9,160 7 $26 3,938 $26

43

42