Nordstrom 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assets, income taxes, post-retirement benefits, contingent liabilities

and litigation. We base our estimates on historical experience and

on other assumptions that we believe to be reasonable under the

circumstances. Actual results may differ from these estimates.

The following discussion highlights the policies we feel are critical.

Off-Balance Sheet Financing

Our co-branded Nordstrom VISA credit card receivables are transferred

to a third-party trust on a daily basis. The balance of the receivables

transferred to the trust fluctuates as new receivables are generated

and old receivables are retired (through payments received, charge-offs,

or credits from merchandise returns). The trust issues securities that

are backed by the receivables. Certain of these securities or “beneficial

interests” are sold to third-party investors and those remaining

securities are issued to us.

We recognize gains or losses on the sale of the co-branded Nordstrom

VISA receivables to the trust based on the difference between the

face value of the receivables sold and the estimated fair value of the

assets created in the securitization process. The fair value of the

assets is calculated as the present value of their expected cash flows.

The internal rate of returns used to calculate fair value represent

the volatility and risk of the assets. Assumptions and judgments are

made to estimate the fair value of our investment in asset backed

securities. We have no other off-balance sheet transactions.

Inventory

Our inventory is stated at the lower of cost or market using the retail

inventory method (first-in, first-out basis). Under the retail method,

inventory is valued by applying a cost-to-retail ratio to the ending

inventory’s retail value. As our inventory retail value is adjusted

regularly to reflect market conditions, our inventory is valued at the

lower of cost or market. Factors considered in determining markdowns

include current and anticipated demand, customer preferences, age of

the merchandise and fashion trends.

We also reserve for obsolescence based on historical trends and

specific identification. Shrinkage is estimated as a percentage of

sales for the period from the most recent semi-annual inventory count

based on historical shrinkage results.

Revenue Recognition

We recognize revenues net of estimated returns and we exclude sales

taxes. Our retail stores record revenue at the point of sale. Our catalog

and Internet sales include shipping revenue and are recorded when the

merchandise is delivered to the customer. Our sales return liability is

estimated based on historical return rates.

management’s discussion and analysis

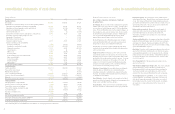

Long-term debt includes financing related to the $200.0 million

off-balance sheet receivable backed securities due in April 2007.

In addition to the required debt repayments disclosed above, we

estimate total interest payments of approximately $628.5 million as

of January 29, 2005, being paid over the remaining life of the debt.

Purchase obligations primarily consist of purchase orders for unreceived

goods or services and capital expenditure commitments.

This table excludes the short-term liabilities, other than the current

portion of long-term debt, disclosed on our balance sheets as the

amounts recorded for these items will be paid in the next year.

Other long-term liabilities consist of workers’ compensation and

general liability insurance reserves and postretirement benefits.

The repayment amounts presented above were determined based

on historical payment trends. Other long-term liabilities not requiring

cash payments, such as deferred property and lease credits, were

excluded from the table above.

Dividends

In 2004, we paid dividends of $0.48 per share, our eighth consecutive

annual dividend increase. We paid dividends of $0.41 and $0.38 per

share in fiscal 2003 and 2002.

Liquidity

We maintain a level of liquidity to allow us to cover our seasonal cash

needs and to minimize our need for short-term borrowings. We believe

that our operating cash flows, existing cash and available credit

facilities are sufficient to finance our cash requirements for the next

12 months. We plan to pay the remaining $96.0 million of our 6.7%

medium-term notes due in July 2005 with existing cash and cash

from operations.

Over the long term, we manage our cash and capital structure to

maximize shareholder return, strengthen our financial position and

maintain flexibility for future strategic initiatives. We continuously

assess our debt and leverage levels, capital expenditure requirements,

principal debt payments, dividend payouts, potential share repurchases,

and future investments or acquisitions. We believe our operating cash

flows, existing cash and available credit facilities, as well as any

potential future borrowing facilities will be sufficient to fund these

scheduled future payments and potential long term initiatives.

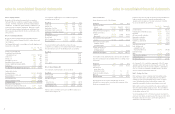

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements requires that we make

estimates and judgments that affect the reported amounts of assets,

liabilities, revenues and expenses, and disclosure of contingent assets

and liabilities. We regularly evaluate our estimates including those

related to off-balance sheet financing, inventory valuation, sales return

accruals, self-insurance liabilities, doubtful accounts, intangible

management’s discussion and analysis

Vendor Allowances

We receive allowances from merchandise vendors for purchase price

adjustments, cooperative advertising programs, cosmetic selling

expenses and vendor sponsored contests. Purchase price adjustments

are recorded as a reduction of cost of sales after an agreement with

the vendor is executed and the related merchandise has been sold.

Allowances for cooperative advertising programs and vendor sponsored

contests are recorded in cost of sales and selling, general and

administrative expenses as a reduction to the related cost when

incurred. Allowances for cosmetic selling expenses are recorded in

selling, general and administrative expenses as a reduction to the

related cost when incurred. Any allowances in excess of actual costs

incurred that are recorded in selling, general and administrative

expenses are recorded as a reduction to cost of sales.

Self Insurance

We are self insured for certain losses related to health and welfare,

workers’ compensation and general liability. We record estimates

of the total cost of claims incurred as of the balance sheet date.

These estimates are based on internal analysis of historical data

and validated by independent actuarial estimates.

Allowance For Doubtful Accounts

Our allowance for doubtful accounts represents our best estimate

of the losses inherent in our private label credit card receivable as of

the balance sheet date. We evaluate the collectibility of our accounts

receivable based on several factors, including historical trends of

aging of accounts, write-off experience and expectations of future

performance. We recognize finance charges on delinquent accounts

until the account is written off. Delinquent accounts are written off

when they are determined to be uncollectible, usually after the passage

of 151 days without receiving a full scheduled monthly payment.

Accounts are written off sooner in the event of customer bankruptcy

or other circumstances that make further collection unlikely. Our

write-off experience and aging trends have been consistent over the

last two years.

Valuation of Long-Lived Assets

We review our intangibles and other long-lived assets annually for

impairment or when events or changes in circumstances indicate

the carrying value of these assets may not be recoverable. We estimate

the fair value of an asset based on the future cash flows the asset

is expected to generate. An impairment loss is recognized when the

carrying value of the asset exceeds its fair value. Factors used in the

valuation of long-lived assets include, but are not limited to,

management’s plans for future operations, recent operating results

and projected cash flows.

Recent Accounting Pronouncements

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs an

amendment of ARB No. 43, Chapter 4.” SFAS 151 amends ARB No. 43,

Chapter 4, “Inventory Pricing” to clarify that abnormal amounts of idle

facility expense, freight, handling costs, and wasted material should

be recognized as current period charges. In addition, this statement

requires that fixed overhead production be allocated to the costs of

conversion based on the normal capacity of the production facilities.

SFAS 151 is effective for inventory costs incurred during fiscal years

beginning after June 15, 2005, and should be applied prospectively.

We do not believe the adoption of SFAS 151 will have a material

impact on our financial statements.

In December 2004, the FASB issued SFAS No. 123R, “Share-Based

Payment.” SFAS 123R requires us to measure the cost of employee

services received in exchange for an award of equity instruments based

on the grant-date fair value of the award. That cost will be recognized

over the period during which an employee is required to provide services

in exchange for the award. We have not yet quantified the effects of

the adoption of SFAS 123R, but it is expected that the new standard will

result in significant stock-based compensation expense. SFAS 123R

will be effective for our third fiscal quarter beginning July 31, 2005.

Cautionary Statement

The preceding disclosures included forward-looking statements

regarding our performance, liquidity, capital expenditures and adequacy

of capital resources. These statements are based on our current

assumptions and expectations and are subject to certain risks and

uncertainties that could cause actual results to differ materially from

those projected. Forward-looking statements are qualified by the risks

and challenges posed by our ability to predict fashion trends, consumer

apparel buying patterns, our ability to control costs, weather conditions,

hazards of nature, trends in personal bankruptcies and bad debt

write-offs, changes in interest rates, employee relations, our ability

to continue our expansion plans, potential opportunities that may be

related to the current changes in our industry, changes in governmental

or regulatory requirements, and the impact of economic and competitive

market forces, including the impact of terrorist activity or the impact of

a war on us, our customers and the retail industry. As a result, while

we believe there is a reasonable basis for the forward-looking

statements, you should not place undue reliance on those statements.

We undertake no obligation to update or revise any forward-looking

statements to reflect subsequent events, new information or future

circumstances. This discussion and analysis should be read in

conjunction with the consolidated financial statements and the

eleven-year statistical summary.

25

24