Nordstrom 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

new receivables are generated and old receivables are retired (through

payments received, charge-offs, or credits from merchandise returns).

The trusts issue securities that are backed by the receivables.

Certain of these securities or “beneficial interests” are sold to

third-party investors and the remaining securities are issued to us.

Under the terms of the trust agreements, we may be required to fund

certain amounts upon the occurrence of specific events. Both of our

credit card securitization agreements set a maximum percentage of

receivables that can be associated with various receivable categories,

such as employee or foreign receivables. As of January 29, 2005, these

maximums were exceeded by $166. It is possible that we may be

required to repurchase these receivables. Aside from these instances,

we do not believe any additional funding will be required.

The private label securitizations are accounted for as a secured

borrowing (on-balance sheet) while the VISA securitization qualifies

for sale treatment (off-balance sheet).

NORDSTROM PRIVATE LABEL RECEIVABLES (ON-BALANCE SHEET)

We transfer these receivables to a third-party trust (“Private Label

Trust”) that issues two Nordstrom private label receivable backed

securitizations:

•In November 2001, the Private Label Trust issued $300,000 of

Class A notes to third party investors (“Private Label Securitization”).

The Class A notes bear a fixed coupon rate of 4.82% and mature in

October 2006. The Class A notes are included in long-term debt

and the Nordstrom private label card receivables, which serve as

collateral for the debt, are included in accounts receivable, net.

•In December 2001, a variable funding note was established that

is also collateralized by the Nordstrom private label receivables

(“Private Label VFN”). The Private Label VFN was initially

established with a facility limit of $200,000 with an annual renewal

subject to agreement by all parties. In May 2004, we renewed the

Private Label VFN and reduced the capacity by $50,000 to $150,000.

Interest on the Private Label VFN varies based on the actual cost of

commercial paper plus specified fees. We also pay a commitment

fee for the Private Label VFN based on the amount of the

commitment. No borrowings were made under the Private Label

VFN in 2004 or 2003.

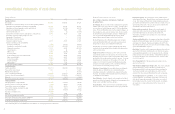

Total principal receivables of the securitized private label portfolio at

the end of 2004 and 2003 were approximately $566,967 and $584,828,

and receivables more than 30 days past due were approximately

$13,099 and $14,910. Net charged off receivables for 2004, 2003

and 2002 were $25,370, $28,703, and $29,555.

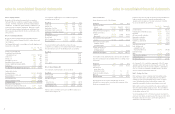

notes to consolidated financial statements

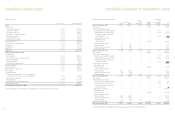

The following table illustrates the effect on net earnings and earnings

per share if we had applied the fair value recognition provisions of SFAS

No. 123, “Accounting for Stock-Based Compensation.”

Fiscal year 2004 2003 2002

Net earnings, as reported $393,450 $242,841 $90,224

Add: stock-based compensation

expense included in reported

net earnings, net of tax 4,894 9,898 2,240

Deduct: stock-based compensation

expense determined under fair

value, net of tax (25,001) (30,154) (22,834)

Pro forma net earnings $373,343 $222,585 $69,630

Earnings per share:

Basic–as reported $2.82 $1.78 $0.67

Diluted–as reported $2.77 $1.76 $0.66

Basic–pro forma $2.68 $1.63 $0.52

Diluted–pro forma $2.62 $1.62 $0.51

Cash Equivalents: Cash equivalents are short-term investments with

a maturity of three months or less from the date of purchase.

As of the end of 2004 and 2003, we have restricted cash of $6,886

and $7,140 included in other long term assets. The restricted cash is

held in a trust for use by our Supplemental Executive Retirement Plan

and Deferred Compensation Plans.

Cash Management: Our cash management system provides for the

reimbursement of all major bank disbursement accounts on a daily

basis. Accounts payable at the end of 2004 and 2003 includes $86,725

and $89,404 of checks not yet presented for payment drawn in excess of

our bank deposit balances.

Short-term Investments: Short-term investments consist of auction

rate securities classified as available-for-sale. Auction rate securities

are high-quality variable rate bonds whose interest rate is periodically

reset, typically every 7, 28, or 35 days. However, the underlying security

can have a duration from 15 to 30 years. Our auction rate securities

are stated at cost, which approximates fair value, and therefore there

were no unrealized gains or losses related to these securities included

in accumulated other comprehensive earnings. The cost of securities

sold was based on the specific identification method.

Securitization of Accounts Receivable: We offer Nordstrom private

label cards and co-branded Nordstrom VISA credit cards to our

customers. Substantially all of the receivables related to both credit

cards are securitized. Under our credit card securitizations, the

receivables are transferred to third-party trusts on a daily basis.

The balance of the receivables transferred to the trusts fluctuates as

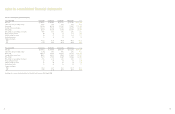

notes to consolidated financial statements

CO-BRANDED NORDSTROM VISA RECEIVABLES (OFF-BALANCE SHEET)

In order to enhance our cost-effective capital sources, we have in place

a securitized asset structure. This allows us to reduce our investment

in the co-branded Nordstrom VISA credit card receivables, so we can

deploy our capital resources to greater-value opportunities.

We transfer our co-branded Nordstrom VISA credit card receivables to

a third-party trust (“VISA Trust”) that issues VISA receivable backed

securities. In May 2002, the VISA Trust issued $200,000 of certificated

Class A and Class B notes to third-party investors (“2002 Class A & B

Notes”) and a certificated, subordinate Class C note to us. The

receivables transferred to the VISA Trust exceeded the face value of the

issued notes. This excess created a certificated, non-subordinated

asset called the Transferor’s Interest, which was also conveyed to us.

In addition, we hold a non-certificated Interest Only Strip, which results

when the estimated value of projected cash inflows related to the notes

exceeds the projected cash outflows.

We do not record the $200,000 in debt related to the VISA securitization

or the receivables transferred to the VISA Trust on our consolidated

financial statements. However, we do hold the 2002 Class C note,

the Transferor’s Interest and the Interest Only Strip. These amounts

are included in the consolidated balance sheets as investment in asset

backed securities and accounted for as investments in “available-for-

sale” debt securities. As such, we record the investment in asset

backed securities at its estimated fair value in our consolidated

balance sheets.

We recognize gains or losses on the sale of the co-branded Nordstrom

VISA receivables to the VISA Trust based on the difference between the

face value of the receivables sold and the estimated fair value of the

assets created in the securitization process. The receivables sold to

the VISA Trust are then allocated between the various interests in the

VISA Trust based on those interests’ relative fair market values. The

fair values of the assets are calculated as the present value of their

expected future cash flows. The unrealized gains and losses, as well

as any adjustments to fair value of the investment in asset backed

securities, are recorded as a component of accumulated other

comprehensive earnings.

In addition, we record interest income related to the investment

in asset backed securities based upon their carrying value and their

internal rate of returns.

The gain on sales of receivables and the interest income earned on the

beneficial interests are included in other income including finance

charges, net in our consolidated statements of earnings.

Accounts Receivable: Accounts receivable consist primarily of our

Nordstrom private label receivables that serve as collateral for our

Private Label Securitization. We record the face value of the principal,

plus any assessed finance charges, late fees, or cash advance fees.

We recognize these charges and fees when earned and accrue for any

earned but not yet billed charges and fees.

We report accounts receivable net of an allowance for doubtful

accounts. Our allowance for doubtful accounts represents our best

estimate of the losses inherent in our customer accounts receivable

based on several factors, including historical trends of aging of

accounts, write-off experience and expectations of future performance.

We recognize finance charges on delinquent accounts until the account

is written off or when an account is placed into a debt management

program. Payments received for these accounts are recorded in the

same manner as other accounts. Our approach for resuming accrual

of interest on these accounts is made on an account by account basis.

Delinquent accounts are written off when they are determined to be

uncollectible, usually after the passage of 151 days without receiving

a full scheduled monthly payment. Accounts are written off sooner

in the event of customer bankruptcy or other circumstances making

further collection unlikely.

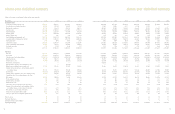

Merchandise Inventories: Merchandise inventories are valued

at the lower of cost or market, using the retail method (first-in,

first-out basis).

Land, Buildings and Equipment: Depreciation is computed using

a combination of accelerated and straight-line methods.

Estimated useful lives by major asset category are as follows:

Asset Life (in years)

Buildings and improvements 5-40

Store fixtures and equipment 3-15

Leasehold improvements Shorter of life of lease or asset life

Software 3-7

Asset Impairment: We review our intangibles and other long-lived

assets annually for impairment or when circumstances indicate the

carrying value of these assets may not be recoverable. The goodwill

and tradename associated with our Façonnable business are our largest

impairment risk. See Note 2 for our impairment evaluation of goodwill

and intangible assets.

35

34