Nordstrom 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

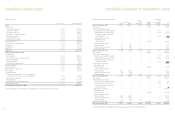

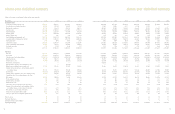

notes to consolidated financial statements

Performance Share Units: Performance share units are earned over

a three-year period. The number of performance share units earned

is determined by the performance of our stock price and dividend

payments relative to a pre-defined group of retail peers over the three-

year period. Employees do not pay any monetary consideration upon

vesting and may elect to receive common stock or cash. The following

table outlines the performance share unit activity:

Fiscal Year 2004 2003 2002

Granted 62 114 191

Vested ———

Cancelled —— (23)

Outstanding, end of year 62 114 168

At the end of 2004 and 2003, our liabilities included $15,278 and

$18,657 for the unvested grants.

Nonemployee Director Stock Incentive Plan

The Nonemployee Director Stock Incentive Plan authorizes the grant of

stock awards to nonemployee directors. These awards may be deferred

or issued in the form of restricted or unrestricted stock, nonqualified

stock options or stock appreciation rights, although we have only issued

stock under the plan. We issued 5, 16 and 19 shares of common stock

for a total expense of $202, $318 and $405 for 2004, 2003 and 2002.

An additional 3 and 11 shares were deferred for a total expense of

$140 and $183 in 2004 and 2003. At January 29, 2005, we had 399

remaining shares available for issuance.

Employee Stock Purchase Plan

We offer an Employee Stock Purchase Plan as a benefit to our

employees. Employees may make payroll deductions of up to ten

percent of their base compensation. At the end of each six-month

offering period, the participants purchase shares of our common stock

at 85% of the lower of the stock’s fair market value at the beginning

or the end of the offering period. We issued 489, 647, and 596 shares

under this plan in 2004, 2003, and 2002. As of January 29, 2005

and January 31, 2004, we had payroll deductions totaling $5,097

and $3,728 for the purchase of shares in the future. We have 1,060

shares available for issuance at January 29, 2005.

Nordstrom.com

In connection with the purchase of the minority interest in

Nordstrom.com (see Note 18), we purchased 3,608 options and 470

warrants for a total cash payment of $11,802 in the third quarter of

2002. At the end of 2004 and 2003, there are no outstanding options

or warrants for Nordstrom.com.

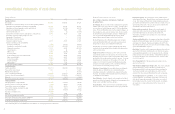

Stock Based Compensation Expense

We apply APB No. 25, “Accounting for Stock Issued to Employees,”

in measuring compensation costs under our stock-based compensation

programs. Stock options are issued at the fair market value of the

stock at the date of grant. Accordingly, we recognized no compensation

cost for stock options issued under the Nordstrom, Inc. Plans.

For performance share units, we record compensation expense over

the performance period at the fair value of the stock at the end of

each reporting period based on the vesting percentages on those dates.

Stock-based compensation expense for 2004, 2003, and 2002 was

$8,051, $17,894, and $1,130.

SFAS No. 123

The table in Note 1, under Stock Compensation, illustrates the effect

on net earnings and earnings per share if we had applied the fair

value recognition provisions of SFAS No. 123, “Accounting for Stock-

Based Compensation.”

notes to consolidated financial statements

The Black-Scholes method was used to estimate the fair value of the

options at grant date under SFAS 123 based on the following factors:

Fiscal Year 2004 2003 2002

Stock Options:

Risk-free interest rate 3.0% 2.9% 4.3%

Volatility 65.4% 70.6% 69.5%

Dividend yield 1.5% 1.5% 1.5%

Expected life in years 6.0 5.0 5.0

Weighted-average fair value

at grant date $21 $10 $14

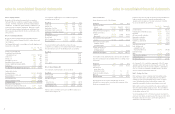

Note 14: Accumulated Other Comprehensive Earnings

The following table shows the components of accumulated other

comprehensive earnings:

Jan. 29, Jan. 31, Jan. 31,

2005 2004 2003

Foreign currency translation $16,276 $15,783 $8,404

SERP adjustment (11,798) (11,679) (6,511)

Securitization fair value adjustment 4,857 4,764 807

Total accumulated other

comprehensive earnings $9,335 $8,868 $2,700

Note 15: Supplementary Cash Flow Information

In 2002, the VISA Trust issued $200,000 of certificated Class A and

Class B notes. The proceeds from this securitization were used to

retire the $200,000 outstanding on a previous off-balance sheet

VISA securitization.

Supplementary cash flow information includes the following:

Fiscal Year 2004 2003 2002

Cash paid during the year for:

Interest (net of

capitalized interest) $88,876 $96,824 $84,898

Income taxes 253,576 121,271 48,386

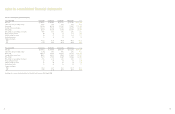

Note 16: Segment Reporting

We have four segments: Retail Stores, Credit Operations,

Catalog/Internet, and Corporate and Other.

The Retail Stores segment derives its revenues from sales of high-

quality apparel, shoes, cosmetics and accessories. It includes

our Full-Line, Rack and Façonnable stores as well as our product

development group, which coordinates the design and production

of private label merchandise sold in our retail stores.

The Credit Operations segment revenues consist primarily of finance

charges earned through operation of the Nordstrom private label and

co-branded VISA credit cards.

The Catalog/Internet segment generates revenues from high-quality

apparel, shoes, cosmetics and accessories via direct mail catalogs and

the Nordstrom.com website.

We use the same measurements to compute net earnings for reportable

segments as we do for the consolidated company. The accounting

policies of the operating segments are the same as those described

in the summary of significant accounting policies in Note 1.

45

44