Nordstrom 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

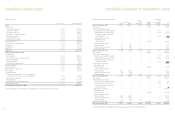

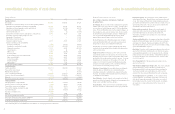

consolidated balance sheets

Amounts in thousands

January 29, 2005 January 31, 2004

Assets

Current assets:

Cash and cash equivalents $360,623 $340,281

Short-term investments 41,825 176,000

Accounts receivable, net 645,663 666,811

Investment in asset backed securities 422,416 272,294

Merchandise inventories 917,182 901,623

Current deferred tax assets 131,547 121,681

Prepaid expenses and other 53,188 46,153

Total current assets 2,572,444 2,524,843

Land, buildings and equipment, net 1,780,366 1,807,778

Goodwill, net 51,714 51,714

Tradename, net 84,000 84,000

Other assets 116,866 100,898

Total assets $4,605,390 $4,569,233

Liabilities and Shareholders’ Equity

Current liabilities:

Accounts payable $482,394 $458,809

Accrued salaries, wages and related benefits 287,904 276,007

Other current liabilities 354,201 314,753

Income taxes payable 115,556 66,157

Current portion of long-term debt 101,097 6,833

Total current liabilities 1,341,152 1,122,559

Long-term debt, net 929,010 1,227,410

Deferred property incentives, net 367,087 407,856

Other liabilities 179,147 177,399

Shareholders’ equity:

Common stock, no par value: 500,000 shares authorized;

135,665 and 138,377 shares issued and outstanding 552,655 424,645

Unearned stock compensation (299) (597)

Retained earnings 1,227,303 1,201,093

Accumulated other comprehensive earnings 9,335 8,868

Total shareholders’ equity 1,788,994 1,634,009

Total liabilities and shareholders’ equity $4,605,390 $4,569,233

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

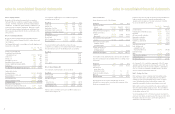

consolidated statements of shareholders’ equity

Amounts in thousands except per share amounts Accumulated

Unearned Other

Common Stock Stock Retained Comprehensive

Shares Amount Compensation Earnings Earnings Total

Balance at January 31, 2002 134,469 $341,316 $(2,680) $975,203 $2,406 $1,316,245

Net earnings — — — 90,224 — 90,224

Other comprehensive earnings:

Foreign currency translation adjustment — — — — 7,755 7,755

SERP adjustment, net of tax of $4,163 — — — — (6,511) (6,511)

Securitization fair value adjustment,

net of tax of $607 — — — — (950) (950)

Comprehensive net earnings — — — — — 90,518

Cash dividends paid

($0.38 per share) — — — (51,322) — (51,322)

Issuance of common stock for:

Stock option plans 350 7,959 — — — 7,959

Employee stock purchase plan 596 8,062 — — — 8,062

Stock compensation 29 732 670 — — 1,402

Balance at January 31, 2003 135,444 358,069 (2,010) 1,014,105 2,700 1,372,864

Net earnings — — — 242,841 — 242,841

Other comprehensive earnings:

Foreign currency translation adjustment — — — — 7,379 7,379

SERP adjustment, net of tax of $3,304 — — — — (5,168) (5,168)

Securitization fair value adjustment,

net of tax of $(2,530) — — — — 3,957 3,957

Comprehensive net earnings — — — — — 249,009

Cash dividends paid

($0.41 per share) — — — (55,853) — (55,853)

Issuance of common stock for:

Stock option plans 2,260 57,981 — — — 57,981

Employee stock purchase plan 648 9,677 — — — 9,677

Stock compensation 25 (1,082) 1,413 — — 331

Balance at January 31, 2004 138,377 424,645 (597) 1,201,093 8,868 1,634,009

Net earnings — — — 393,450 — 393,450

Other comprehensive earnings:

Foreign currency translation adjustment — — — — 493 493

SERP adjustment, net of tax of $76 — — — — (119) (119)

Securitization fair value adjustment,

net of tax of $(59) — — — — 93 93

Comprehensive net earnings — — — — — 393,917

Cash dividends paid

($0.48 per share) — — — (67,240) — (67,240)

Issuance of common stock for:

Stock option plans 3,618 111,315 — — — 111,315

Employee stock purchase plan 489 14,081 — — — 14,081

Stock compensation 89 2,614 298 — — 2,912

Repurchase of common stock (6,908) — — (300,000) — (300,000)

Balance at January 29, 2005 135,665 $552,655 $(299) $1,227,303 $9,335 $1,788,994

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

31

30