Nordstrom 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESULTS OF OPERATIONS

Segment results are discussed in each of the following sections

as applicable.

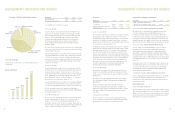

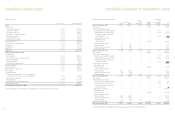

Net Sales (in millions)

Fiscal Year 2002 2003 2004

Net sales increase 6.0% 8.5% 10.6%

Same-store sales increase 1.4% 4.1% 8.5%

See our GAAP sales reconciliation on page 21.

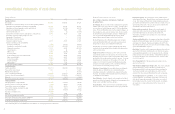

2004 VS 2003 NET SALES

In general, retailers’ sales results were mixed in 2004. Our net sales

increased as our customers responded to our merchandise offerings.

Both our Full-Line and Rack stores had overall and same-store sales

increases. All of our geographic regions and major merchandise

categories also reported overall and same-store sales increases.

The strongest performing categories were Accessories, Women’s

Shoes and Women’s Better Apparel, followed by Women’s Designer

and Men’s Apparel.

Total net sales also benefited from the six Full-Line stores and two Rack

stores opened since February 2003, increasing our retail square footage

5% during the last two years.

Sales at Nordstrom Direct increased 28.3% due to strong Internet sales

and improved fulfillment of customer orders. Internet sales increased

53.1% due to an increase in the rate of website visits that result in

sales and increased Internet advertising. Catalog net sales decreased

in 2004 by 3%, which is consistent with our strategy to shift catalog

customers to the Internet.

2003 VS 2002 NET SALES

We had significant sales growth in 2003 as net sales increased 8.5%

over the prior year. This overall growth resulted from same-store sales

increases and store openings. Same-store sales on a 4-5-4 basis

increased 4.1% due to increases at both our Full-Line stores and Rack

stores. Additionally, we opened twelve Full-Line and six Rack stores

since February 2002. We also closed one Rack store. The net impact

was an increase to our retail square footage of 12%.

Sales at Nordstrom Direct increased 15.4% due to improved fulfillment

of customers orders and strong Internet sales. During 2003, Internet

sales increased approximately 46% while catalog sales declined by 9%.

In 2003, merchandise division sales growth was led by Women’s

Designer Apparel, Accessories and Cosmetics, followed by Men’s Apparel

and Women’s and Men’s Shoes.

2005 FORECAST OF NET SALES

In 2005, we plan to open four Full-Line stores, increasing retail square

footage by approximately 3%. We expect 2005 same-store sales to

increase 1 to 3%. In 2005, we will expand the integration of our

merchandise offerings across our full-price channels. Our goal for the

next several years is to build a multi-channel merchandise offering that

creates a superior and seamless experience for our customers.

management’s discussion and analysis management’s discussion and analysis

Gross Profit

Fiscal Year 2002 2003 2004

Gross profit as a percentage

of net sales 33.2% 34.6% 36.1%

Average inventory per square foot $58.15 $54.81 $52.46

Inventory turnover 3.85 4.10 4.51

2004 VS 2003 GROSS PROFIT

In 2004, the improvement in gross profit as a percentage of net sales

was primarily a result of meeting our customers’ desire for fresh,

compelling merchandise, which increased the sales of regular priced

merchandise. In addition, gross profit benefited from our ongoing

improvement in managing inventory and by holding buying costs and

the fixed portion of occupancy expenses flat.

Contributing to our gross profit rate improvement was the continuous

improvement we are making utilizing our perpetual inventory system

investment, which we made in 2003. We have better visibility into

sales trends and on-hand content, allowing us to more effectively

manage our merchandise; the result was a significant improvement

in our inventory turnover rate. Increased sell-through of regular priced

merchandise reduced the markdowns necessary to sell slow moving

goods. We maintained our inventory at levels consistent with the

prior year, even though our sales and square footage grew in 2004.

The overall improvements in merchandise management have

generated higher margins on our inventory investments.

2003 VS 2002 GROSS PROFIT

Gross profit as a percentage of net sales improved in 2003 due to

strong sales, substantially lower markdowns and improved shrink

results, as well as an improvement in expenses related to our private

label business.

Merchandise division gross profit was led by Accessories, Women’s

Specialized Apparel, Women’s Contemporary/Juniors Apparel and

Men’s Apparel.

Average inventory per square foot declined due to improved

merchandise management at both our Full-Line and Rack stores.

Buying and occupancy expenses benefited from leverage on a higher

sales base resulting in a small improvement on a percentage of

sales basis.

2005 FORECAST OF GROSS PROFIT

In 2005, we expect to see a 10 to 20 basis point improvement in

our gross profit rate performance from ongoing merchandise margin

improvement as well as buying and occupancy efficiencies.

Selling, General and Administrative Expenses

Fiscal Year 2002 2003 2004

Selling, general and administrative

expenses as a percentage of sales 30.0% 29.4% 28.3%

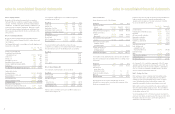

2004 VS 2003 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

We continued to use our infrastructure to support increased sales.

In 2004, our selling, general and administrative expenses as a

percentage of net sales improved 110 basis points. We were able

to control and leverage our fixed general and administrative expenses,

especially non-selling labor. While selling expense increased in 2004,

primarily from higher costs linked to increased sales, we experienced a

slight rate improvement in selling expense as a percentage of net sales.

2003 VS 2002 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

The 2002 selling, general and administrative expense includes an

impairment charge of $15.6 million related to the write-down of

an information technology investment in a supply chain software

application in our private label division. We believe that excluding

this charge provides a more comparable basis from which to evaluate

performance between years. Without this charge, 2002 selling, general

and administrative expenses as a percentage of net sales would have

been 29.7%.

Excluding the effects of the 2002 impairment charge, selling, general

and administrative expenses as a percentage of net sales decreased

in 2003 to 29.4% from 29.7% in the prior year. This improvement

was primarily the result of leverage on better-than-planned sales

and overall expense improvements.

2005 FORECAST OF SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

In 2005, selling, general and administrative expenses as a percentage

of net sales are expected to improve 40 to 60 basis points as we

continue to take steps to improve the effectiveness and efficiency of

our business processes.

Interest Expense, Net

2004 VS 2003 INTEREST EXPENSE, NET

We prepaid debt of $198.2 million in 2004 and $105.7 million in 2003.

We incurred debt prepayment costs of $20.9 million in 2004 and $14.3

million in 2003. The decrease in our interest expense, net in 2004 was

due to the reduction in our 2004 average outstanding debt, partially

offset by the increase in the prepayment costs.

19

18

women’s

apparel 36%

women’s accessories

and cosmetics 20%

shoes 20%

men’s

apparel 18%

children’s apparel 3%

other 3%

Percentage of 2004 Sales by Merchandise Category

2000 2001 2002 2003 2004

$5,512

$5,608

$5,945

$6,449

$7,131