Nordstrom 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

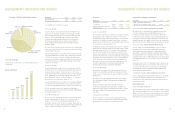

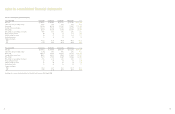

The components of SERP expense and a summary of significant

assumptions are as follows:

Fiscal Year 2004 2003 2002

Service cost $1,489 $819 $1,447

Interest cost 3,965 3,420 3,537

Amortization of net loss 1,543 751 1,613

Amortization of prior service cost 962 693 1,004

Amortization of transition obligation —— 324

Total expense $7,959 $5,683 $7,925

Assumption percentages:

Discount rate 6.25% 6.25% 7.00%

Rate of compensation increase 4.00% 4.00% 4.00%

Measurement date 10/31/04 10/31/03 10/31/02

The expected future benefit payments based upon the same

assumptions as of January 29, 2005 and including benefits attributable

for future employee service for the following periods are as follows:

Fiscal Year

2005 $3,471

2006 3,497

2007 3,591

2008 3,589

2009 3,641

2010 - 2014 22,733

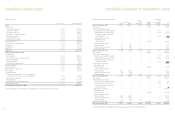

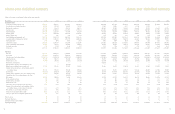

Note 5: Interest Expense, Net

The components of interest expense, net are as follows:

Fiscal Year 2004 2003 2002

Short-term debt $725 $652 $677

Long-term debt 87,793 99,866 89,850

Total interest expense 88,518 100,518 90,527

Less:

Interest income (7,929) (5,981) (4,254)

Capitalized interest (3,161) (3,585) (4,352)

Interest expense, net $77,428 $90,952 $81,921

Interest income is recorded in our Corporate and Other segment as an

offset to interest expense, net.

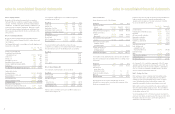

notes to consolidated financial statements

Note 3: Employee Benefits

We provide a 401(k) and profit sharing plan for our employees.

The Board of Directors establishes our profit sharing contribution

each year. The 401(k) component is funded by voluntary employee

contributions. In addition, we provide matching contributions up to

a fixed percentage of employee contributions. Our expense related

to the profit sharing component and matching contributions to the

401(k) component totaled $54,186, $51,720, and $33,668 in 2004,

2003, and 2002.

Note 4: Postretirement Benefits

We have an unfunded Supplemental Executive Retirement Plan

(“SERP”), which provides retirement benefits to certain officers and

select employees.

The following table provides a reconciliation of benefit obligations and

funded status of the SERP:

Jan. 29, Jan. 31,

2005 2004

Change in benefit obligation:

Accumulated benefit obligation

at beginning of year $59,613 $47,573

Service cost 1,489 819

Interest cost 3,965 3,420

Amortization of net loss 1,543 751

Amortization of prior service cost 962 693

Change in additional minimum liability (766) 9,046

Distributions (2,856) (2,689)

Accumulated benefit obligation at end of year $63,950 $59,613

Funded status of plan:

Underfunded status $(69,598) $(64,870)

Unrecognized prior service cost 5,266 6,228

Unrecognized loss 24,989 24,403

Accrued pension cost (39,343) (34,239)

Additional minimum liability (24,607) (25,374)

Total SERP liability $(63,950) $(59,613)

Other balance sheet amounts:

Intangible asset included in other assets $5,266 $6,228

Accumulated other comprehensive loss, net of tax 11,798 11,679

notes to consolidated financial statements

Note 6: Income Taxes

Income tax expense consists of the following:

Fiscal Year 2004 2003 2002

Current income taxes:

Federal $282,430 $118,559 $76,901

State and local 45,091 15,516 10,633

Total current income tax expense 327,521 134,075 87,534

Deferred income taxes:

Current (15,259) (7,904) (4,225)

Non-current (58,431) 29,129 8,732

Total deferred income tax (benefit)

expense (73,690) 21,225 4,507

Total income tax expense before

cumulative effect of

accounting change 253,831 155,300 92,041

Deferred income taxes on

cumulative effect of

accounting change —— (8,541)

Total income tax expense $253,831 $155,300 $83,500

A reconciliation of the statutory Federal income tax rate to the effective

tax rate on earnings before the cumulative effect of accounting change

is as follows:

Fiscal Year 2004 2003 2002

Statutory rate 35.0% 35.0% 35.0%

State and local

income taxes, net of

Federal income taxes 3.5 3.1 3.8

Change in valuation allowance 0.3 — 8.5

Other, net 0.4 0.9 (0.2)

Effective tax rate 39.2% 39.0% 47.1%

Our effective tax rate in 2002 was unusually high, due to non-

deductible losses we incurred in connection with our purchase of the

Nordstrom.com minority interest.

Deferred income taxes reflect the net tax effect of temporary differences

between amounts recorded for financial reporting purposes and

amounts used for tax purposes. The major components of deferred

tax assets and liabilities are as follows:

January 29, January 31,

2005 2004

Accrued expenses $56,135 $41,096

Compensation and benefits accruals 57,947 55,013

Bad debts 6,309 6,799

Gift cards and gift certificates 12,743 2,172

Merchandise certificates 3,461 3,721

Merchandise inventories 20,933 24,630

Capital loss carryforwards 6,286 6,286

Other 1,654 9,722

Total deferred tax assets 165,468 149,439

Land, buildings and

equipment basis and

depreciation differences (13,294) (78,558)

Employee benefits ——

Other (11,317) (5,532)

Total deferred tax liabilities (24,611) (84,090)

Valuation allowance (1,800) —

Net deferred tax assets $139,057 $65,349

As of January 29, 2005, capital loss carryforwards of $16,117 remain

available to offset capital gain income through the end of 2005. We

expect to utilize most, but not all, of this capital loss carryforward in

2005. As a result, we established a valuation allowance in 2004 of

$1,800 to offset the related deferred tax asset.

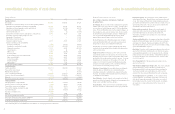

Note 7: Earnings Per Share

Basic earnings per share is computed using the weighted average

number of common shares outstanding during the year. Diluted

earnings per share uses the weighted average number of common

shares outstanding during the year plus dilutive common stock

equivalents, primarily stock options and performance share units.

Options with an exercise price greater than the average market price

were not included in diluted earnings per share. These anti-dilutive

options totaled 5,335 and 7,259 shares in 2003 and 2002. There were

no anti-dilutive options in 2004.

Since the beginning of 2003, 5,878 shares have been issued upon the

exercise of stock options; we repurchased 6,908 shares in 2004 to offset

the impact of these share issuances and to return capital to our

shareholders in an efficient manner.

39

38