Neiman Marcus 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

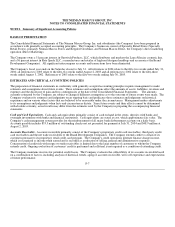

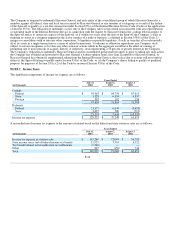

Income Taxes. The Company is routinely under audit by federal, state or local authorities in the area of income taxes. These audits

include questioning the timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating

the exposure associated with various tax filing positions, the Company accrues charges for probable exposures. Based on its annual

evaluations of tax positions, the Company believes it has appropriately accrued for probable exposures. To the extent the Company

were to prevail in matters for which accruals have been established or be required to pay amounts in excess of recorded reserves, the

Company's effective tax rate in a given financial statement period could be materially impacted.

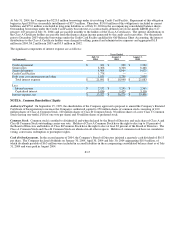

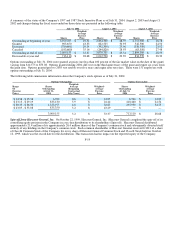

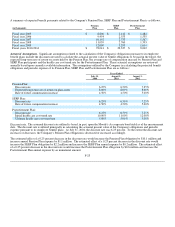

Basic and Diluted Net Income Per Share. Basic net income per share is computed by dividing net income by the weighted average

number of shares of common stock outstanding. The dilutive effect of stock options and other common stock equivalents, including

contingently returnable shares, is included in the calculation of diluted earnings per share using the treasury stock method.

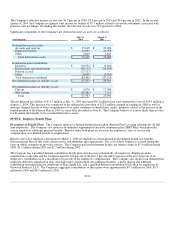

Recent Accounting Pronouncements. In December 2003, the Financial Accounting Standards Board (FASB), revised SFAS No. 132,

"Employers' Disclosures about Pensions and other Postretirement Benefits," (SFAS No. 132R) which requires additional disclosures

about the assets, obligations, cash flows, and net periodic benefit cost of defined benefit pension plans and other defined benefit

postretirement plans. SFAS No. 132R was effective January 31, 2004 and the Company has provided the revised disclosures.

In December 2003, the U.S. Congress enacted the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (Act)

that will provide a prescription drug subsidy, beginning in 2006, to companies that sponsor postretirement health care plans that

provide drug benefits. Additional legislation is anticipated that will clarify whether a company is eligible for the subsidy, the amount

of the subsidy available and the procedures to be followed in obtaining the subsidy. In May 2004, the FASB issued Staff Position

106-2 "Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of

2003" that provides guidance on the accounting and disclosure for the effects of the Act. The Company is evaluating the impact of the

Act on its Postretirement Plan as well as future actions that the Company might take in response to the Act. As a result, the Company

is currently unable to quantify the effects of this legislation on its obligations pursuant to the Postretirement Plan.

NOTE 2. Securitization of Credit Card Receivables

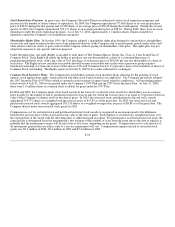

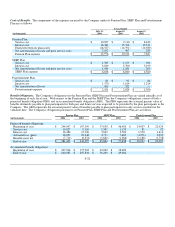

Pursuant to a revolving credit card securitization program (the Credit Card Facility), the Company transfers substantially all of its

credit card receivables to a wholly-owned subsidiary, Neiman Marcus Funding Corporation, which in turn sells such receivables to the

Neiman Marcus Credit Card Master Trust (Trust). At the inception of the Credit Card Facility in September 2000, the Trust issued

certificates representing undivided interests in the credit card receivables to third-party investors in the face amount of $225 million

(Sold Interests) and to the Company in an aggregate amount equal to the excess of the balance of the credit card portfolio over $225

million (Retained Interests). In order to maintain the committed level of securitized assets, cash collections on the securitized

receivables are used by the Trust to purchase new credit card balances from the Company in accordance with the terms of the Credit

Card Facility.

The Company continues to service the credit card receivables and receives a contractually defined servicing fee. Total credit card

receivables held by the Trust and serviced by the Company aggregated $525.7 million as of July 31, 2004. Servicing fees earned by

the Company were $6.3 million in each of 2004, 2003 and 2002.

Beginning in April 2005, cash collections will be used by the Trust to repay the $225 million principal balance of the Class A

Certificates in six monthly installments of $37.5 million (Amortization Period). As a result of certain provisions in the securitization

agreement, the Company holds certain rights to repurchase the Class A Certificates (Repurchase Option) subsequent to the

commencement of the Amortization Period and, therefore, has the ability to regain effective control over the credit card receivables

held by the Trust at the time the Repurchase Option becomes exercisable. The Company believes that the Repurchase Option will

become exercisable in September 2005.

F-13