Memorex 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

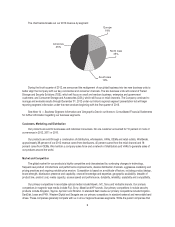

The chart below breaks out our 2012 revenue by segment:

Europe

19%

A

mericas

46%

North Asia

25%

South Asia

10%

During the fourth quarter of 2012, we announced the realignment of our global business into two new business units to

better align the Company with our key commercial and consumer channels. The two business units will consist of Tiered

Storage and Security Solutions (TSS), which will focus on small and medium business, enterprise and government

customers; and Consumer Storage and Accessories (CSA), which will focus on retail channels. The Company continued to

manage and evaluate results through December 31, 2012 under our historic regional segment presentation but will begin

reporting segment information under the new structure beginning with the first quarter of 2013.

See Note 14 — Business Segment Information and Geographic Data in our Notes to Consolidated Financial Statements

for further information regarding our business segments.

Customers, Marketing and Distribution

Our products are sold to businesses and individual consumers. No one customer accounted for 10 percent or more of

our revenue in 2012, 2011 or 2010.

Our products are sold through a combination of distributors, wholesalers, VARs, OEMs and retail outlets. Worldwide,

approximately 39 percent of our 2012 revenue came from distributors, 45 percent came from the retail channel and 16

percent came from OEMs. We maintain a company sales force and a network of distributors and VARs to generate sales of

our products around the world.

Market and Competition

The global market for our products is highly competitive and characterized by continuing changes in technology,

frequent new product introductions and performance improvements, diverse distribution channels, aggressive marketing and

pricing practices and ongoing variable price erosion. Competition is based on a multitude of factors, including product design,

brand strength, distribution presence and capability, channel knowledge and expertise, geographic availability, breadth of

product line, product cost, media capacity, access speed and performance, durability, reliability, scalability and compatibility.

Our primary competitors in recordable optical media include Maxell, JVC, Sony and Verbatim brands. Our primary

competitors in magnetic tape media include Fuji, Sony, Maxell and HP brands. Our primary competitors in mobile security

products include Kingston, Spyrus, Apricorn and Rocstor. In standard flash media our primary competitors include Kingston,

SanDisk, Lexar and PNY. Western Digital and Seagate are our primary competitors in standard external and removable hard

drives. These companies generally compete with us in all our regional business segments. While the parent companies that

6