Memorex 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

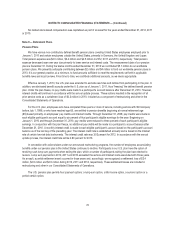

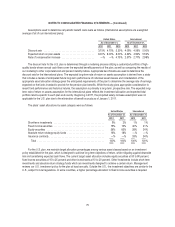

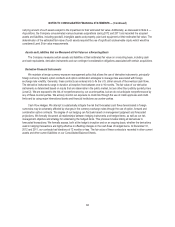

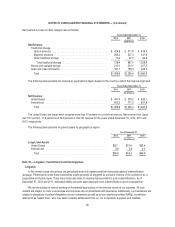

We regularly assess the likelihood that our deferred tax assets will be recovered in the future. A valuation allowance is

recorded to the extent we conclude a deferred tax asset is not considered to be more-likely-than-not to be realized. We

consider all positive and negative evidence related to the realization of the deferred tax assets in assessing the need for a

valuation allowance.

During the fourth quarter of 2010, we recognized significant restructuring charges related to our U.S. operations. Due to

these charges and cumulative losses incurred in recent years, we were no longer able to conclude that it was more-likely-

than-not that our U.S. deferred tax assets would be fully realized. Therefore, during 2010, we recorded a charge to establish a

valuation allowance of $105.6 million related to our U.S. deferred tax assets. The valuation allowance charge is included in

income tax provision on our Consolidated Statement of Operations.

Our accounting for deferred tax consequences represents our best estimate of future events. A valuation allowance

established or revised as a result of our assessment is recorded through income tax provision (benefit) in our Consolidated

Statements of Operations. Changes in our current estimates due to unanticipated events, or other factors, could have a

material effect on our financial condition and results of operations.

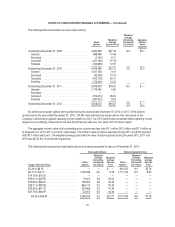

The valuation allowance was $239.1 million, $141.1 million and $127.4 million as of December 31, 2012, 2011 and

2010, respectively. The valuation allowance change in 2012 compared to 2011 was due primarily to operating losses and the

impact of intangible asset impairments charges.

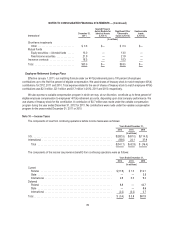

The valuation allowance increase in 2011, as compared to 2010, was due to $13.4 million of additional federal tax

credits related to the repatriation of cash to the U.S., $3.8 million of additional U.S. net operating losses and $1.5 million of

other items, offset by a $5.0 million benefit from the reversal of a foreign net operating loss valuation allowance.

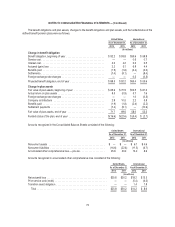

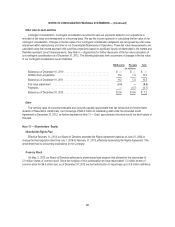

Federal net operating loss carry forwards totaling $182.7 million will begin expiring in 2026. We have state income tax

loss carryforwards of $263.8 million, $2.3 million of which will expire between 2013 and 2015 and the remaining will expire at

various dates up to 2032. We have U.S. and foreign tax credit carryforwards of $39.2 million, $5.9 million of which will expire

between 2013 and 2015 and the remaining will expire between 2016 and 2031. Of the aggregate foreign net operating loss

carryforwards totaling $46.1 million, $4.1 million will expire in the next 3 years, $12.9 million will expire at various dates up to

2032 and $29.1 million may be carried forward indefinitely.

In January 2012, we made a distribution to the U.S. as part of the 2011 distribution plan. In December 2012, we

continue to have loans to the U.S. from our overseas subsidiaries, which we expect to repay in future periods.

During the fourth quarter of 2011, we distributed funds to the U.S. These distributions were treated as permanent

repatriations of unremitted earnings during the fourth quarter of 2011. Our 2011 provision includes a $4.0 million charge to

record the U.S. tax liability associated with these earnings. Some of these distributions were loans to the U.S. from our

subsidiaries.

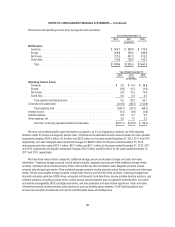

Any amount of earnings in excess of the loan amounts described above were either already invested in the foreign

operations or needed as working capital. The remaining unremitted earnings of our foreign subsidiaries will continue to be

permanently reinvested in their operations, and no additional deferred taxes have been recorded. The actual U.S. tax cost of

any future repatriation of foreign earnings would depend on income tax law and circumstances at the time of distribution.

Determination of the related tax liability is not practicable because of the complexities associated with the hypothetical

calculation. As of December 31, 2012, approximately $92.8 million of earnings attributable to foreign subsidiaries were

considered to be permanently invested in those operations.

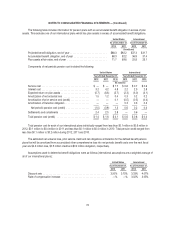

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record accruals

for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the benefit of a tax

return position in the financial statements is that the position must be more-likely-than-not to be sustained by the taxing

authorities based solely on the technical merits of the position. If the recognition threshold is met, the tax benefit is measured

and recognized as the largest amount of tax benefit that, in our judgment, is greater than 50 percent likely to be realized.

80