Memorex 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 2 — Summary of Significant Accounting Policies

Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make

estimates and assumptions that affect the reported asset and liability amounts, and the contingent asset and liability

disclosures at the date of the financial statements, as well as the revenue and expense amounts reported during the period.

Actual results could differ from those estimates.

Foreign Currency. For our international operations where the local currency has been determined to be the functional

currency, assets and liabilities are translated at year-end exchange rates with cumulative translation adjustments included as

a component of shareholders’ equity. Income and expense items are translated at average foreign exchange rates prevailing

during the year. Gains and losses from foreign currency transactions are included in the Consolidated Statements of

Operations.

Cash Equivalents. Cash equivalents consist of highly liquid investments with an original maturity of three months or

less at the time of purchase. The carrying amounts reported in the Consolidated Balance Sheets for cash equivalents

approximate fair value. Restricted cash is related to contractual obligations or has been restricted by management for specific

use and is included in other assets on our Consolidated Balance Sheets.

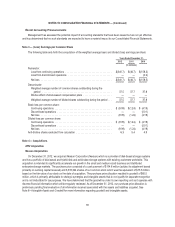

Trade Accounts Receivable and Allowances. Trade accounts receivable are stated net of estimated allowances, which

primarily represent estimated amounts associated with customer returns, discounts on payment terms and the inability of

certain customers to make the required payments. When determining the allowances, we take several factors into

consideration, including prior history of accounts receivable credit activity and write-offs, the overall composition of accounts

receivable aging, the types of customers and our day-to-day knowledge of specific customers. Changes in the allowances are

recorded as reductions of net revenue or as bad debt expense (included in selling, general and administrative expense), as

appropriate, in the Consolidated Statements of Operations. In general, accounts which have entered into an insolvency

action, have been returned by a collection agency as uncollectible or whose existence can no longer be confirmed are written

off in full and both the receivable and the associated allowance are removed from the Consolidated Balance Sheet. If,

subsequent to the write-off, a portion of the account is recovered, it is recorded as a reduction of bad debt expense in the

Consolidated Statements of Operations at the time cash is received.

Inventories. Inventories are valued at the lower of cost or market, with cost generally determined on a first-in, first-out

basis. We provide estimated inventory write-downs for excess, slow-moving and obsolete inventory as well as inventory with a

carrying value in excess of net realizable value.

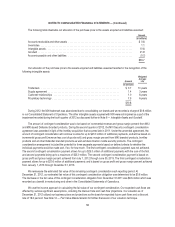

Derivative Financial Instruments. We recognize all derivatives, including foreign currency exchange contracts on the

balance sheet at their estimated fair value. Fair value of our derivative contracts with durations of twelve months or less are

classified as current and durations of greater than twelve months as non-current. Changes in the estimated fair value of

derivatives that are not designated as, and qualify for, hedge accounting are recorded in our results of operations. We do not

hold or issue derivative financial instruments for speculative or trading purposes and we are not a party to leveraged

derivatives. If a derivative is designated as, and qualifies for hedge accounting, depending on the nature of the hedge,

changes in the fair value of the derivative are either offset against the change in fair value of the underlying assets or liabilities

through operations or recognized in accumulated other comprehensive loss in shareholders’ equity until the underlying

hedged item is recognized in operations. These gains and losses are generally recognized as an adjustment to cost of goods

sold for inventory-related hedge transactions, or as adjustments to foreign currency transaction gains or losses included in

non-operating expenses for foreign denominated payables and receivables-related hedge transactions. Cash flows

attributable to these derivatives are included with cash flows of the associated hedged items. The ineffective portion of a

derivative’s change in fair value is immediately recognized in our Consolidated Statements of Operations. See Note 12 — Fair

Value Measurements for more information on our derivative financial instruments.

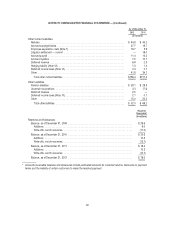

Property, Plant and Equipment. Property, plant and equipment, including leasehold and other improvements that

extend an asset’s useful life or productive capabilities, are recorded at cost. Maintenance and repairs are expensed as

51