Memorex 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

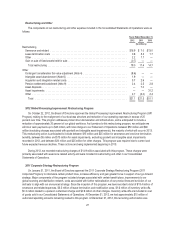

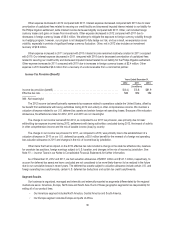

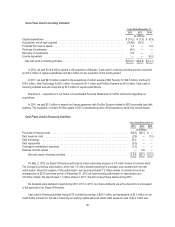

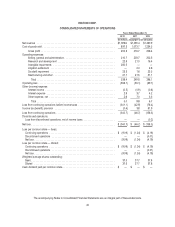

Cash Flows Used in Investing Activities:

Years Ended December 31,

2012 2011 2010

(In millions)

Capital expenditures ......................................................... $ (10.2) $ (7.3) $ (8.3)

Acquisitions, net of cash acquired ............................................... (103.8) (47.0) —

Proceeds from sale of assets ................................................... 1.4 — 0.2

Purchase of tradename ....................................................... (4.0) — —

Recovery of investments ...................................................... 0.9 — —

License agreement .......................................................... — — (5.0)

Net cash used in investing activities ............................................ $(115.7) $(54.3) $(13.1)

In 2012, we paid $104.6 million related to the acquisition of Nexsan. Cash used in investing activities was also impacted

by $10.2 million of capital expenditures and $4.0 million for the acquisition of the IronKey brand.

In 2011, we paid $47.0 million related to the acquisitions of certain assets of MXI Security for $24.5 million, IronKey for

$19.0 million, Nine Technology for $2.0 million, Encryptx for $1.0 million and ProStor Systems for $0.5 million. Cash used in

investing activities was also impacted by $7.3 million of capital expenditures.

See Note 4 — Acquisitions in our Notes to Consolidated Financial Statements for further information regarding our

acquisitions.

In 2010, we paid $5.0 million to extend our license agreement with ProStor Systems related to RDX removable hard disk

systems. The acquisition of certain ProStor assets in 2011 excluded the portion of the business to which this license relates.

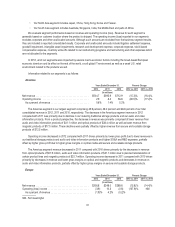

Cash Flows Used in Financing Activities:

Years Ended December 31,

2012 2011 2010

(In millions)

Purchase of treasury stock ........................................................ $(6.5) $(9.7) $ —

Debt issuance costs ............................................................. (2.4) — (1.0)

Debt borrowings ................................................................ 25.0 — —

Debt repayments ............................................................... (5.0) — —

Contingent consideration payments ................................................. (1.2) — —

Exercise of stock options ......................................................... — 0.6 —

Net cash used in financing activities ............................................. $ 9.9 $(9.1) $(1.0)

On May, 2, 2012 our Board of Directors authorized a share repurchase program of 5.0 million shares of common stock.

The Company’s previous authorization, which had 1.2 million shares remaining for purchase, was canceled with the new

authorization. Since the inception of this authorization, we have repurchased 1.2 million shares of common stock at an

average price of $5.30 per share and as of December 31, 2012 we had remaining authorization to repurchase up to

3.8 million shares. We repurchased 1.1 million shares in 2011. We did not repurchase shares during 2010.

No dividends were declared or paid during 2012, 2011 or 2010. Any future dividends are at the discretion of and subject

to the approval of our Board of Directors.

Cash used in financing activities during 2012 included borrowings of $25.0 million and repayments of $5.0 million on our

credit facility primarily for the use in financing our working capital seasonal needs. Debt issuance costs of $2.4 million and

35