Memorex 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

other similar events. Awards may be granted under the 2011 Incentive Plan until the earlier to occur of May 3, 2021 or the

date on which all shares available for awards under the 2011 Incentive Plan have been granted; provided, however, that

incentive stock options may not be granted after February 10, 2021. Stock-based compensation awards issued under the

2011 Incentive Plan generally have a term of ten years and, for employees, vest over a three-year period. Awards issued to

directors under this plan become fully exercisable on the first anniversary of the grant date. Stock options granted under these

plans are not incentive stock options. Exercise prices of awards issued under these plans are equal to the fair value of the

Company’s stock on the date of grant. As of December 31, 2012, we had 2,237,119 of stock-based compensation awards

consisting of stock options and restricted stock outstanding under the 2011 Incentive Plan. As of December 31, 2012 there

were 2,098,474 shares available for grant under our 2011 Incentive Plan.

On February 8, 2013, the Board adopted, subject to shareholder approval, amendments to the Imation Corp. 2011

Incentive Plan (the “Stock Plan Amendments”). The purpose of the Stock Plan Amendments is, among other things, to permit

the Company to continue to grant awards under the 2011 Incentive Plan beyond the date when the currently authorized

shares have been exhausted, to give the Compensation Committee additional flexibility in granting performance-based

awards and remove the limitation on the number of shares that can be issued pursuant to full value awards.

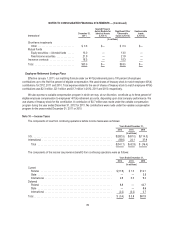

Stock Options

The fair value of each option award is estimated on the date of grant using the Black-Scholes option pricing model. The

assumptions used in the valuation model are supported primarily by historical indicators and current market conditions.

Volatility was calculated using the historical weekly close rate for a period of time equal to the expected term. The risk-free

rate of return was determined by using the U.S. Treasury yield curve in effect at the time of grant. The expected term was

calculated on an aggregated basis and estimated based on an analysis of options already exercised and any foreseeable

trends or changes in recipients’ behavior. In determining the expected term, we considered the vesting period of the awards,

the contractual term of the awards, historical average holding periods, stock price history, impacts from recent restructuring

initiatives and the relative weight for each of these factors. The dividend yield was based on the latest dividend payments

made on or announced by the date of the grant.

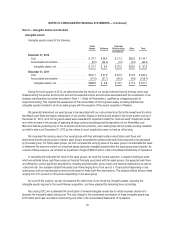

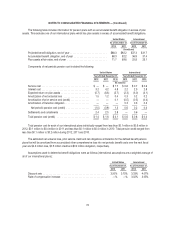

The following table summarizes our weighted average assumptions used in the valuation of options for the years ended

December 31:

2012 2011 2010

Volatility ............................................................ 45% 44% 43%

Risk-free interest rate ................................................... 1.07% 2.13% 2.49%

Expected life (months) .................................................. 71 70 66

Dividend yield ........................................................ —% —% —%

69