Memorex 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

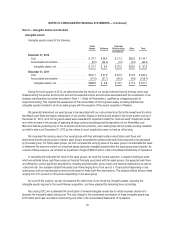

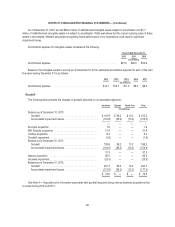

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

BeCompliant Corporation (doing business as Encryptx)

On February 28, 2011 we acquired substantially all of the assets of BeCompliant Corporation, doing business as

Encryptx (Encryptx), a technology leader in encryption and security solutions for removable storage devices and removable

storage media. The purchase price was $2.3 million, consisting of a cash payment of $1.0 million and the estimated fair value

of future contingent consideration of $1.3 million. The purchase price allocation resulted in goodwill of $1.6 million, primarily

attributable to expected strategic synergies and intangible assets that do not qualify for separate recognition. This goodwill is

deductible for tax purposes. See Note 6 — Intangible Assets and Goodwill for further discussion of this goodwill. During 2012

we paid $0.7 million of the contingent consideration. The final contingent consideration payment of $0.7 million was

determined based on certain 2012 milestones and was paid during the first quarter of 2013 and is the value of the contingent

consideration that is recorded as of December 31, 2012.

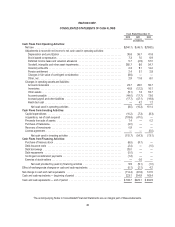

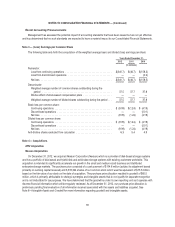

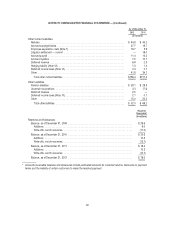

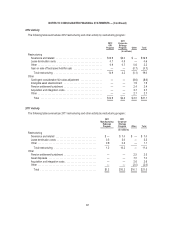

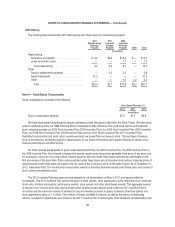

Note 5 — Supplemental Balance Sheet Information

As of December 31,

2012 2011

\ (In millions)

Inventories

Finished goods ....................................................... $146.9 $ 186.7

Work in process ...................................................... 6.4 13.5

Raw materials and supplies ............................................. 12.7 8.6

Total inventories .................................................... $166.0 $ 208.8

Other Current Assets

Non-trade receivables .................................................. $ 15.1 $ 4.3

Deferred income taxes (Note 10) .......................................... 4.7 6.1

Prepaid expenses ..................................................... 5.4 6.1

Hedging asset (Note 12) ................................................ 5.5 3.4

Assets held for sale (Note 7) ............................................. 2.5 3.3

Restricted cash(1) .................................................... 7.5 2.2

Other .............................................................. 20.9 24.3

Total other current assets ............................................. $ 61.6 $ 49.7

Property, Plant and Equipment

Land .............................................................. $ 1.2 $ 1.2

Buildings and leasehold improvements ..................................... 95.0 92.6

Machinery and equipment ............................................... 124.8 146.1

Construction in progress ................................................ 1.6 1.5

Total ............................................................ 222.6 241.4

Less accumulated depreciation ........................................... (163.7) (186.0)

Property, plant and equipment, net ...................................... $ 58.9 $ 55.4

Other Assets

Deferred income taxes (Note 10) .......................................... $ 9.3 $ 15.8

Pension assets (Note 9) ................................................ 6.6 5.1

Credit facility fees (Note 11) ............................................. 2.3 0.3

Other .............................................................. 3.9 3.2

Total other assets ................................................... $ 22.1 $ 24.4

(1) Restricted cash at December 31, 2012 primarily includes cash acquired from Nexsan that was previously restricted to

specifically fulfill certain obligations of Nexsan.

59