Memorex 2012 Annual Report Download - page 56

Download and view the complete annual report

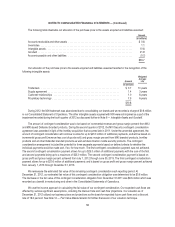

Please find page 56 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Revenue Recognition. We sell a wide range of removable data storage media products as well as certain consumer

electronic products. Net revenue consists primarily of magnetic, optical, flash media, consumer electronics and accessories

sales. We recognize revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have

been rendered, fees are fixed or determinable and collectability is reasonably assured. For product sales, delivery is

considered to have occurred when the risks and rewards of ownership transfer to the customer. For inventory maintained at

the customer site, revenue is recognized at the time these products are sold by the customer. We base our estimates for

returns on historical experience and have not experienced significant fluctuations between estimated and actual return

activity. Non-income based taxes collected from customers and remitted to governmental authorities are also recorded as

revenue and include levies and various excise taxes, mainly in non-U.S. jurisdictions. These taxes included in revenue in

2012, 2011, and 2010 were $13.8 million, $20.3 million, and $28.3 million, respectively.

We do not utilize a significant amount of multiple-element revenue arrangements. As of December 31, 2012, we had an

immaterial amount of deferred revenue associated with such arrangements (excluding amounts acquired as a part of the

Nexsan acquisition).

Rebates that are provided to our customers are accounted for as a reduction of revenue at the time of sale based on an

estimate of the cost to honor the related rebate programs. The rebate programs that we offer vary across our businesses as

we serve numerous markets. The most common incentives relate to amounts paid or credited to customers that are volume-

based and rebates to support promotional activities.

Concentrations of Credit Risk. We sell a wide range of products and services to a diversified base of customers

around the world and perform ongoing credit evaluations of our customers’ financial condition. Therefore, we believe there is

no material concentration of credit risk. No single customer represented more than 10 percent of total net revenue or accounts

receivable in 2012, 2011, or 2010.

Inventory Related Shipping and Handling Costs. Costs related to shipping and handling are included in cost of goods

sold.

Research and Development Costs. Research and development costs are charged to expense as incurred. Research

and development costs include salaries, stock compensation, payroll taxes, employee benefit costs, supplies, depreciation

and maintenance of research equipment as well as the allocable portion of facility costs such as rent, utilities, insurance,

repairs, maintenance and general support services.

Advertising Costs. Advertising and other promotional costs are expensed as incurred and were approximately $6

million, $2 million and $4 million in 2012, 2011 and 2010, respectively.

Rebates Received. We receive rebates from some of our inventory vendors if we achieve pre-determined purchasing

thresholds. These rebates are accounted for as a reduction of the price of the vendor’s products and are included as a

reduction of our cost of goods sold in the period in which the purchased inventory is sold.

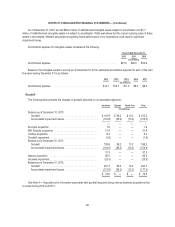

Income Taxes. We are required to estimate our income taxes in each of the jurisdictions in which we operate. This

process involves estimating our actual current tax obligations based on expected taxable income, statutory tax rates and tax

credits allowed in the various jurisdictions in which we operate. Tax laws require certain items to be included in our tax returns

at different times than the items are reflected in our results of operations. Some of these differences are permanent, such as

expenses that are not deductible in our tax returns, and some are temporary differences that will reverse over time.

Temporary differences result in deferred tax assets and liabilities, which are included in our Consolidated Balance Sheets. We

must assess the likelihood that our deferred tax assets will be realized and establish a valuation allowance to the extent

necessary.

We record income taxes using the asset and liability approach. Under this approach, deferred tax assets and liabilities

are recognized for the expected future tax consequences of temporary differences between the book and tax basis of assets

53