Memorex 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

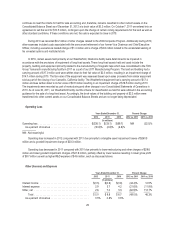

The South Asia segment revenue comprised 10.3 percent, 10.8 percent and 9.8 percent of our total consolidated

revenue in 2012, 2011 and 2010, respectively. The South Asia segment revenue decreased in 2012 compared with 2011

driven primarily by declines in our maturing traditional storage products. From a product perspective, the decrease in revenue

was composed primarily of lower revenue from traditional data storage products of $18.6 million, primarily consisting of

declines in optical media of $10.7 million and audio video tape of $4.7 million. Secure and scalable products, principally

commodity flash products, declined $5.2 million. Revenue was not impacted by foreign currency.

Operating income decreased in 2012 compared with 2011 driven by lower gross profit due to lower revenues from all

major product categories and lower gross margins from traditional storage products.

The South Asia segment revenue decreased in 2011 compared with 2010 driven primarily by decreases in revenue from

optical products of $4.6 million and other traditional storage products of $2.8 million, partially offset by higher revenue from

audio and video information of $4.4 million. Operating income remained unchanged in 2011 compared with 2010, impacted by

higher gross margins on audio and video information products offset by higher SG&A costs. Revenue was benefited by

foreign currency impacts of approximately six percent.

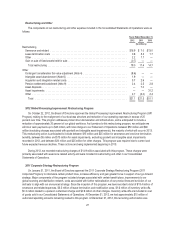

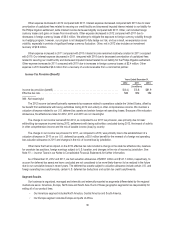

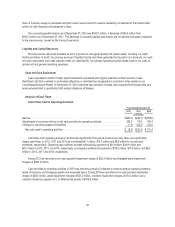

Corporate and Unallocated

Years Ended December 31, Percent Change

2012 2011 2010 2012 vs. 2011 2011 vs. 2010

(In millions)

Operating loss ..................................... $(341.6) $(68.3) $(124.8) NM (45.3)%

NM - Not meaningful

The corporate and unallocated operating loss includes costs which are not allocated to the business segments in

management’s evaluation of segment performance such as litigation settlement expense, intangible asset impairments,

goodwill impairment, research and development expense, corporate expense, stock-based compensation expense and

restructuring and other expense. The 2012 operating loss in Corporate and Unallocated included intangible asset impairment

losses of $260.5 million and a goodwill impairment loss of $23.3 million as discussed above.

The operating loss decreased in 2011 compared with 2010 driven primarily by an asset impairment charge during 2010

of $31.2 million and a goodwill impairment charge during 2010 of $23.5 million, offset partially by increased restructuring and

other expense related to our previously announced programs and the $7.0 million charge relating to the demolition of our

Camarillo, California facility during 2011.

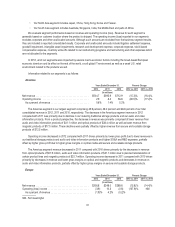

Financial Position

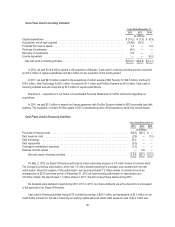

Our cash and cash equivalents balance as of December 31, 2012 was $108.7 million, a decrease of $114.4 million from

$223.1 million as of December 31, 2011. The decrease was primarily attributable to $103.8 million of cash paid in the

acquisition of Nexsan, net of cash acquired, capital expenditures of $10.2 million, restructuring payments of $8.0 million,

pension contributions of $5.1 million, share repurchases of $6.5 million, litigation settlement payments of $18.5 million,

contingent consideration payments related to acquisitions of $1.2 million and other changes in working capital, partially offset

by net borrowings on our credit facility of $20.0 million and proceeds of $1.4 million from the sale of some of our assets held

for sale.

Our accounts receivable balance as of December 31, 2012 was $220.8 million, a decrease of $14.1 million from $234.9

million as of December 31, 2011 as a result of lower sales during the period. Days sales outstanding was 59 days as of

December 31, 2012, up 1 day from December 31, 2011. Days sales outstanding is calculated using the count-back method,

which calculates the number of days of most recent revenue that is reflected in the net accounts receivable balance.

Our inventory balance as of December 31, 2012 was $166.0 million, a decrease of $42.8 million from $208.8 million as

of December 31, 2011. Days of inventory supply was 89 days as of December 31, 2012, up 4 days from December 31, 2011.

33