Memorex 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

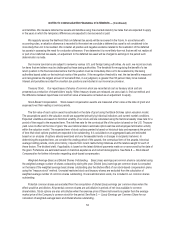

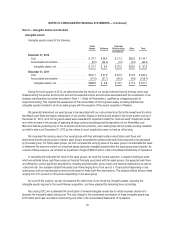

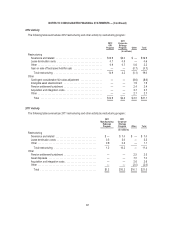

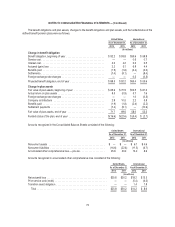

The components of our restructuring and other expense and other certain expenses related to restructuring plans

included in our Consolidated Statements of Operations were as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Restructuring

Severance and related ............................................. $16.9 $ 7.0 $13.0

Lease termination costs ............................................ 0.6 3.3 1.7

Other .......................................................... 2.2 1.1 —

Gain on sale of fixed assets held for sale ............................... (0.7) — —

Total restructuring .............................................. 19.0 11.4 14.7

Other

Contingent consideration fair value adjustment (Note 4) .................... (8.6) — —

Intangible asset abandonment (Note 6) ................................ 1.9 — —

Acquisition and integration related costs ................................ 3.7 2.6 —

Pension settlement/curtailment (Note 9) ................................ 2.4 2.5 2.8

Asset disposals .................................................. — 7.0 —

Asset impairments ................................................ — — 31.2

Other .......................................................... 2.7 (2.0) 2.4

Total ........................................................ $21.1 $21.5 $51.1

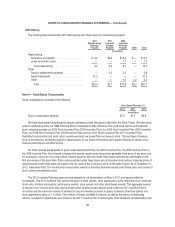

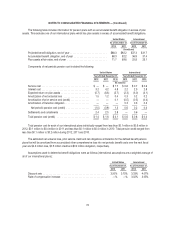

2012 Global Process Improvement Restructuring Program

On October 22, 2012, the Board of Directors approved the Global Process Improvement Restructuring Program (GPI

Program) related to the realignment of our business structure and the reduction of our operating expenses in excess of 25

percent over time. This program addresses product line rationalization and infrastructure, and is anticipated to include a

reduction of approximately 20 percent of our global workforce. These actions are being implemented beginning in 2013.

During 2012, we recorded restructuring charges of $14.9 million associated with this program. These charges were

primarily associated with severance related activity and were included in restructuring and other in our Consolidated

Statements of Operations.

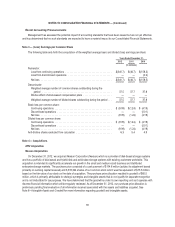

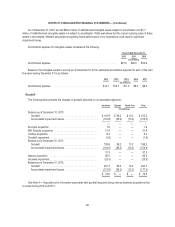

Activity related to the 2012 GPI Program accruals was as follows:

Severance

and Related

Lease

Termination

Costs Other Total

(In millions)

Accrued balance at December 31, 2011 .................... $ — $— $ — $ —

Charges ........................................... 13.9 0.1 0.9 14.9

Usage ............................................. (0.1) — (0.1) (0.2)

Currency impacts ..................................... — — — —

Accrued balance at December 31, 2012 .................... $13.8 $0.1 $ 0.8 $14.7

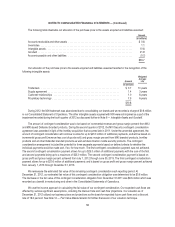

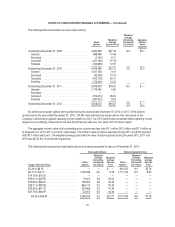

2011 Corporate Strategy Restructuring Program

On January 31, 2011, the Board of Directors approved the 2011 Corporate Strategy Restructuring Program (2011

Corporate Program) to rationalize certain product lines, increase efficiency and gain greater focus in support of our go-forward

64