Memorex 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

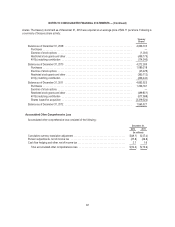

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

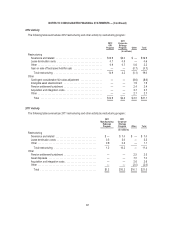

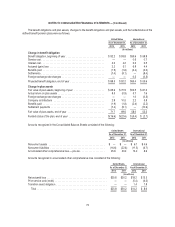

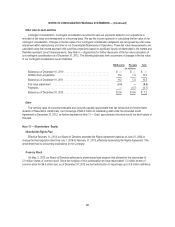

The fair value of the plan assets by asset category were as follows:

United States

December 31,

2012

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

Significant Other

Observable

Inputs (Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments

Money market securities ............. $ 6.3 $ 6.3 $ — $—

Mutual Funds

Equity securities

Large-cap growth funds ............ 14.0 — 14.0 —

International growth fund ........... 7.4 7.4 — —

Fixed income securities .............. 14.0 14.0 — —

Absolute return strategy funds ......... 11.6 — 11.6 —

Common stocks ...................... 10.7 10.7 — —

Commingled trust funds ................ 7.7 — 7.7 —

Total .............................. $71.7 $38.4 $33.3 $—

International

December 31,

2012

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs (Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments

Other ........................... $ 0.3 $— $ 0.3 $—

Mutual Funds

Equity securities — blended funds ..... 15.3 — 15.3 —

Fixed income securities ............. 23.5 — 23.5 —

Insurance contracts .................. 18.9 — 18.9 —

Total ............................. $58.0 $— $58.0 $—

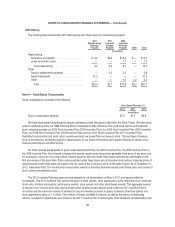

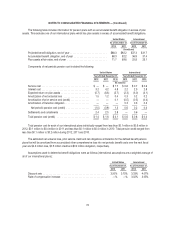

United States

December 31,

2011

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs (Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments

Money market securities ............ $ 1.5 $ 1.5 $ — $—

Mutual Funds

Equity securities

Large-cap growth funds ........... 18.0 — 18.0 —

International growth fund .......... 6.8 6.8 — —

Fixed income securities ............. 10.7 10.7 — —

Absolute return strategy funds ........ 12.2 — 12.2 —

Common stocks ..................... 13.3 13.3 — —

Commingled trust funds ............... 7.1 — 7.1 —

Total ............................. $69.6 $32.3 $37.3 $—

77