Logitech 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

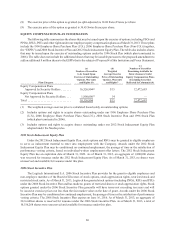

NON-QUALIFIED DEFERRED COMPENSATION FOR FISCAL YEAR 2013

The following table sets forth information regarding the participation by our named executive officers in the

Logitech Inc. U.S. Deferred Compensation Plan during fiscal year 2013 and at fiscal year-end.

Name

Executive

Contributions

in Last Fiscal

Year ($)(1)

Logitech

Contributions

in Last Fiscal

Year ($)

Aggregate

Earnings in

Last Fiscal

Year ($)(2)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance at Last

Fiscal Year End

($)

Guerrino De Luca .................... — — — — —

Bracken P. Darrell .................... — — — — —

L. Joseph Sullivan .................... — — 49,268 — 415,283

Former Officers:

Erik K. Bardman. . . . . . . . . . . . . . . . . . . . . — — — — —

Werner Heid ........................ — — 19,154 — 234,726

Junien Labrousse .................... — — 278,273 — 2,958,953(3)

(1) Amounts are included in the Summary Compensation table in the “Salary” column for fiscal year 2013. All

contributions were made under the Logitech Inc. Deferred Compensation Plan.

(2) These amounts are not included in the Summary Compensation table because plan earnings were not

preferential or above market.

(3) Mr. Labrousse’s aggregate contributions of $1,392,280 for fiscal year 2008 through fiscal year 2011 were

reported as compensation to Mr. Junien Labrousse in the Summary Compensation table.

NARRATIVE DISCLOSURE TO NON-QUALIFIED DEFERRED COMPENSATION TABLE

The Logitech Inc. U.S. Deferred Compensation Plan effective January 1, 2009 allows the participating

executive officers and other eligible employees to defer up to 80% of their annual base salary and up to 90% of

annual cash bonuses or commissions.

Upon enrollment, participants select from a number of mutual funds selected by Logitech Inc.’s Deferred

Compensation Committee for this purpose, and the participants’ contributions are invested according to the

participants’ elections. Investment elections may be changed by participants at any time.

Participants can elect upon enrollment to receive one lump-sum distribution per year beginning in the

third year of plan participation. Although pre-retirement distributions can subsequently be postponed (subject to

conditions) or canceled, participants cannot elect any additional pre-retirement distributions after initial enrollment,

except in limited circumstances.

Distributions are generally payable to participants upon termination of employment in a lump sum or, in

the case of retirement, disability or death, in a series of annual payments of up to 10 years, as elected by the

participants, subject to any requirements of Section 409A of the U.S. Tax Code.

The Deferred Compensation Plan is the successor to an earlier plan that provided substantially similar benefits.

PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

We have entered into agreements that provide for payments under certain circumstances in the event of

termination of employment of our executive officers. These agreements include:

• Change of control severance agreements, under which the executive officers may receive certain benefits

if they are subject to an involuntary termination within 12 months after a “change of control” because

his or her employment is terminated without cause or because the executive resigns for good reason.

• PSU, RSU and PSO award agreements that provide for the accelerated vesting of the shares subject

to the award agreements under certain circumstances, including the same circumstances as under the

change of control agreements.

78