Logitech 2013 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

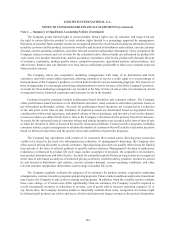

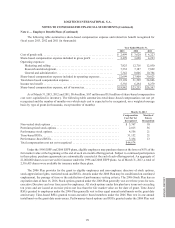

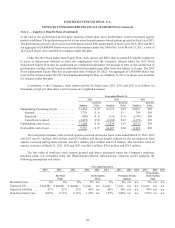

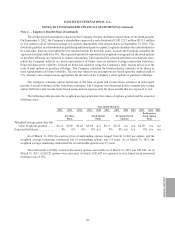

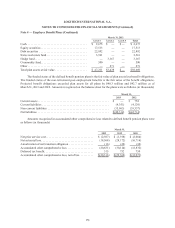

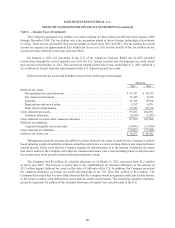

A summary of the Company’s time- and performance-based RSU activity for fiscal years 2013, 2012 and 2011

is as follows (in thousands, except per share values; grant-date fair values are weighted averages):

Year ended March 31,

2013 2012 2011

Number

Grant

Date Fair

Value Number

Grant

Date Fair

Value Number

Grant

Date Fair

Value

Outstanding, beginning of year. . . . . . . . . . . . . . . 4,125 $ 13 2,370 $ 21 514 $18

Time-based RSUs granted . . . . . . . . . . . . . . . . 2,219 $ 7 2,496 $ 9 1,599 $20

Performance-based RSUs granted. . . . . . . . . . 101 $ 6 516 $ 11 538 $28

Vested. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,097) $ 11 (399) $ 19 (142) $15

Cancelled or expired . . . . . . . . . . . . . . . . . . . . (706) $ 13 (858) $ 19 (139) $24

Outstanding, end of year . . . . . . . . . . . . . . . . . . . . 4,642 $ 10 4,125 $ 13 2,370 $21

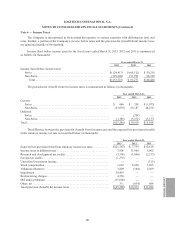

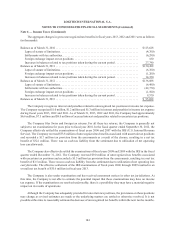

The total pretax intrinsic value (fair value) of RSUs vested during the fiscal years ended March 31, 2013, 2012

and 2011 was $ 8.3 million, $3.8 million and $1.7 million. The tax benefit realized for the tax deduction from RSUs

vested during the fiscal years ended March 31, 2013, 2012 and 2011 was $1.9 million, $0.9 million and $0.2 million.

The Company determines the fair value of the time-based RSUs based on the market price on the date of grant.

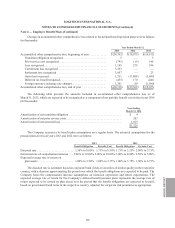

The fair value of the performance-based RSUs is estimated using the Monte-Carlo simulation model applying the

following assumptions:

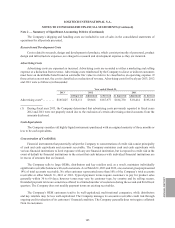

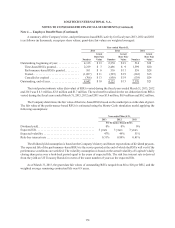

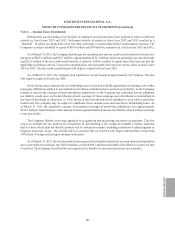

Year ended March 31,

2013 2012 2011

Performance-Based RSUs

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0% 0% 0%

Expected life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 years 3 years 3 years

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47% 49% 51%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.31% 0.99% 0.81%

The dividend yield assumption is based on the Company’s history and future expectations of dividend payouts.

The expected life of the performance-based RSUs is the service period at the end of which the RSUs will vest if the

performance conditions are satisfied. The volatility assumption is based on the actual volatility of Logitech’s daily

closing share price over a look-back period equal to the years of expected life. The risk free interest rate is derived

from the yield on US Treasury Bonds for a term of the same number of years as the expected life.

As of March 31, 2013, the grant date fair values of outstanding RSUs ranged from $6 to $28 per RSU, and the

weighted average remaining contractual life was 8.9 years.

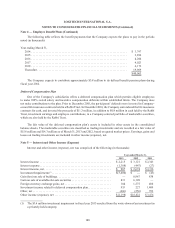

Note 4 — Employee Benefit Plans (Continued)

174