Logitech 2013 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

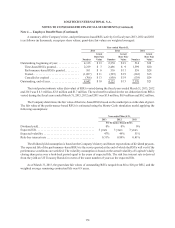

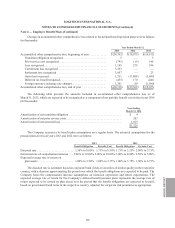

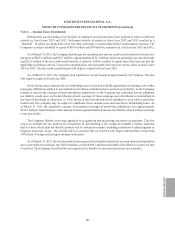

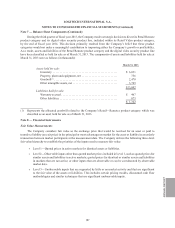

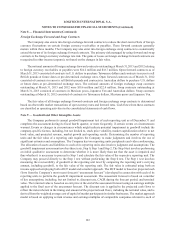

The aggregate changes in gross unrecognized tax benefits in fiscal years 2013, 2012 and 2011 were as follows

(in thousands):

Balance as of March 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $113,628

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,760)

Settlements with tax authorities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,290)

Foreign exchange impact on tax positions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 180

Increases in balances related to tax positions taken during the current period . . . . . . . . . . . . . . . . 27,740

Balance as of March 31, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $130,498

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,760)

Foreign exchange impact on tax positions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,200)

Increases in balances related to tax positions taken during the current period . . . . . . . . . . . . . . . . 14,350

Balance as of March 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $136,888

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,490)

Settlements with tax authorities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (42,770)

Foreign exchange impact on tax positions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,500)

Increases in balances related to tax positions taken during the current period . . . . . . . . . . . . . . . . 9,570

Balance as of March 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 95,698

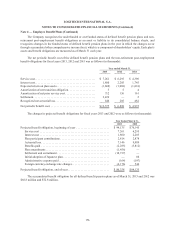

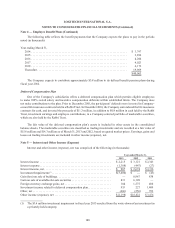

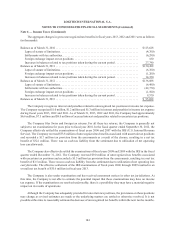

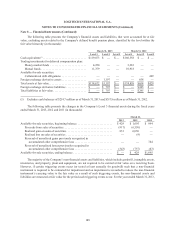

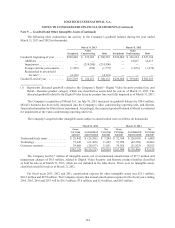

The Company recognizes interest and penalties related to unrecognized tax positions in income tax expense.

The Company recognized $1.0 million, $1.2 million and $1.3 million in interest and penalties in income tax expense

during fiscal years 2013, 2012 and 2011. As of March 31, 2013, 2012 and 2011, the Company had approximately

$6.6 million, $7.5 million and $8.0 million of accrued interest and penalties related to uncertain tax positions.

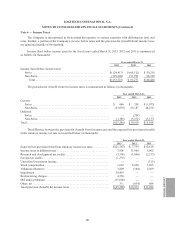

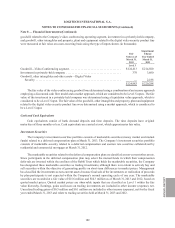

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally not

subject to tax examinations for years prior to fiscal year 2001. In the fiscal quarter ended September 30, 2012, the

Company effectively settled the examinations of fiscal years 2006 and 2007 with the IRS (U.S. Internal Revenue

Service). The Company reversed $33.8 million of unrecognized tax benefits associated with uncertain tax positions

and recorded a $1.7 million tax provision from the assessments as a result of the closure, resulting in a net tax

benefit of $32.1 million. There was no cash tax liability from the settlement due to utilization of net operating

loss carryforwards.

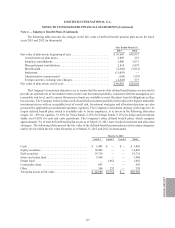

The Company also effectively settled the examinations of fiscal years 2008 and 2009 with the IRS in the fiscal

quarter ended December 31, 2012. The Company reversed $9.0 million of unrecognized tax benefits associated

with uncertain tax positions and recorded a $5.5 million tax provision from the assessments, resulting in a net tax

benefit of $3.5 million. There was no cash tax liability from the settlement due to utilization of net operating loss

carryforwards. The effective settlement of the IRS examinations of fiscal years 2006 through 2009 resulted in an

overall net tax benefit of $35.6 million in fiscal year 2013.

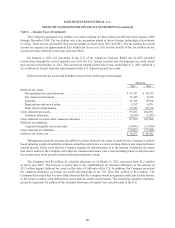

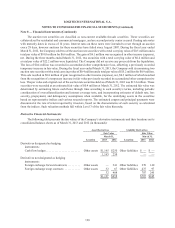

The Company is also under examination and has received assessment notices in other tax jurisdictions. At

this time, the Company is not able to estimate the potential impact that these examinations may have on income

tax expense. If the examinations are resolved unfavorably, there is a possibility they may have a material negative

impact on its results of operations.

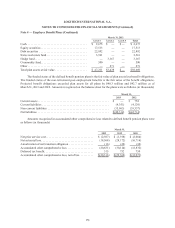

Although the Company has adequately provided for uncertain tax positions, the provisions on these positions

may change as revised estimates are made or the underlying matters are settled or otherwise resolved. It is not

possible at this time to reasonably estimate the decrease of unrecognized tax benefits within the next twelve months.

Note 6 — Income Taxes (Continued)

184