Logitech 2013 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

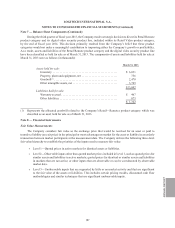

Note 10 — Financing Arrangements

In December 2011, the Company entered into a Senior Revolving Credit Facility Agreement with a group of

primarily Swiss banks that provides for a revolving multicurrency unsecured credit facility in an amount of up to

$250.0 million. The Company may, upon notice to the lenders and subject to certain requirements, arrange with

existing or new lenders to provide up to an aggregate of $150.0 million in additional commitments, for a total of

$400.0 million of unsecured revolving credit. The credit facility may be used for working capital, general corporate

purposes, and acquisitions. There were no outstanding borrowings under the credit facility at March 31, 2013

or 2012.

The credit facility matures on October 31, 2016. The Company may prepay the loans under the credit facility

in whole or in part at any time without premium or penalty. Borrowings under the credit facility will accrue interest

at a per annum rate based on LIBOR (London Interbank Offered Rate), or EURIBOR (Euro Interbank Offered

Rate) in the case of loans denominated in euros, plus a variable margin determined quarterly based on the ratio of

senior debt to earnings before interest, taxes, depreciation and amortization for the preceding four-quarter period,

plus, if applicable, an additional rate per annum intended to compensate the lenders for the cost of compliance with

regulatory reserve requirements and other banking regulations. The Company also pays a quarterly commitment

fee of 40% of the applicable margin on the available commitment. In connection with entering into the credit

facility, the Company incurred non-recurring fees totaling $1.5 million, which are amortized on a straight-line basis

over the term of the credit facility.

The facility agreement contains representations, covenants, including threshold financial covenants, and

events of default customary in Swiss credit markets. Affirmative covenants include covenants regarding reporting

requirements, maintenance of insurance, maintenance of properties and compliance with applicable laws and

regulations, and financial covenants that require the maintenance of net senior debt, interest cover and adjusted

equity ratios determined in accordance with the terms of the facility. Negative covenants limit the ability of the

Company and its subsidiaries, among other things, to grant liens, make investments, incur debt, make restricted

payments, enter into a merger or acquisition, or sell, transfer or dispose of assets, in each case subject to certain

exceptions. As of March 31, 2013, the Company was not in compliance with the interest cover ratio of this facility.

This situation resulted from the significant operating loss incurred during fiscal year 2013. The Company believes

that this is only a short-term situation. Until the Company is in compliance with all covenants, including the interest

cover ratio, this facility is not available for its use.

This facility stipulates that, upon an uncured event of default under the facility, the lenders may declare all

or a portion of the outstanding obligations payable by the Company to be immediately due and payable, terminate

their commitments and exercise other rights and remedies provided for under the facility. The events of default

under the facility include, among other things, payment defaults, covenant defaults, inaccuracy of representations

and warranties, cross defaults with certain other indebtedness, bankruptcy and insolvency events and events that

have a material adverse effect (as defined in the facility). Upon a change of control of the Company, lenders

whose commitments aggregate more than two-thirds of the total commitments under the facility may terminate the

commitments and declare all outstanding obligations to be due and payable.

The Company had several uncommitted, unsecured bank lines of credit aggregating $55.8 million at

March 31, 2013. There are no financial covenants under these lines of credit with which the Company must comply.

At March 31, 2013, the Company had no outstanding borrowings under these lines of credit. The Company also

had credit lines related to corporate credit cards totaling $17.3 million as of March 31, 2013. The outstanding

borrowings under these credit lines are recorded in other current liabilities. There are no financial covenants under

these credit lines.

ANNUAL REPORT

195