Logitech 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

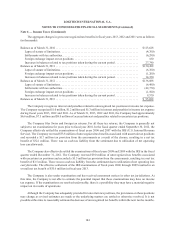

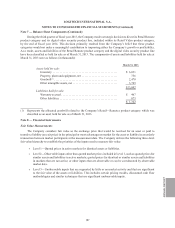

its reporting units to the respective revenue and earnings metrics of the Company’s reporting units. To test the

reasonableness of the fair values indicated by the income approach and the market approach, the Company also

assesses the implied premium of the aggregate fair value over the market capitalization considered attributable to

an acquisition control premium, which is the price in excess of a market stock price that investors would typically

pay to gain control of an entity. The discounted cash flow model and the market approach model require the

exercise of significant judgment, including assumptions about appropriate discount rates, long-term growth rates

for purposes of determining a terminal value at the end of the discrete forecast period, economic expectations,

timing of expected future cash flows, and expectations of returns on equity that will be achieved. Such assumptions

are subject to change as a result of changing economic and competitive conditions. If the carrying amount of the

reporting unit exceeds its fair value as determined by these assessments, goodwill is considered impaired, and the

Step 2 test is performed to measure the amount of impairment loss. Prior to proceeding with the Step 2 test, the

Company is required to assess whether the fair value of the reporting units other intangibles have been impaired.

For this test, fair value is estimated using an undiscounted DCF model. If an impairment is determined, carrying

value of the other intangibles are reduced to the then fair value. The Company proceeds to the Step 2 test if no

impairment results from this assessment. The Step 2 test measures the impairment loss by allocating the reporting

unit’s fair value to its assets and liabilities other than goodwill, comparing the resulting implied fair value of

goodwill with its carrying amount, and recording an impairment charge for the difference.

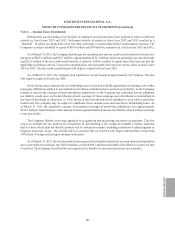

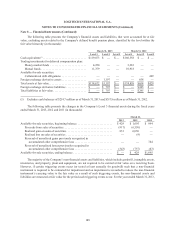

The Company performed its annual goodwill impairment analysis of each of its reporting units as of

December 31, 2012 and completed the assessment during its fiscal fourth quarter of 2013 using the income approach

and market approach described above. The Company chose not to perform the Step 0 test and to proceed directly

to the Step 1 test. This assessment resulted in the Company determining that its peripherals reporting unit passed

the Step 1 test because the estimated fair value exceeded its carrying value by more than 75%. By contrast, the

video conferencing reporting unit failed the Step 1 test because the estimated fair value was less than its carrying

value, thus requiring a Step 2 assessment of this reporting unit. This impairment primarily resulted from a decrease

in the expected CAGR during the assessment forecast period based on greater evidence of the overall enterprise

video conferencing industry experiencing a slowdown in recent quarters, combined with lower demand related

to new product launches, increased competition in fiscal year 2013 and other market data. These factors had an

adverse effect on the Company’s recent video conferencing operating results and are anticipated to have an adverse

effect on its future outlook. The Company was unable to fully complete the Step 2 analysis prior to the filing of

its Form 10-Q for the quarter ended December 31, 2012 due to the complexities of determining the implied fair

value of goodwill of its video conferencing reporting unit. As a result, the Company recorded a preliminary non-

cash goodwill impairment charge estimate of $211.0 million related to its video conferencing reporting unit in the

quarter ended December 31, 2012. During the fourth quarter of fiscal year 2013, the Company completed its annual

goodwill impairment assessment and recorded an additional $3.5 million in goodwill impairment charge during

that period.

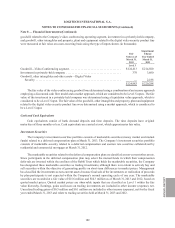

Management continues to evaluate and monitor all key factors impacting the carrying value of the Company’s

recorded goodwill and long-lived assets. Further adverse changes in the Company’s actual or expected operating

results, market capitalization, business climate, economic factors or other negative events that may be outside the

control of management could result in a material non-cash impairment charge in the future.

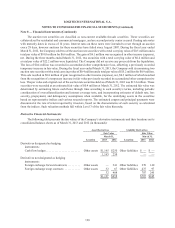

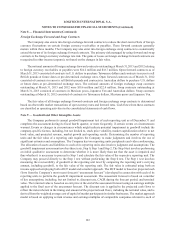

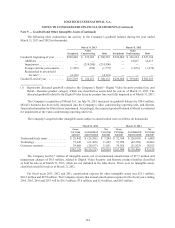

Note 9 — Goodwill and Other Intangible Assets (Continued)

ANNUAL REPORT

193