Logitech 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-13

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

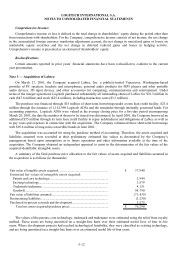

Where the development projects had not reached technological feasibility and had no further alternative uses,

they were classified as in-process research and development (“IPR&D”), and expensed in fiscal 2001 upon the

consummation of the merger. The value of IPR&D was determined by estimating the expected cash flows from the

projects once commercially viable, discounting the net cash flows back to their present value and then applying a

percentage of completion to the calculated value.

As a result of the acquisition of Labtec, the Company expected to incur and accrued for restructuring costs of

$3.25 million for the incremental costs to exit and consolidate activities at Labtec locations, and to involuntarily

terminate certain employees. During fiscal year 2002 and 2003, cash payments of $2.1 million and $.5 million were

charged against the accrued liability and $.7 million of the accrual remains at March 31, 2003 to be utilized for cash

payments for lease commitments over the next two years relating to duplicate facilities abandoned.

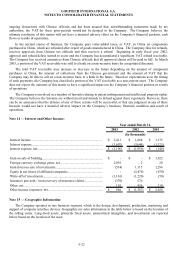

Unaudited pro forma condensed combined income statement information for the year ended March 31, 2001, as

if Labtec had been acquired as of the beginning of fiscal year 2000 is shown below. These pro formas exclude the

$3.3 million purchased in-process research and development charge in connection with the acquisition and costs

incurred by Labtec to complete the acquisition, but include adjustments to conform Labtec’s accounting policies,

including areas such as accounts receivable, inventories and related accounts, to those accounting policies followed

by Logitech.

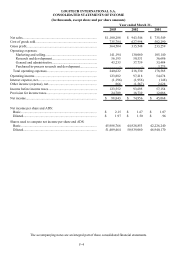

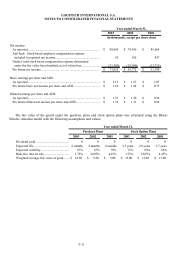

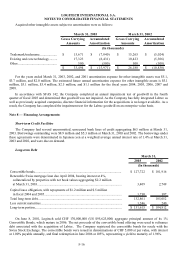

Pro Forma

Year ended March 31, Year ended

2003 2002 March 31, 2001

(in thousands, except per share data)

Net sales.............................................. 1,100,288$ 943,546$ 822,947$

Operating income................................ 123,882$ 97,218$ 57,344$

Net income.......................................... 98,843$ 74,956$ 40,599$

Net income per share and ADS:

Basic............................................. 2.15 $ 1.67 $ .96 $

Diluted.......................................... 1.97 $ 1.50 $ .86 $

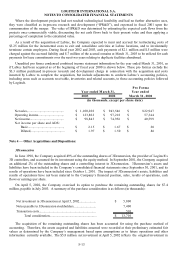

Note 4 — Other Acquisitions and Dispositions:

3Dconnexion

In June 1998, the Company acquired 49% of the outstanding shares of 3Dconnexion, the provider of Logitech’s

3D controllers, and accounted for its investment using the equity method. In September 2001, the Company acquired

an additional 2% of the outstanding shares and a controlling interest in 3Dconnexion. 3Dconnexion’s assets and

liabilities have been included in the Company’s consolidated financial statements since September 30, 2001, and its

results of operations have been included since October 1, 2001. The impact of 3Dconnexion’s assets, liabilities and

results of operations have not been material to the Company’s financial position, sales, results of operations, cash

flows or earnings per share.

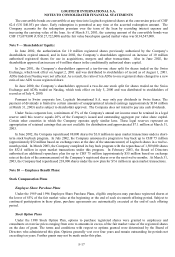

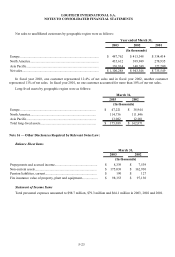

On April 5, 2002, the Company exercised its option to purchase the remaining outstanding shares for $7.4

million, payable in July 2003. A summary of the purchase consideration is as follows (in thousands):

5,800$

7,400

510

13,710$

Net investment in 3Dconnexion at April 5, 2002.....................

Notes payable to 3Dconnexion stockholders............................

Transaction costs......................................................................

Total consideration..........................................................

The acquisition of the remaining outstanding shares has been accounted for using the purchase method of

accounting. Therefore, the assets acquired and liabilities assumed were recorded at their preliminary estimated fair

values as determined by the Company’s management based upon assumptions as to future operations and other

information currently available. The $5.8 million net investment at April 5, 2002 reflects the original investment in