Logitech 2003 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 32

ergonomically shaped computer mouse. This matter was settled in March 2003. The settlement did not have a

material impact on our business, financial condition or operating results.

See discussion in Item 3.D Risk Factors – “Pending lawsuits could adversely impact us.”

Dividends

Under Swiss law, a corporation pays dividends upon a vote of its shareholders. This vote typically follows the

recommendation of the corporation’s board of directors. Although we have paid dividends in the past, our board of

directors announced in 1997 its intention not to recommend to shareholders any payment of cash dividends in the

future in order to retain any future earnings for use in the operation and expansion of our business.

B. Significant Changes

None.

ITEM 9. THE OFFER AND LISTING

On March 27, 1997, the Company consummated a public offering in the U.S. of 4,000,000 registered shares,

represented by 4,000,000 ADSs. On April 25, 1997, the Company sold an additional 600,000 registered shares,

represented by 600,000 ADSs, pursuant to an option granted to the underwriters in the offering to cover over-

allotments. Each ADS represented one-tenth of one registered share.

In July 2000, Logitech completed a two-for-one stock split. The stock split did not alter the ADS to share ratio.

In June 2001, the Company’s shareholders approved a ten-for-one stock split that was effective on August 2, 2001.

The stock split related only to shares traded on the Swiss Exchange. As a result, the ratio of ten ADSs to one

registered share changed to a new ratio of one ADS to one registered share. All references to share and per share data

for all periods presented have been adjusted to give effect to both the two-for-one and the ten-for-one stock split.

On June 8, 2001, Logitech sold CHF 170,000,000 (US $95,625,000) aggregate principal amount of its 1%

Convertible Bonds, which mature in 2006. The Company registered the convertible bonds for resale with the Swiss

Stock Exchange. The convertible bonds were issued in denominations of CHF 5,000 at par value, with interest at

1.00% payable annually, and final redemption in June 2006 at 105%, representing a yield to maturity of 1.96%. The

convertible bonds are convertible at any time into shares of Logitech registered shares at the conversion price of CHF

62.4 (US $46.05) per share. Early redemption is permitted at any time at the accreted redemption amount, subject to

certain requirements.

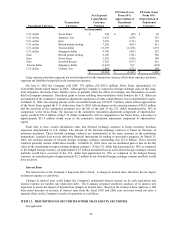

Market Price Information

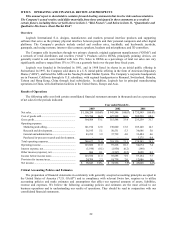

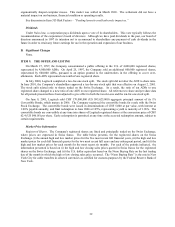

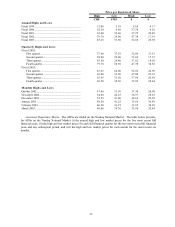

Registered Shares. The Company's registered shares are listed and principally traded on the Swiss Exchange,

where prices are expressed in Swiss francs. The table below presents, for the registered shares on the Swiss

Exchange (i) the annual high and low market prices for the five most recent full financial years, (ii) the high and low

market prices for each full financial quarter for the two most recent full years and any subsequent period, and (iii) the

high and low market prices for each month for the most recent six months. For each of the periods indicated, the

information presented is based on (i) the high and low closing sales prices quoted in Swiss francs for the registered

shares on the Swiss Exchange, and (ii) the U.S. dollar equivalent based on the Noon Buying Rate on the last trading

day of the month in which the high or low closing sales price occurred. The “Noon Buying Rate” is the rate in New

York City for cable transfers in selected currencies as certified for customs purposes by the Federal Reserve Bank of

New York.