Logitech 2003 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 23

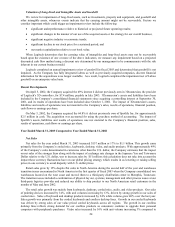

Revenue Recognition

Revenues are recognized when all of the following criteria are met:

• evidence of an arrangement exists between the Company and the customer;

• title and risk of loss transfers to the customer;

• the price of the product is fixed or determinable; and

• collectibility of the receivable is reasonably assured.

Revenues from sales to distributors and authorized resellers are subject to terms allowing certain rights of return,

price protection and allowances for customer marketing programs. Accordingly, allowances for estimated future

returns, price protection and customer marketing programs are recorded upon revenue recognition. Upon shipment of

the product, we record an estimate of potential future product returns related to revenue recorded in the period.

Management analyzes historical returns, distributor inventory levels, current economic trends and changes in

customer demand and acceptance of our products when evaluating the adequacy of the sales returns allowances. We

also record reductions to revenue for the estimated cost of customer programs and incentive offerings including

special pricing agreements, price protection, promotions and other volume-based incentives. Significant management

judgments and estimates must be used in connection with establishing these allowances in any accounting period. If

market conditions were to deteriorate, the Company may take actions to increase customer incentive offerings

possibly resulting in an incremental reduction of revenue at the time the incentive is offered.

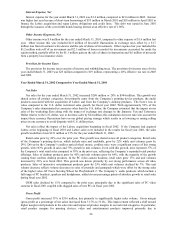

Accounts Receivable

We also estimate the uncollectability of our accounts receivable, and we maintain allowances for estimated

losses. Management analyzes accounts receivable, historical bad debts, receivable aging, customer credit-worthiness

and current economic trends when evaluating the adequacy of the allowance for doubtful accounts. If the financial

condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments,

additional allowances may be required.

Inventory Reserves

We evaluate our inventory for estimated excess and obsolete amounts as well as declines in marketability based

upon technology trends, our plans for the product and assumptions about future demand and market conditions. If a

sudden and significant decrease in demand for our products occurs, or if rapidly changing technology and customer

requirements results in a higher risk of excess inventory or obsolescence, we may be required to increase our

inventory allowances and our gross margin could be adversely affected.

Accounting for Income Taxes

We operate in multiple jurisdictions and our profits are taxed pursuant to the tax laws of these jurisdictions. Our

effective tax rate may be affected by the changes in or interpretations of tax laws in any given jurisdiction, utilization

of net operating losses and tax credit carryforwards, changes in geographical mix of income and expense, and

changes in management’s assessment of matters such as the ability to realize deferred tax assets. As a result of these

considerations, we must estimate our income taxes in each of the jurisdictions in which we operate. This process

involves estimating our actual current tax exposure together with assessing temporary differences resulting from

differing treatment of items for tax and accounting purposes. These differences result in deferred tax assets and

liabilities, which are included in our consolidated balance sheet. We must then assess the likelihood that our deferred

tax assets will be recovered from future taxable income, and establish a valuation allowance for any amounts we

believe will not be recoverable. Establishing or increasing a valuation allowance increases our income tax expense.

Significant management judgment is required in determining our provision for income taxes, our deferred tax

assets and liabilities and any valuation allowance recorded against our net deferred tax assets. We have recorded a

valuation allowance at March 31, 2003, due to uncertainties related to our ability to utilize some of our deferred tax

assets before they expire. The valuation allowance is based on our estimates of taxable income by jurisdiction in

which we operate and the period over which our deferred tax assets will be recoverable. In the event that actual

results differ from these estimates or we adjust these estimates in future periods we may need to establish an

additional valuation allowance which could materially impact our financial position and results of operations.