Logitech 2003 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. F-8

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

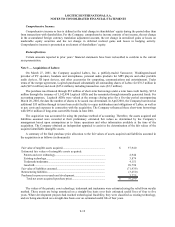

Foreign Currency

The functional currencies of the Company's operations are primarily the U.S. dollar, and to a lesser extent, the

Euro, Swiss franc, Taiwanese dollar, and Japanese yen. The financial statements of the Company's

subsidiarieswhose functional currency is other than the U.S. dollar are translated to U.S. dollars using period-end

rates of exchange for assets and liabilities and using monthly rates for net sales and expenses. Translation gains and

losses are deferred and included in the cumulative translation adjustment component of shareholders' equity. Gains

and losses arising from transactions denominated in currencies other than a subsidiary's functional currency are

reflected in other income (expense), net in the statements of income.

Cash Equivalents

The Company considers all highly liquid instruments purchased with an original maturity of three months or less

to be cash equivalents.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of

cash and cash equivalents and accounts receivable. The Company maintains cash and cash equivalents with various

financial institutions to limit exposure with any one financial institution.

The Company sells to large OEMs, distributors and high volume resellers and, as a result, maintains individually

significant receivable balances with large customers. At March 31, 2003, one customer represented 18% of total

accounts receivable and at March 31, 2002, one customer represented 10% of total accounts receivable. The

Company's OEM customers tend to be well-capitalized, multi-national companies, while retail customers may be less

well capitalized. The Company controls its accounts receivable credit risk through ongoing credit evaluation of its

customers’ financial condition and by purchasing credit insurance on European retail accounts receivable. The

Company generally does not require collateral from its customers.

Accounts Receivable

Accounts receivable are stated net of doubtful accounts. The Company estimates the uncollectability of the

accounts receivable balance and maintains allowances for estimated losses. Management analyzes accounts

receivable, historical bad debts, receivable aging, customer credit-worthiness and current economic trends when

evaluating the adequacy of the allowance for doubtful accounts.

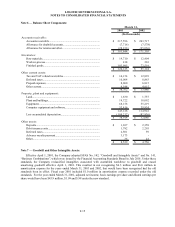

Inventories

Inventories are stated at the lower of cost or market. Cost is computed on a first-in, first-out basis. Provisions are

made for estimated excess and obsolete inventory as well as declines in marketability based upon technology trends,

our plans for the products and assumptions about future demand and market conditions.

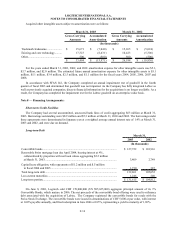

Investments

Investments in companies in which Logitech owns between 20% and 50%, and does not control, are accounted

for using the equity method. Under the equity method, the Company adjusts its carrying value to recognize its share

of results of operations. Investments less than 20% owned are carried at cost less any decrease in value deemed to be

other than temporary in nature. At March 31, 2002, the Company owned an investment in a marketable equity

security that was classified as “available-for-sale”. The Company carried this investment at market value and

recorded increases or decreases in market value as a component of shareholders’ equity.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions and improvements are capitalized, whereas

maintenance and repairs are expensed as incurred. The Company capitalizes the cost of software developed for

internal use in connection with major projects. Costs incurred during the feasibility stage are expensed, whereas costs

incurred during the application development stage are capitalized. Depreciation is provided using the straight-line

method over estimated useful lives of five to 25 years for plant and buildings, one to five years for equipment and