Logitech 2003 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. Major Shareholders

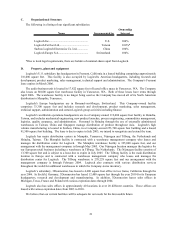

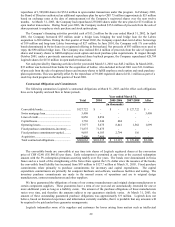

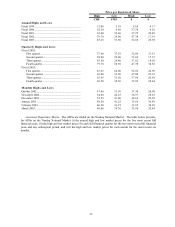

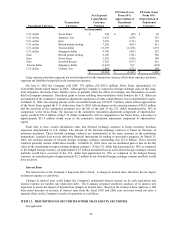

The following table sets forth certain beneficial ownership information at March 31, 2003 by each shareholder

known by the Company to be the beneficial owner of more than five percent of the Company's registered shares or

ADSs. To the knowledge of the Company, it is not directly or indirectly owned or controlled by any corporation or

by any foreign government. The voting rights of our shares held by major shareholders are the same as the voting

rights of our shares held by all other shareholders. The Company is unaware of any arrangement, that might result in

a change in its control.

Name of Beneficial Owner Percentage(2)

Daniel Borel (3) 3,277,698 6.8%

Fidelity Investments 2,757,005 5.8%

Shares Beneficially

Owned(1)

(1) Beneficial ownership is determined in accordance with rules of the Securities and Exchange Commission that

deem shares to be beneficially owned by any person who has or shares voting or investment power with respect

to such shares. This information has been furnished by the beneficial owners. Unless otherwise indicated

below, the persons named in the table have sole voting and sole investment power with respect to all shares

shown as beneficially owned, subject to community property laws where applicable. Registered shares subject

to options that are currently exercisable or exercisable within 60 days after March 31, 2003 are deemed to be

issued and beneficially owned by the person holding such options for the purpose of computing the percentage

ownership of such person but are not treated as issued for the purpose of computing the percentage ownership of

any other person.

(2) Percentage ownership is calculated based on 47,901,655 registered shares outstanding as of March 31, 2003.

(3) Includes 125,400 registered shares registered in the name of Sylviane Borel (Mr. Borel’s wife). Mr. Borel

disclaims beneficial ownership of the registered shares registered in the name of his wife.

B. Related Party Transactions

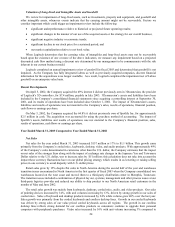

In fiscal 2000, the Company made an investment in a privately held technology company. Certain executive

officers of the Company also purchased stock of the private issuer from the Company. At the time of these

transactions, the Company loaned executive officers a total principal amount of $317,500 for the purchase of this

stock at interest rates determined by reference to the applicable federal rate of interest. The maximum amount

outstanding on these loans during fiscal year 2002 was $335,900, including interest. The executive officers repaid the

loans in full in May 2002. Special bonuses totaling $303,200 were paid to certain of the executive officers, and used

by them to repay these loans in full.

C. Interests of Experts and Counsel

Not applicable.

ITEM 8. FINANCIAL INFORMATION

A. Consolidated Statements and Other Financial Information

Please see Item 18 “Financial Statements” and pages F-1 through F-23 of our Consolidated Financial Statements.

In addition, for more information regarding our results of operations, please see Item 5 “Operating and Financial

Review and Prospects.”

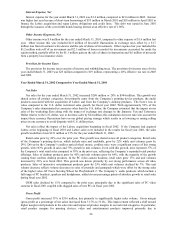

Legal Proceedings

From time to time, Logitech becomes involved in claims and legal proceedings that arise in the ordinary course

of its business. We are currently subject to several such claims and legal proceedings. We believe that all of these

pending lawsuits are without merit and intend to defend against them vigorously.

In July 1998, our U.S. subsidiary, Logitech Inc., was sued by Samuel Gart, an individual, in the U.S. District

Court for the Central Division of California. This lawsuit alleged that Logitech infringed a patent for an