Logitech 2003 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

This annual report to shareholders contains forward-looking statements that involve risks and uncertainties.

The Company’s actual results could differ materially from those anticipated in these statements as a result of

certain factors, including those set forth above in Item 3, “Risk Factors”, and below in Item 11, “Quantitative and

Qualitative Disclosure About Market Risk”.

Overview

Logitech International S.A. designs, manufactures and markets personal interface products and supporting

software that serve as the primary physical interface between people and their personal computers and other digital

platforms. The Company’s products include corded and cordless mice, trackballs, and keyboards; joysticks,

gamepads, and racing systems; internet video cameras; speakers, headsets and microphones; and 3D controllers.

The Company sells its products through two primary channels, original equipment manufacturers (“OEMs”) and

a network of retail distributors and resellers (“retail”). Products sold to OEMs, principally pointing devices, are

generally resold to end users bundled with new PCs. Sales to OEMs as a percentage of total net sales can vary

significantly and have ranged from 13% to 33% on a quarterly basis over the past three fiscal years.

Logitech was founded in Switzerland in 1981, and in 1988 listed its shares in an initial public offering in

Switzerland. In 1997, the Company sold shares in a U.S. initial public offering in the form of American Depositary

Shares (“ADS”), and listed the ADSs on the Nasdaq National Market System. The Company’s corporate headquarters

are in Fremont, California through its U.S. subsidiary, with regional headquarters in Romanel, Switzerland, Hsinchu,

Taiwan and Hong Kong, China through local subsidiaries. In addition, Logitech has its principal manufacturing

operations in China, with distribution facilities in the United States, Europe and Asia.

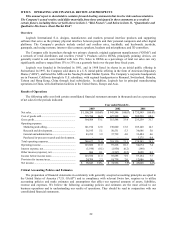

Results of Operations

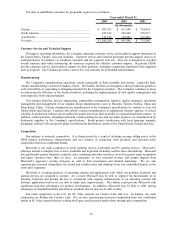

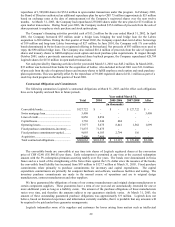

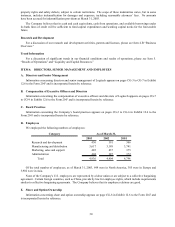

The following table sets forth certain consolidated financial statement amounts in thousands and as a percentage

of net sales for the periods indicated:

Net sales................................................................... 1,100,288$ 100.0% 943,546$ 100.0

%

735,549$ 100.0%

Cost of goods sold.................................................... 735,784 66.9 627,998 66.6 502,290 68.3

Gross profit.............................................................. 364,504 33.1 315,548 33.4 233,259 31.7

Operating expenses:

Marketing and selling........................................... 141,194 12.8 130,060 13.8 105,140 14.3

Research and development................................... 56,195 5.1 50,531 5.3 36,686 5.0

General and administrative................................... 43,233 3.9 37,739 4.0 33,484 4.6

Purchased in-process research and development.. - - - - 3,275 0.4

Total operating expenses.......................................... 240,622 21.8 218,330 23.1 178,585 24.3

Operating income..................................................... 123,882 11.3 97,218 10.3 54,674 7.4

Interest expense, net................................................. (1,196) (0.1) (1,956) (0.2) (148) -

Other income (expense), net..................................... 866 0.1 (1,567) (0.2) 2,628 0.3

Income before income taxes..................................... 123,552 11.3 93,695 9.9 57,154 7.7

Provision for income taxes....................................... 24,709 2.3 18,739 2.0 12,086 1.6

Net income............................................................... 98,843$ 9.0% 74,956$ 7.9% 45,068$ 6.1%

Year ended March 31,

2003 2002 2001

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with generally accepted accounting principles accepted in

the United States of America (“U.S. GAAP”) and in compliance with relevant Swiss law, requires us to utilize

accounting policies and make estimates and assumptions that affect our reported amounts of assets, liabilities,

revenue and expenses. We believe the following accounting policies and estimates are the most critical to our

business operations and to understanding our results of operations. They should be read in conjunction with our

consolidated financial statements.