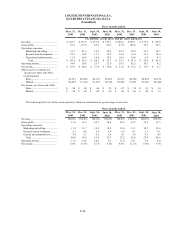

Logitech 2003 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. F-17

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

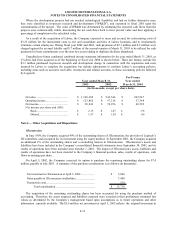

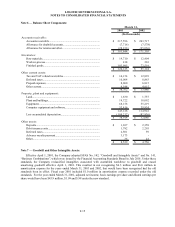

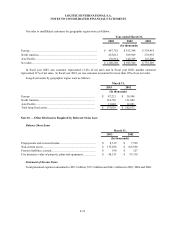

The convertible bonds are convertible at any time into Logitech registered shares at the conversion price of CHF

62.4 (US $46.05) per share. Early redemption is permitted at any time at the accreted redemption amount. The

Company accounts for the redemption premium over the term of the loan by recording interest expense and

increasing the carrying value of the loan. As of March 31, 2003, the carrying amount of the convertible bonds was

CHF 173,079,000 (US $127,722,000) and the fair value based upon quoted market value was $134,547,000.

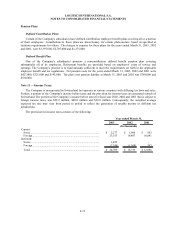

Note 9 — Shareholders' Equity:

In June 2002, the authorization for 10 million registered shares previously authorized by the Company’s

shareholders expired unused, and in June 2002, the Company’s shareholders approved an increase of 10 million

authorized registered shares for use in acquisitions, mergers and other transactions. Also in June 2002, the

shareholders approved an increase of 6 million shares in the conditionally authorized share capital.

In June 2001, the Company’s shareholders approved a ten-for-one share split for shares traded on the Swiss

Exchange, which took effect on August 2, 2001 and was distributed to stockholders of record as of August 1, 2001.

ADSs traded on Nasdaq were not affected. As a result, the ratio of ten ADSs to one registered share changed to a new

ratio of one ADS to one registered share.

In June 2000, the Company’s shareholders approved a two-for-one stock split for shares traded on the Swiss

Exchange and ADSs traded on Nasdaq, which took effect on July 5, 2000 and was distributed to stockholders of

record as of July 4, 2000.

Pursuant to Swiss corporate law, Logitech International S.A. may only pay dividends in Swiss francs. The

payment of dividends is limited to certain amounts of unappropriated retained earnings (approximately $104 million

at March 31, 2003) and is subject to shareholder approval. The Company does not intend to pay any cash dividends.

Under Swiss corporate law, a minimum of 5% of the Company's annual net income must be retained in a legal

reserve until this reserve equals 20% of the Company's issued and outstanding aggregate par value share capital.

Certain other countries in which the Company operates apply similar laws. These legal reserves represent an

appropriation of retained earnings that are not available for distribution and approximated $7.1 million at March 31,

2003.

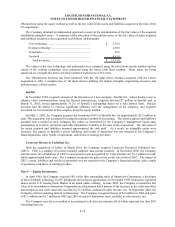

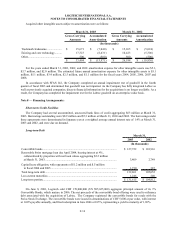

In June 2002, the Company repurchased 88,000 shares for $3.8 million in open market transactions under a short-

term stock buyback program. In July 2002, the Company announced a program to buy back up to CHF 75 million

(approximately $52 million based on exchange rates at the date of the announcement) of Logitech shares in a twelve-

month period. In March 2003, the Company completed its buy back program with the repurchase of 1,509,000 shares

for $52.4 million in open market transactions under this program. In February 2003, the Board of Directors

authorized an additional repurchase plan for up to CHF 75 million (approximately $55 million based on exchange

rates at the date of the announcement) of the Company’s registered shares over the next twelve months. At March 31,

2003, the Company had repurchased 238,000 shares under the new plan for $7.6 million in open market transactions.

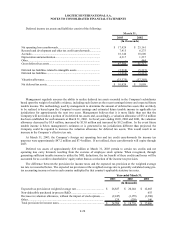

Note 10 — Employee Benefit Plans:

Stock Compensation Plans

Employee Share Purchase Plans

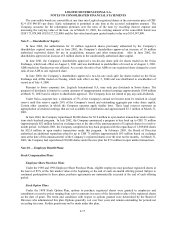

Under the 1989 and 1996 Employee Share Purchase Plans, eligible employees may purchase registered shares at

the lower of 85% of the fair market value at the beginning or the end of each six-month offering period. Subject to

continued participation in these plans, purchase agreements are automatically executed at the end of each offering

period.

Stock Option Plans

Under the 1988 Stock Option Plan, options to purchase registered shares were granted to employees and

consultants at exercise prices ranging from zero to amounts in excess of the fair market value of the registered shares

on the date of grant. The terms and conditions with respect to options granted were determined by the Board of

Directors who administered this plan. Options generally vest over four years and remain outstanding for periods not

exceeding ten years. Further grants may not be made under this plan.