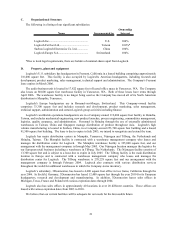

Logitech 2003 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 27

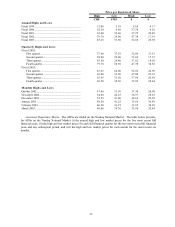

manufacturing cost reductions. OEM product margins also increased due to both continued cost reductions and a sales

mix of higher margin products.

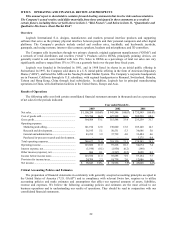

Operating Expenses

Marketing and Selling

Marketing and selling expense increased 24% to $130 million. This increase was directly related to the

Company’s increased sales performance and marketing initiatives aimed at strengthening the Company’s retail

presence. The Company increased marketing costs in new product areas, particularly internet video cameras and

audio products. With the acquisition of Labtec at the end of fiscal year 2001, the Company incurred product

marketing, product and packaging design and advertising costs relating to the audio products. As a percentage of

sales, marketing and selling costs slightly decreased from 14.3% to 13.8%.

Research and Development

Research and development expenses increased 38% to $51 million. The increase was related to new product

development, cost reduction efforts on existing products and increased costs associated with intellectual property used

in our products. As a percentage of sales, research and development increased from 5.0% to 5.3%.

General and Administrative

General and administrative expense for the year ended March 31, 2002 increased 13% to $38 million. This

increase was primarily due to increased headcount and personnel-related expenses. As a percentage of sales, general

and administrative decreased from 4.6% to 4.0%.

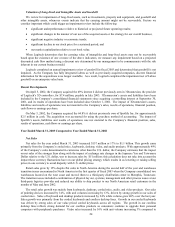

Interest Expense, Net

Interest expense for the year ended March 31, 2002 was $2.0 million, compared to $.1 million in 2001. Interest

expense increased due to the short-term borrowing and subsequent issuance of the five-year convertible bonds to

finance the Labtec acquisition and repay Labtec obligations and credit lines. This debt was repaid in June 2001 using

proceeds from the issuance of our convertible bonds.

Other Income (Expense), Net

Other expense was $1.6 million for the year ended March 31, 2002, compared to other income of $2.6 million in

2001. Other expense in fiscal year 2002 included the $1.2 million write-off of an investment and $2.5 million of

losses recorded for investments accounted for under the equity method, partially offset by the $1.1 million gain on the

sale of shares in Immersion Corporation and $.6 million of proceeds from a property loss insurance claim. Other

income in fiscal year 2001 was primarily due to the gains of $1.9 million from the sale of a building and $1.3 million

from the sale of an investment, partially offset by $.7 million of losses recorded as an investment accounted for under

the equity method.

Provision for Income Taxes

The provision for income taxes for the year ended March 31, 2002 was $19 million, representing a 20% effective

tax rate, compared to $12 million, representing a 21% effective tax rate in 2001. In 2001, the effective tax rate was

impacted by certain non-deductible one time purchased in-process research and development expenses of $3.3 million

related to the Labtec acquisition.

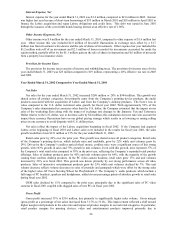

Liquidity and Capital Resources

Cash Balances, Available Borrowings, and Capital Resources

At March 31, 2003, net working capital was $325.7 million, compared to $265.7 million at March 31, 2002. Cash

and cash equivalents totaled $218.7 million, an increase of $75.6 million from March 31, 2002. The increase in cash

during fiscal 2003 was primarily due to profitable operations.

The Company has financed its operations and capital requirements primarily through cash flow from operations

and, to a lesser extent, capital markets and bank borrowings. The Company's normal short-term liquidity and long-

term capital resource requirements will be provided from three sources: ongoing cash flow from operations, cash and

cash equivalents on hand and borrowings, as needed, under the credit facilities.