Logitech 2003 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

repurchase of 1,509,000 shares for $52.4 million in open market transactions under this program. In February 2003,

the Board of Directors authorized an additional repurchase plan for up to CHF 75 million (approximately $55 million

based on exchange rates at the date of announcement) of the Company’s registered shares over the next twelve

months. At March 31, 2003, the Company had repurchased 238,000 shares under the new plan for $7.6 million in

open market transactions. During fiscal year 2003, the Company realized $15.6 million of proceeds from the sale of

shares pursuant to employee stock purchase and stock option plans.

The Company’s financing activities provided cash of $13.2 million for the year ended March 31, 2002. In April

2001, the Company borrowed $55 million under a bridge loan, bringing the total bridge loan for the Labtec

acquisition to $90 million. During the first quarter of fiscal 2002, the Company repaid short-term Labtec borrowings

of $19 million and long-term Labtec borrowings of $27 million. In June 2001, the Company sold 1% convertible

bonds denominated in Swiss francs in a registered offering in Switzerland. Net proceeds of $93 million were used to

repay the $90 million bridge loan. The Company also realized $16.4 million of proceeds from the sale of registered

shares and treasury shares to fulfill employee stock option and stock purchase plan requirements. In August through

October 2001, under a previously announced registered share buyback program, the Company repurchased 628,704

Logitech shares for $15.0 million in open market transactions.

Net cash provided by financing activities for the year ended March 31, 2001 was $45.2 million. In March 2001,

$35 million was borrowed from banks for the acquisition of Labtec. Also included in fiscal 2001 were $11.0 million

of proceeds from the sale of registered shares and treasury shares to fulfill employee stock option and stock purchase

plan requirements. This was partially offset by the repurchase of 39,000 registered shares for $1.1 million as part of a

stock buy-back program in the first quarter of fiscal 2001.

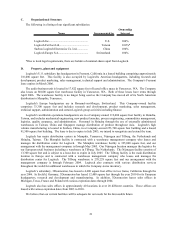

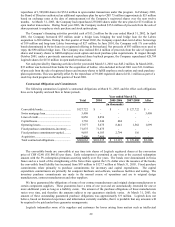

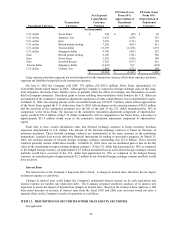

Contractual Obligations and Commitments

The following summarizes Logitech’s contractual obligations at March 31, 2003, and the effect such obligations

have on its liquidity and cash flow in future periods.

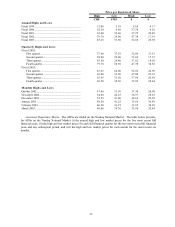

Total 2004 2005-2006 2007-2008 After

Convertible bonds........................................ 127,722$ -$ -$ 127,722$ -$

Swiss mortgage loan.................................... 3,409 - - - 3,409

Lines of credit.............................................. 8,856 8,856 - - -

Capital leases............................................... 1,730 1,246 484 - -

Operating leases........................................... 17,977 5,675 8,841 1,562 1,899

Fixed purchase commitments-inventory...... 71,875 71,875 - - -

Fixed purchase commitments-capital........... 9,093 6,183 2,794 116 -

Acquisition.................................................. 7,400 7,400 - - -

Total contractual obligations....................... 248,062$ 101,235$ 12,119$ 129,400$ 5,308$

Year ended March 31,

(in thousands)

The convertible bonds are convertible at any time into shares of Logitech registered shares at the conversion

price of CHF 62.40 (US $46.05) per share. Early redemption is permitted at any time at the accreted redemption

amount with the 5% redemption premium accreting ratably over five years. The bonds were denominated in Swiss

francs and as a result of the strengthening of the Swiss franc against the U.S. dollar since the issuance of the bonds,

the convertible bond liability has increased from $93 million to $127.7 million at March 31, 2003. Fixed purchase

commitments relate primarily to purchase commitments for inventory and capital expenditures. The capital

expenditure commitments are primarily for computer hardware and software, warehouse facilities and tooling. The

inventory purchase commitments are made in the normal course of operations and are to original design

manufacturers, contract manufacturers and other suppliers.

We have guaranteed the obligations of some of our contract manufacturers and original design manufacturers to

certain component suppliers. These guarantees have a term of one year and are automatically extended for one or

more additional years as long as a liability exists. The amount of the purchase obligations of these manufacturers

varies over time, and therefore the amounts subject to our guarantees similarly varies. At March 31, 2003, the

amount of these outstanding guaranteed purchase obligations was approximately $.9 million. Logitech does not

believe, based on historical experience and information currently available, that it is probable that any amounts will

be required to be paid under these guarantee arrangements.

Logitech indemnifies some of its suppliers and customers for losses arising from matters such as intellectual