Logitech 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

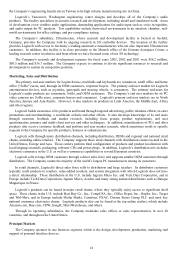

The Company had credit lines with several European and Asian banks totaling $62.8 million as of March 31,

2003. As is common for business in European and Asian countries, these credit lines are uncommitted and unsecured.

Despite the lack of formal commitments from its banks, the Company believes that these lines of credit will continue

to be made available because of its long-standing relationships with these banks. As of March 31, 2003, $54 million

was available under these facilities.

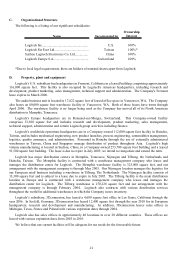

Acquisition of Labtec

In March 2001, the Company completed the acquisition of Labtec, Inc. for $73 million, with $47.6 million paid

in cash and $25.4 million paid through the issuance of ADSs. In fiscal 2001, the Company borrowed $35 million

under a $90 million term loan credit facility to finance part of the cash portion of the acquisition cost. During the first

quarter of fiscal 2002, the Company borrowed the remaining term loan balance of $55 million to repay short-term

Labtec borrowings of $19 million, long-term Labtec borrowings of $27 million and to pay other obligations relating

to the acquisition. In June 2001, the Company sold 1% convertible bonds in a registered offering. Net proceeds of $93

million were used to repay the $90 million bridge loan.

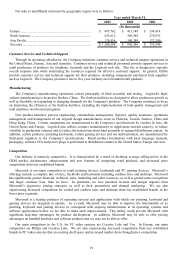

Cash Flow from Operating Activities

The Company's operating activities provided net cash of $145.1 million for the year compared to $112.6 million,

and $12.0 million for the years ended March 31, 2002 and 2001. The increased cash flow was due to stronger

collection efforts on higher sales during the year and increased focus on receivable collection efforts. The Company

also invested cash in inventory because of a combination of factors including logistical difficulties in product

distribution and preparing for higher levels of sales of our new products in future quarters. This increase in inventory

was partially offset by our increase in accounts payable and accrued liabilities.

Depreciation expense decreased by $2.6 million compared to last year. One of the main components of our

depreciation expense is depreciation from tooling, which can vary significantly from period to period. The variability

occurs because tooling is depreciated over the shorter of the estimated life of the tool or one year, and is based on

production levels. In fiscal year 2002, most new tools were placed in service late in the first quarter and early in the

second quarter while in fiscal year 2003, fully depreciated tools were in use and most of the new tools were not

placed in service until late in the second quarter. This resulted in tooling depreciation that was lower by $1.8 million

for the year.

Cash Flow from Investing Activities

The Company's investing activities used cash of $24.6 million for the year ended March 31, 2003, compared to

$24.5 million and $59.1 million for the years ended March 31, 2002 and 2001. During the year ended March 31,

2003, the Company received net cash of $2.5 million as a result of the Spotlife acquisition in May 2002 and used $.4

million to acquire non-marketable securities. The Company recognized $.7 million proceeds from the sale of

available-for-sale securities, and $1.3 million of net cash proceeds from the sale of a non-core business activity in

December 2002.

During the year ended March 31, 2002, cash of $6.8 million was used for additional acquisition costs related to

the purchase of Labtec and to acquire non-marketable equity investments. These expenditures were partially offset

by cash proceeds of $4.2 million from the sale of available-for-sale securities.

Cash used in the year ended March 31, 2001 included $47.6 million, excluding $5.5 million cash acquired, for

the acquisition of Labtec, $5 million for an additional investment in Spotlife, Inc., Logitech’s spin-off focused on

enhancing video communications using the Internet infrastructure, and $.6 million for investment in other affiliated

companies. In addition, 2001 includes cash proceeds of $3.6 million for the sale of a building in Europe that was no

longer being used in the Company’s operations and $1.8 million from the sales of available-for-sales securities.

The amounts invested in all three years for capital expenditures include normal expenditures for computer

hardware and software, tooling costs, capital improvements, and machinery and equipment.

Cash Flow from Financing Activities

The Company’s financing activities used net cash of $46.6 million for the year ended March 31, 2003. This was

principally the result of treasury stock purchases, offset by the sale of shares upon the exercise of employee stock

options and stock purchase rights. In June 2002, the Company repurchased 88,000 shares for $3.8 million in open

market transactions under a short-term stock buyback program. In July 2002, the Company announced a program to

buy back up to CHF 75 million (approximately $52 million based on exchange rates at the date of announcement) of

Logitech shares in a twelve-month period. In March 2003, the Company completed its buy back program with the