Kroger 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

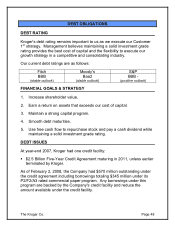

FREE CASH FLOW

Kroger’s long-term financial strategy is to manage free cash flow to

repurchase shares and pay dividends, while maintaining a leverage ratio

that supports our solid investment grade rating. Kroger believes

maintaining a solid investment grade rating provides the best cost of capital

and the flexibility to execute our Customer 1st strategy in a competitive and

consolidating industry.

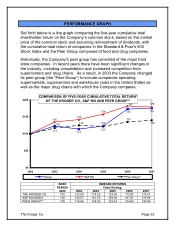

From January 2000 through the end of fiscal 2007, Kroger reduced its net

total debt to EBITDA ratio from 2.8 to 2.0, a reduction of 0.8 times EBITDA.

During the same time frame, Kroger invested $5.0 billion to repurchase

237.3 million shares of stock at an average price of $21.22 per share. The

Company also paid $342 million in cash dividends to shareholders since it

initiated its dividend program in 2006.

Kroger’s share repurchase and dividend programs deliver substantial value

to shareholders. These programs reflect the Board of Directors’ confidence

in Kroger’s Customer 1st strategic plan.

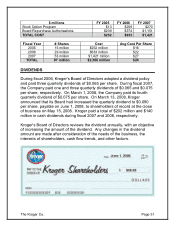

SHARE REPURCHASE

Board Repurchase Authorizations

We maintain stock repurchase programs that comply with Securities

Exchange Act Rule 10b5-1 to allow for the orderly repurchase of our

common stock, from time to time, even though we may be aware of

material non-public information, as long as purchases are made in

accordance with the plan. We made open market purchases totaling

$1,151 million, $374 million, and $239 million under Board-authorized

repurchase programs during fiscal 2007, 2006, and 2005, respectively.

Stock Option Program

The Kroger Co. Page 50

In addition to the Board-authorized repurchase programs, in December

1999, Kroger initiated a program to repurchase common stock to reduce

dilution resulting from our employee stock option plans. This program is

solely funded by proceeds from stock option exercises, including the tax

benefit from these exercises. We repurchased approximately $270 million,

$259 million, and $13 million under the stock option program during 2007,

2006, and 2005, respectively.