Kroger 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

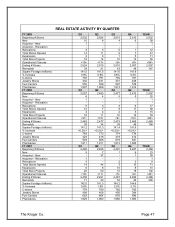

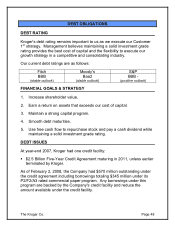

DEBT OBLIGATIONS

DEBT RATING

Kroger’s debt rating remains important to us as we execute our Customer

1st strategy. Management believes maintaining a solid investment grade

rating provides the best cost of capital and the flexibility to execute our

growth strategy in a competitive and consolidating industry.

Our current debt ratings are as follows:

Fitch Moody’s S&P

BBB

(stable outlook)

Baa2

(stable outlook) BBB -

(positive outlook)

FINANCIAL GOALS & STRATEGY

1. Increase shareholder value.

2. Earn a return on assets that exceeds our cost of capital.

3. Maintain a strong capital program.

4. Smooth debt maturities.

5. Use free cash flow to repurchase stock and pay a cash dividend while

maintaining a solid investment grade rating.

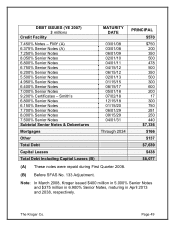

DEBT ISSUES

At year-end 2007, Kroger had one credit facility:

$2.5 Billion Five-Year Credit Agreement maturing in 2011, unless earlier

terminated by Kroger.

The Kroger Co. Page 48

As of February 2, 2008, the Company had $570 million outstanding under

the credit agreement including borrowings totaling $345 million under its

P2/F2/A3 rated commercial paper program. Any borrowings under this

program are backed by the Company’s credit facility and reduce the

amount available under the credit facility.