Kroger 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

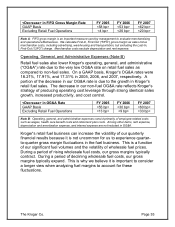

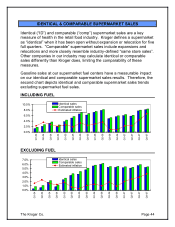

<Decrease> in FIFO Gross Margin Rate FY 2005 FY 2006 FY 2007

GAAP Basis <58 bp> <53 bp> <62 bp>

Excluding Retail Fuel Operations <4 bp> <26 bp> <20 bp>

Note A: FIFO gross margin is an important measure used by management to evaluate merchandising

and operational effectiveness. We calculate First-In, First-Out (“FIFO”) gross margin as sales minus

merchandise costs, including advertising, warehousing and transportation, but excluding the Last-In,

First-Out (“LIFO”) charge. Merchandise costs exclude depreciation and rent expense.

Operating, General, and Administrative Expenses (Note B)

Retail fuel sales also lower Kroger’s operating, general, and administrative

(“OG&A”) rate due to the very low OG&A rate on retail fuel sales as

compared to non-fuel sales. On a GAAP basis, Kroger’s OG&A rates were

18.21%, 17.91%, and 17.31% in 2005, 2006, and 2007, respectively. A

portion of the decrease in our OG&A rate is due to the growth in Kroger’s

retail fuel sales. The decrease in our non-fuel OG&A rate reflects Kroger’s

strategy of producing operating cost leverage through strong identical sales

growth, increased productivity, and cost control.

<Decrease> in OG&A Rate FY 2005 FY 2006 FY 2007

GAAP Basis <55 bp> <30 bp> <60 bp>

Excluding Retail Fuel Operations <13 bp> <9 bp> <33 bp>

Note B: Operating, general, and administrative expenses consist primarily of employee-related costs

such as wages, health care benefit costs and retirement plan costs. Among other items, rent expense,

depreciation and amortization expense, and interest expense are not included in OG&A.

Kroger’s retail fuel business can increase the volatility of our quarterly

financial results because it is not uncommon for us to experience quarter-

to-quarter gross margin fluctuations in the fuel business. This is a function

of our significant fuel volumes and the volatility of wholesale fuel prices.

During a period of rising wholesale fuel costs, our gross margins typically

contract. During a period of declining wholesale fuel costs, our gross

margins typically expand. This is why we believe it is important to consider

a longer view when analyzing fuel margins to account for these

fluctuations.

The Kroger Co. Page 35