Kroger 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

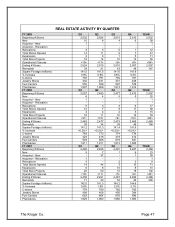

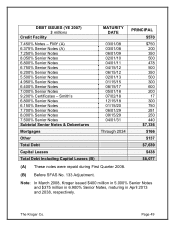

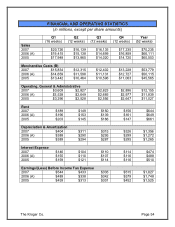

DEBT ISSUES (YE 2007)

$ millions MATURITY

DATE PRINCIPAL

Credit Facility $570

7.450% Notes – FMY (A) 03/01/08 $750

6.375% Senior Notes (A) 03/01/08 200

7.250% Senior Notes 06/01/09 350

8.050% Senior Notes 02/01/10 500

6.800% Senior Notes 04/01/11 478

6.750% Senior Notes 04/15/12 500

6.200% Senior Notes 06/15/12 350

5.500% Senior Notes 02/01/13 500

4.950% Senior Notes 01/15/15 300

6.400% Senior Notes 08/15/17 600

7.000% Senior Notes 05/01/18 200

9.200% Certificates – Smith’s 07/02/18 17

6.800% Senior Notes 12/15/18 300

6.150% Senior Notes 01/15/20 750

7.700% Senior Notes 06/01/29 281

8.000% Senior Notes 09/15/29 250

7.500% Senior Notes 04/01/31 440

Subtotal Senior Notes & Debentures $7,336

Mortgages Through 2034 $166

Other $137

Total Debt $7,639

Capital Leases $438

Total Debt Including Capital Leases (B) $8,077

(A) These notes were repaid during First Quarter 2008.

(B) Before SFAS No. 133 Adjustment.

Note: In March 2008, Kroger issued $400 million in 5.000% Senior Notes

and $375 million in 6.900% Senior Notes, maturing in April 2013

and 2038, respectively.

The Kroger Co. Page 49