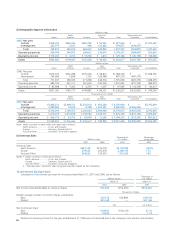

Konica Minolta 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

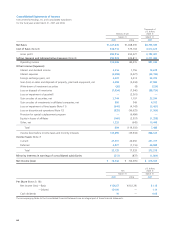

During the year ended March 31, 2007 the reserve for dis-

continued operations declined by ¥29,980 million ($253,960

thousand) to ¥28,097 million ($238,009 thousand).

On the statement of income for the year ended March 31,

2007 the Companies posted ¥935 million ($7,920 thousand) of

loss on discontinued operations. It is the net amount of ¥17,567

million ($148,810 thousand) of income from the reversal of reserve

and ¥18,502 million ($156,730 thousand) of loss on discontinued

operations due to the changes various conditions and environment.

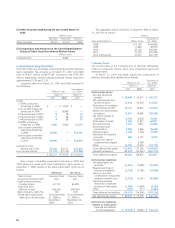

13. Lease Transactions

Proforma information on the Company and its domestic sub-

sidiaries finance lease transactions (except for those which are

deemed to transfer the ownership of the leased assets to the

lessee) and operating lease transactions is as follows:

Lessee

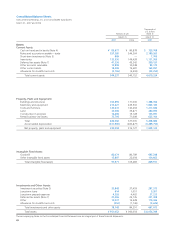

1) Finance Leases Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Buildings and structures ¥ 8,841 ¥ 10,598 $ 74,892

Machinery, equipment

and other 2,435 15,110 20,627

Tools and furniture 11,348 13,230 96,129

Rental business-use assets 4,173 6,590 35,349

Intangible fixed assets 358 694 3,033

27,158 46,224 230,055

Less: Accumulated

depreciation (16,037) (28,572) (135,849)

Loss on impairment of

lease assets 15 3,972 127

Net book value ¥ 11,106 ¥ 13,679 $ 94,079

The scheduled maturities of future lease rental payments on

such lease contracts at March 31, 2007 and 2006 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Due within one year ¥ 2,913 ¥ 5,949 $24,676

Due over one year 8,236 11,701 69,767

Total ¥11,150 ¥17,651 $94,452

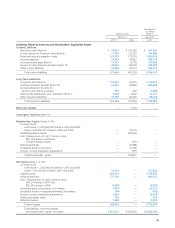

Lease rental expenses and depreciation equivalents under the

finance leases which are accounted for in the same manner as

operating leases for the years ended March 31, 2007 and 2006

were as follows:

Lease rental expenses

for the period ¥ 4,168 ¥10,045 $35,307

Depreciation equivalents ¥ 1,081 ¥ 9,175 $ 9,157

Depreciation equivalents are calculated based on the straight-

line method over the lease terms of the leased assets.

Reserve for loss on impairment of leased assets as of March

31, 2007 and 2006 are as follows: Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Reserve for loss ¥ 15 ¥ 3,102 $ 127

Reversals of reserve for loss on impairment of leased assets for the

years ended March 31, 2007 and 2006 are as follows: Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Reversals of reserve for loss ¥ 3,087 ¥ 869 $26,150

2) Operating Leases

The scheduled maturities of future operating lease rental pay-

ments as of March 31, 2007 and 2006 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Due within one year ¥ 5,052 ¥ 5,350 $ 42,795

Due over one year 14,676 11,670 124,320

Total ¥19,728 ¥17,021 $167,116

Lessor

1) Finance Leases Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Leased rental

business-use assets:

Purchase cost ¥ 28,524 ¥ 22,569 $ 241,626

Less: Accumulated

depreciation (17,940) (14,830) (151,970)

Net book value ¥ 10,584 ¥ 7,738 $ 89,657

The scheduled maturities of future finance lease rental income

as of March 31, 2007 and 2006 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Due within one year ¥5,089 ¥3,780 $43,109

Due over one year 3,953 4,236 33,486

Total ¥9,043 ¥8,017 $76,603

Lease rental income and depreciation under the finance leases

which are accounted for in the same manner as operating leases

for the years ended March 31, 2007 and 2006 were as follows:

Lease rental income

for the period ¥5,638 ¥4,496 $47,759

Depreciation ¥5,312 ¥4,174 $44,998

2) Operating Leases

The scheduled maturities of future lease rental income on such

lease contracts as of March 31, 2007 and 2006 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2007 2006 2007

Due within one year ¥1,694 ¥3,045 $14,350

Due over one year 1,677 2,690 14,206

Total ¥3,372 ¥5,735 $28,564

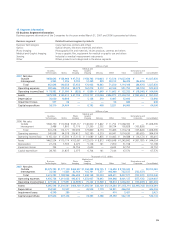

14. Retirement Benefit Plans

The Companies have defined benefit retirement plans that include

corporate defined benefit pensions plans (CDBPs), which are gov-

erned by the Japanese Welfare Pension Insurance Law, tax-quali-

fied pension plans and lump-sum payment plans. In addition, the

Company may pay additional retirement benefits to employees at

its discretion.

The Company and certain of its domestic subsidiaries changed

their retirement plans, as follows:

On April 1, 2003, Konica’s tax-qualified benefit plan was

transferred to a CDBP.